filmov

tv

Understanding the ACH Network and Compliance Changes

Показать описание

Understanding the ACH Network and Compliance Changes

It's crucial for entrepreneurs to understand a few concepts related to NACHA and the Bank Secrecy Act (BSA) to ensure they do business with compliant entities.

Let's start with NACHA and its definition. NACHA stands for the National Automated Clearinghouse Association, which governs the ACH network.

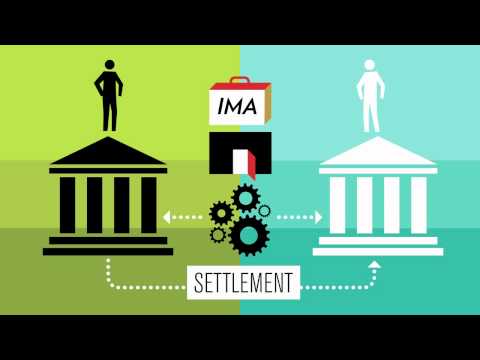

The ACH network is a batch filing system that facilitates electronic money transfers between financial institutions. NACHA establishes operating rules and guidelines that regulate this payment clearinghouse, enabling secure electronic transfers without the need for physical currency or checks.

Participants in the ACH network must adhere to NACHA's operating rules and guidelines. These rules require regular risk assessments and audits to demonstrate compliance or address any issues that arise. It's important to note that NACHA is not an enforcement agency.

The enforcement of operating rules lies with the banks since they are responsible for executing transactions. Banks may request risk assessments and audits from ACH participants to ensure compliance. Non-compliance could strain the banking relationship of the involved parties.

Host: Mike Vannoy, VP of Marketing at Asure

Expert panelist: Chris W. Bell, Regulatory Compliance Attorney with Asure

#NACHA

#BankSecrecyAct

#MoneyTransmitterLaw

Related Videos:

Unions Are Gaining Popularity: What Employers Can and Can NOT Do About It

The Truth About On-Demand Pay - What Employers Need to Know

Maximizing ChatGPT for HR: Mitigating Risks and Boosting Productivity

0:15:38

0:15:38

0:03:58

0:03:58

0:03:01

0:03:01

0:00:45

0:00:45

0:03:13

0:03:13

0:09:41

0:09:41

0:00:33

0:00:33

1:46:54

1:46:54

0:03:35

0:03:35

0:01:59

0:01:59

0:02:15

0:02:15

0:02:43

0:02:43

0:02:48

0:02:48

0:01:00

0:01:00

0:36:13

0:36:13

0:00:32

0:00:32

0:01:40

0:01:40

0:00:45

0:00:45

0:03:49

0:03:49

0:00:22

0:00:22

0:02:51

0:02:51

0:02:10

0:02:10

0:00:45

0:00:45

0:01:44

0:01:44