filmov

tv

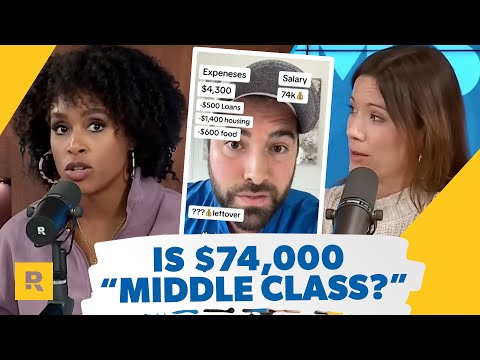

Gen-Z Says $74,000 Per Year Is No Longer Middle Class

Показать описание

The YouTube Creator Academy:

Original TikTok Video From Freddie Smith:

-A $74,000 income is reduced to $4300 per month after taxes, 401k contributions, and health insurance.

-$500 Per Month is going towards student loans.

- $1400 to SPLIT a 2-bedroom apartment in a medium-sized city like Orlando, Florida - with utilities.

- $600 per month on food and groceries.

-$400 for a car payment

-$200 for insurance

-$150 for gas

-$100 for a cell phone

-$300 for fun expenses

That leaves you with just $650 left over. Is this middle class?

My Thoughts:

First: Very few people can qualify to buy a home, at 25 years old, with a $74,000 salary. Even if you’re disciplined and live frugally, it’s going to take you 3-10 years to pay off debts and / or save up an amount that would even be considered as a down payment, depending on your area.

Second: This doesn’t take into account the combined incomes of couples.

Just consider that 2021 Census data showed that “46% of people buying a home were married couples, compared to just 22 percent of single men and 30 percent of single women. That’s because lenders COMBINE the income of both people to determine how much money they’ll lend.

Third: It also REALLY depends on where you live.

For example, the median income in Newton Massachusetts is $122,000…while the median income in Flint, Michigan, is $24,900. This means that there will be a LOT of variance in terms of average income and values, and what “middle class” means for your location.

Fourth: Even a savings rate of $500 per month could lead to a SUBSTANTIAL amount of money later in life - especially if you start by age 25.

The way I see it - housing is INSANELY EXPENSIVE. To make matters worse, according to the Bureau of Labor Statistics, “you’d have to earn about $129,000 today to have the same purchasing power that a salary of $100,000 had just a decade ago.”

However, I tend to believe that the person earning $74,000 per year at 25 years old is going to have the upward mobility to eventually make $110,000 per year by the age of 33 - at which point, qualifying for the median house is going to be much more achievable - ESPECIALLY if they keep their expenses the exact same, during a time where their income is increasing.

No, it’s not going to happen as as soon as you land a job - and, life IS expensive - especially when you’re just starting out - but, I DO believe it’s entirely possible, and you will be able to buy a home after getting established in your career - if you budget for it .

My ENTIRE Camera and Recording Equipment:

*Some of the links and other products that appear on this video are from companies which Graham Stephan will earn an affiliate commission or referral bonus. Graham Stephan is part of an affiliate network and receives compensation for sending traffic to partner sites. The content in this video is accurate as of the posting date. Some of the offers mentioned may no longer be available. This is not investment advice.

Комментарии

0:19:18

0:19:18

0:10:05

0:10:05

0:14:37

0:14:37

0:08:39

0:08:39

0:09:00

0:09:00

0:01:01

0:01:01

0:03:55

0:03:55

0:01:01

0:01:01

0:01:00

0:01:00

0:22:35

0:22:35

0:02:12

0:02:12

0:03:34

0:03:34

1:01:57

1:01:57

0:03:00

0:03:00

0:08:02

0:08:02

0:06:00

0:06:00

1:04:34

1:04:34

0:03:05

0:03:05

0:26:05

0:26:05

0:09:59

0:09:59

0:07:47

0:07:47

0:00:20

0:00:20

0:10:11

0:10:11

0:03:30

0:03:30