filmov

tv

Calculating Risk and Return of a Two Asset Portfolio

Показать описание

Ryan O'Connell, CFA, FRM shows how to calculate the risk and return of a two asset portfolio.

Chapters:

0:00 - Calculating Expected Return of a Portfolio

1:06 - Calculating Standard Deviation of a Portfolio

🎓 Tutor With Me: 1-On-1 Video Call Sessions Available

📚 CFA Exam Prep Discount - AnalystPrep:

*Disclosure: This is not financial advice and should not be taken as such. The information contained in this video is an opinion. Some of the information could be wrong. This channel is owned and operated by Portfolio Constructs LLC. Some of the links above are affiliate links, meaning, at no additional cost to you, I will earn a commission if you click through and make a purchase.

Chapters:

0:00 - Calculating Expected Return of a Portfolio

1:06 - Calculating Standard Deviation of a Portfolio

🎓 Tutor With Me: 1-On-1 Video Call Sessions Available

📚 CFA Exam Prep Discount - AnalystPrep:

*Disclosure: This is not financial advice and should not be taken as such. The information contained in this video is an opinion. Some of the information could be wrong. This channel is owned and operated by Portfolio Constructs LLC. Some of the links above are affiliate links, meaning, at no additional cost to you, I will earn a commission if you click through and make a purchase.

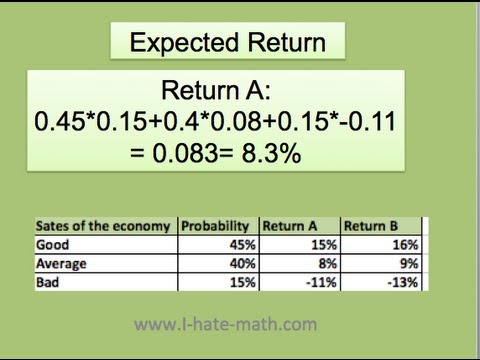

How to find the Expected Return and Risk

Calculating Risk and Return of a Two Asset Portfolio

Risk & Return (1 of 7) - Introduction

PROBLEMS ON RISK AND RETURN calculation No.1

Risk, Return, and the Security Market Line

How to calculate portfolio risk and return in Excel / Analyzing stock returns / Episode 7

Beta, the risk-free rate, and CAPM. Calculate the expected return of a security on Excel.

Risk & Return Relationship | Types of Risks | Expected Return | Expected Risk| Financial Managem...

BEING CALCULATED | Robert Greene's 48 LAWS OF POWER #law35

Session 4: Defining and Measuring Risk

The Risk to Reward Ratio Explained in One Minute: From Definition and 'Formula' to Example...

Portfolio Risk and Return - Part I (2024/2025 Level I CFA® Exam – PM – Module 1)

Essentials of Investing Chapter 5 Risk and Return

Historical Method: Value at Risk (VaR) In Excel

Calculation of Risk & Return for Individual Security

Portfolio Risk and Portfolio Return Calculation | Problems and Solutions

Finding Portfolio's Expected Return and Risk using BA-II Calculator

Stock Risk-Return Calculations | Collecting Stock Price Data | Excel | MBA | Self Learning

Risk and Return in Finance and Investments

IAPM | Risk-Return Analysis | Calculation of Expected Return and Standard Deviation | TYBMS |Part 1

Applied Portfolio Management - Class 1 - Risk & Return

Portfolio risk and return calculation

Market Risk Premium | Formula | Calculation | Examples

Risk and Return: Case of without probability

Комментарии

0:06:53

0:06:53

0:03:29

0:03:29

0:13:36

0:13:36

0:07:05

0:07:05

0:51:50

0:51:50

0:14:40

0:14:40

0:20:20

0:20:20

0:09:09

0:09:09

0:15:22

0:15:22

0:17:03

0:17:03

0:01:36

0:01:36

0:55:39

0:55:39

0:44:50

0:44:50

0:05:01

0:05:01

0:10:12

0:10:12

0:07:31

0:07:31

0:07:22

0:07:22

0:14:15

0:14:15

0:03:58

0:03:58

0:13:52

0:13:52

1:14:52

1:14:52

0:18:08

0:18:08

0:10:26

0:10:26

0:03:59

0:03:59