filmov

tv

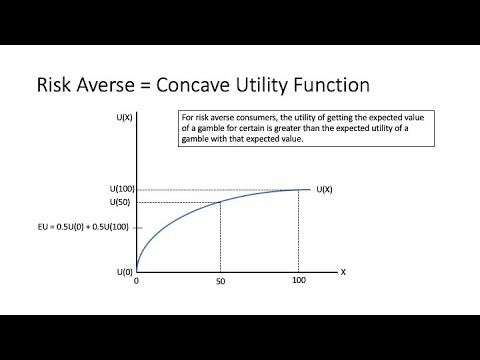

Expected Utility and Risk Preferences

Показать описание

This video provides a basic explanation of how to calculate a consumer's expected utility from a risky choice. Also explain the different types of risk preferences and the relationship between the shape of a utility function and a consumer's risk preferences.

Expected Utility and Risk Preferences

Utility and Risk Preferences Part 1 - Utility Function

Expected Utility (1): Risk Aversion, Risk Loving, and Risk Neutral

Risk Aversion and Expected Utility Basics

Expected Utility and Insurance

expected utility and lottery || choice under uncertainty || microeconomics ||

Lecture 7: Risk Preferences I

attitude towards risk . risk averse , risk loving , risk neutral . expected utility. choice under u

Expected utility theory: Choices, Prospects, and Risk Aversion

Expected Utility Theory Risk Aversion

Lecture 8: Risk Preferences II

20. Uncertainty

Lecture 17A - Risk Preferences, Expected Utility

What is Risk Aversion?

Risk Averse, Risk Seeker & Risk neutral

Risk Aversion

Economics of Insurance: Expected Utility, Actuarially Fair Premium

Risk Aversion and Risk Seeking

Game Theory 101 (#53): Risk Averse, Risk Neutral, and Risk Acceptant Preferences

What is Risk Aversion | Explained in 2 min

Watt'z 27-How does Expected Utility theory insist upon securing the situation

certainity equivalent | risk premium | risk aversion| expected utility | expected value |

Choice Under Uncertainty | Part 1 | Meaning of Expected Value and Expected Utility | 35 |

Utility and Risk Preferences Part 2 - Indifference Curves

Комментарии

0:11:10

0:11:10

0:08:55

0:08:55

0:07:30

0:07:30

0:21:45

0:21:45

0:06:44

0:06:44

0:09:01

0:09:01

1:16:54

1:16:54

0:21:15

0:21:15

0:09:08

0:09:08

0:10:25

0:10:25

1:13:13

1:13:13

0:48:30

0:48:30

0:10:55

0:10:55

0:01:35

0:01:35

0:04:07

0:04:07

0:10:29

0:10:29

0:11:09

0:11:09

0:10:36

0:10:36

0:11:45

0:11:45

0:02:20

0:02:20

0:00:50

0:00:50

0:19:09

0:19:09

0:23:35

0:23:35

0:10:20

0:10:20