filmov

tv

Utility and Risk Preferences Part 2 - Indifference Curves

Показать описание

Utility and Risk Preferences Part 1 - Utility Function

Expected Utility and Risk Preferences

Utility and Risk Preferences Part 2 - Indifference Curves

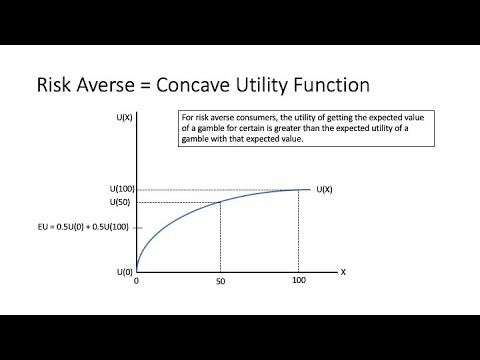

Expected Utility (1): Risk Aversion, Risk Loving, and Risk Neutral

(M5E2) [Microeconomics] Risk Preferences

Lecture 17A - Risk Preferences, Expected Utility

Risk Aversion and Expected Utility Basics

Lecture 7: Risk Preferences I

Lecture 8: Risk Preferences II

What is Risk Aversion?

Anomalies in expected utility theory: absurd rates of risk aversion

Chapter 5 Part 2 - Risk preferences Microeconomics by Robert Pindyck and Daniel Rubinfeld

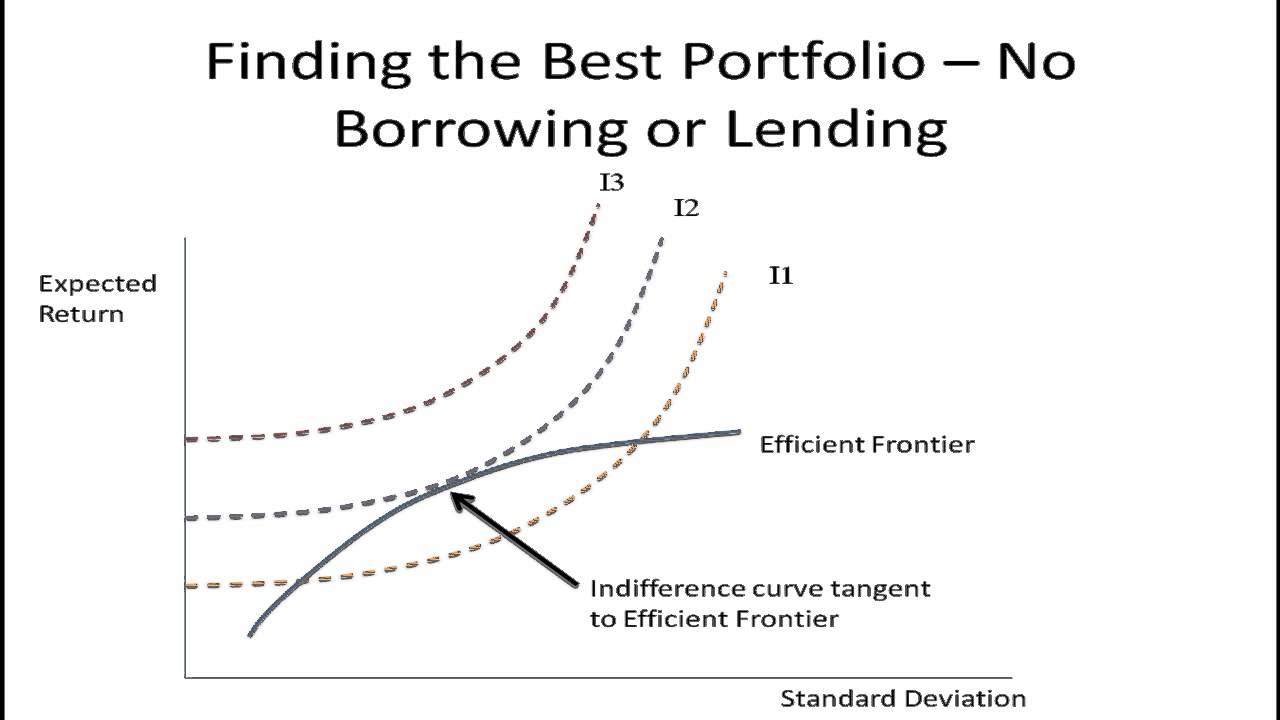

Utility given Risk and Return

Risk preferences of investors

Ch 06 02 Risk Aversion and Utility

Risk Preferences Implied by Synthetic Options

Axioms for expected utility theory

Expected Utility and Insurance

Investment Analysis 4 utility of wealth and risk aversion

Risk Types (Economics)

Anomalies in expected utility theory: framing and reference points

Game theory - Utility curves

Expected Utility (2): Risk Aversion and Insurance

Risk Averse, Risk Seeker & Risk neutral

Комментарии

0:08:55

0:08:55

0:11:10

0:11:10

0:10:20

0:10:20

0:07:30

0:07:30

![(M5E2) [Microeconomics] Risk](https://i.ytimg.com/vi/Mr7GJg8MEzE/hqdefault.jpg) 0:18:33

0:18:33

0:10:55

0:10:55

0:21:45

0:21:45

1:16:54

1:16:54

1:13:13

1:13:13

0:01:35

0:01:35

0:09:41

0:09:41

0:26:05

0:26:05

0:01:56

0:01:56

0:52:48

0:52:48

0:04:03

0:04:03

0:45:47

0:45:47

0:02:09

0:02:09

0:06:44

0:06:44

0:20:13

0:20:13

0:01:36

0:01:36

0:02:44

0:02:44

0:13:27

0:13:27

0:06:25

0:06:25

0:04:07

0:04:07