filmov

tv

Old Vs. New Tax Regime | Which is better? | Tax Slabs FY 2021-2022

Показать описание

Tax season is about to end and we are sure most of you would have filed your income tax returns. But one of the most important things we all miss out on during tax season is choosing the right tax regime for your ITR filings.

This video highlights the differences between old and new tax regimes and suggests which one should you choose based on your income levels. Do watch it till the end and let us know all your doubts in the comments section.

If you liked this explanatory video, share it with your friends and clear their doubts too!

0:00 : Introduction

0:31 : Old Vs. New Tax Regime

01:20 : New Tax Regime

02:10 : Changes in Tax Rate

03:29 : What's missing in New Tax Regime?

04:02 : Understand with an example

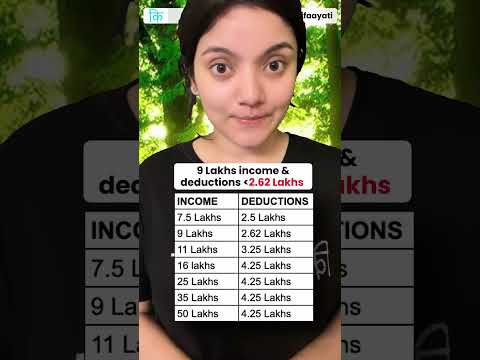

05:56 : Table : Tax liability in Old Vs New Tax Regime

08:03 : Why you should Inform your company about your tax regime?

08:19 : Don't miss if you own a business

08:40 : A step- by- step Guide : Old Vs. New Tax Regime

10:09 : Conclusion

#TaxFiling2022 #TaxRegime #Unfinance

✅ Subscribe/follow us on :

INSTAGRAM : @Unfinance

Kunwar Raj | LinkedIn

Amit Singh | LinkedIn

TWITTER : @unfinance1

FACEBOOK : @unfinance

----------------------------------------------

About : We, as Unfinance, are a community of 8000K+ investors & finance enthusiasts. We are on a mission to empower more than 100 million Indians to achieve financial freedom. Founded by Amit & Kunwar, we believe there has not been a better time to talk openly about money; people want to achieve financial freedom and be able to conduct their financial lives more meaningfully.

This video highlights the differences between old and new tax regimes and suggests which one should you choose based on your income levels. Do watch it till the end and let us know all your doubts in the comments section.

If you liked this explanatory video, share it with your friends and clear their doubts too!

0:00 : Introduction

0:31 : Old Vs. New Tax Regime

01:20 : New Tax Regime

02:10 : Changes in Tax Rate

03:29 : What's missing in New Tax Regime?

04:02 : Understand with an example

05:56 : Table : Tax liability in Old Vs New Tax Regime

08:03 : Why you should Inform your company about your tax regime?

08:19 : Don't miss if you own a business

08:40 : A step- by- step Guide : Old Vs. New Tax Regime

10:09 : Conclusion

#TaxFiling2022 #TaxRegime #Unfinance

✅ Subscribe/follow us on :

INSTAGRAM : @Unfinance

Kunwar Raj | LinkedIn

Amit Singh | LinkedIn

TWITTER : @unfinance1

FACEBOOK : @unfinance

----------------------------------------------

About : We, as Unfinance, are a community of 8000K+ investors & finance enthusiasts. We are on a mission to empower more than 100 million Indians to achieve financial freedom. Founded by Amit & Kunwar, we believe there has not been a better time to talk openly about money; people want to achieve financial freedom and be able to conduct their financial lives more meaningfully.

Комментарии

0:11:02

0:11:02

0:13:35

0:13:35

0:12:34

0:12:34

0:12:38

0:12:38

0:05:24

0:05:24

0:15:28

0:15:28

0:15:14

0:15:14

0:00:12

0:00:12

0:08:04

0:08:04

0:00:47

0:00:47

0:01:00

0:01:00

0:00:52

0:00:52

0:01:01

0:01:01

0:11:53

0:11:53

0:13:30

0:13:30

0:12:14

0:12:14

0:01:01

0:01:01

0:01:00

0:01:00

0:01:30

0:01:30

0:10:27

0:10:27

0:01:00

0:01:00

0:06:41

0:06:41

0:00:59

0:00:59

0:00:41

0:00:41