filmov

tv

Deductions in New Tax Regime AY 24-25 | New tax regime 2024 | New tax regime vs Old tax regime 2024

Показать описание

Deductions in New Tax Regime AY 24-25 | New tax regime 2024 | New tax regime vs Old tax regime 2024

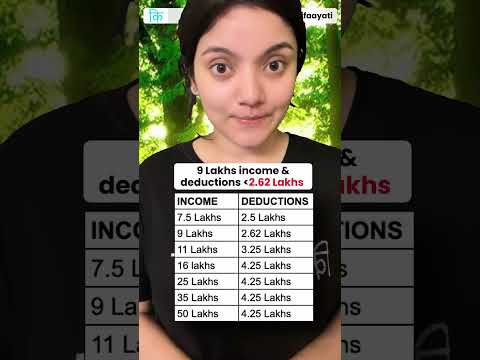

In this video, we have discussed about deductions available under new tax regime for filing income tax returns and comparison with old vs new regime.

your queries covered in this video

deductions in new tax regime 24-25

new tax regime 2024

new tax regime vs old tax regime 2024

new tax regime deductions ay 24-25

old vs new tax regime 2024

standard deduction in new tax regime 24-25

new vs old tax regime ay 2024-25

new tax regime deductions in hindi 24-25

new tax regime 2024

old tax regime vs new tax regime

new tax regime slab rates ay 24-25

new tax regime slab rates fy 23-24

new regime slab rates for senior citizens fy 23-24

-------------------------------------------------------------------------------------------

*** Invest & Trade in Stocks & Mutual Funds ***

Open your Discount Demat Account here:

-------------------------------------------------------------------------------------------

Join this channel to get access to perks:

-------------------------------------------------------------------------------------------

-------------------------------------------------------------------------------------------

#BankingBaba

In this video, we have discussed about deductions available under new tax regime for filing income tax returns and comparison with old vs new regime.

your queries covered in this video

deductions in new tax regime 24-25

new tax regime 2024

new tax regime vs old tax regime 2024

new tax regime deductions ay 24-25

old vs new tax regime 2024

standard deduction in new tax regime 24-25

new vs old tax regime ay 2024-25

new tax regime deductions in hindi 24-25

new tax regime 2024

old tax regime vs new tax regime

new tax regime slab rates ay 24-25

new tax regime slab rates fy 23-24

new regime slab rates for senior citizens fy 23-24

-------------------------------------------------------------------------------------------

*** Invest & Trade in Stocks & Mutual Funds ***

Open your Discount Demat Account here:

-------------------------------------------------------------------------------------------

Join this channel to get access to perks:

-------------------------------------------------------------------------------------------

-------------------------------------------------------------------------------------------

#BankingBaba

Комментарии

0:10:48

0:10:48

0:08:11

0:08:11

0:06:30

0:06:30

0:18:30

0:18:30

0:05:25

0:05:25

0:05:00

0:05:00

0:00:20

0:00:20

0:07:31

0:07:31

0:12:38

0:12:38

0:12:34

0:12:34

0:12:14

0:12:14

0:04:05

0:04:05

0:09:10

0:09:10

0:11:05

0:11:05

0:08:35

0:08:35

0:00:47

0:00:47

0:27:07

0:27:07

0:22:57

0:22:57

0:32:04

0:32:04

0:15:28

0:15:28

0:08:59

0:08:59

0:01:43

0:01:43

0:12:18

0:12:18

0:11:02

0:11:02