filmov

tv

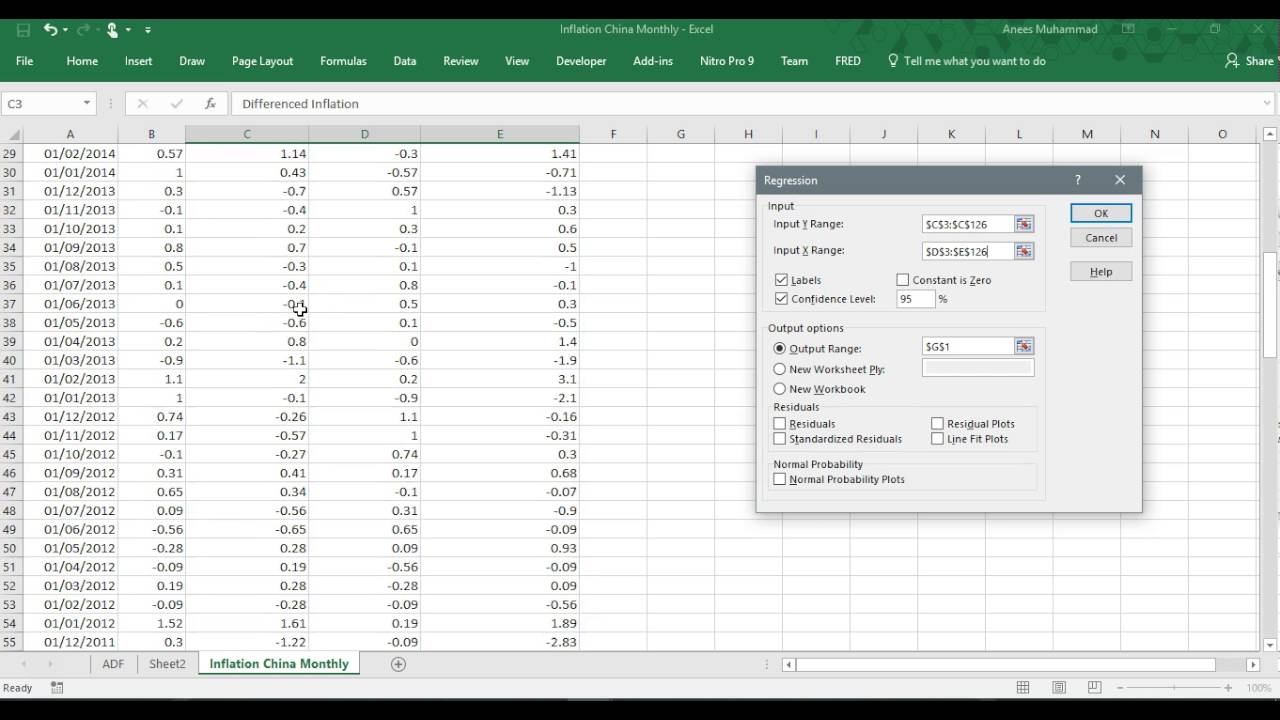

Unit Root Testing using Excel Dickey Fuller Test using Excel

Показать описание

Unit Root Testing using Excel Dickey Fuller Test using Excel

Dickey-Fuller test and augmented Dickey-Fuller test - unit roots and stationarity (Excel and EViews)

Unit Root Test - Step 1 of 4

(Excel):Perform Augmented Dickey-Fuller Test, Stationarity #adf #pp #stationarity #integration

Unit Roots : Time Series Talk

Unit Roots and Tests for Non-Stationarity

Test for Unit Roots on Multiple Time Series at Once EViews

Unit Root Test in EVIEWs

Time Series Analysis: Why are Unit Roots Important?

(EViews10):Augmented Dickey-Fuller Test, Stationarity #adf #pp #stationarity #integration

10.7. Time Series Econometrics: Unit root testing

Stata Tutorial: Basic Unit Root Test

5) i) B) Unit Root Testing - Generate Critical Values of the Dickey - Fuller Distribution

How to test stationarity for time series data using ADF method in stata

Augmented Dickey Fuller tests

Dickey Fuller Test and Philips Perron Test for unit root

Eviews: Unit Root Testing

KPSS test explained: Time series stationarity (Excel)

(EViews 10) Unit Root Testing for stationary

Test for unit root

Unit root tests in Eviews - Stationarity

Panel Unit Root Test

How to solve Unit root test in time series?

Checking stationarity by ADF Test in Eviews

Комментарии

0:02:02

0:02:02

0:19:45

0:19:45

0:06:12

0:06:12

0:14:11

0:14:11

0:13:53

0:13:53

0:17:28

0:17:28

0:07:13

0:07:13

0:11:00

0:11:00

0:12:49

0:12:49

0:11:23

0:11:23

0:05:50

0:05:50

0:23:57

0:23:57

0:06:50

0:06:50

0:00:51

0:00:51

0:05:01

0:05:01

0:24:12

0:24:12

0:03:23

0:03:23

0:13:52

0:13:52

0:11:15

0:11:15

0:20:48

0:20:48

0:05:55

0:05:55

0:07:19

0:07:19

0:00:49

0:00:49

0:04:20

0:04:20