filmov

tv

Covered Call Strategies On CIBC Investor's Edge

Показать описание

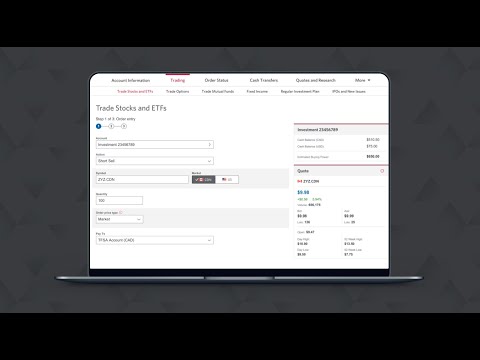

Looking to enhance your options trading strategy? In this video, I show you how to roll covered calls using CIBC’s Investor’s Edge platform. Rolling covered calls is a powerful technique to maximize your income while managing risk. Whether you're new to options trading or looking to refine your skills, this step-by-step guide makes it easy to understand and execute.

By subscribing to my investment newsletter and trade alerts service, you'll get access to expert market insights, up-to-date trade ideas, and strategies like covered calls, ensuring you stay ahead of the curve in today’s market. Don’t miss out—subscribe now for free updates!

Make sure to hit the like button, subscribe, and turn on notifications so you never miss out on new content designed to improve your investing skills.

This covered call strategy is perfect for tax-advantaged accounts like TFSA, RRSP, and ROTH IRA, making it ideal for long-term investors looking to generate monthly income while growing their portfolios. Whether you're using CIBC Investor's Edge or another platform, this simple, repeatable strategy helps maximize returns in registered accounts while minimizing risk. Perfect for both beginner and seasoned traders, it’s a great way to make your investments work harder for you every month.

▬ CONTENTS ▬▬▬▬▬▬▬▬▬▬

0:00 Intro to Covered Calls

0:35 Real annual returns in a TFSA

1:35 Stock Holdings Review and Sep Results

2:45 Step by Step Investor's Edge Rolling Calls

4:54 Confirm Order Before Submitting

6:06 How to adjust an open order

8:36 Get Trade Alerts

My primary investment strategy is long term high yield dividend investing, index funds and reducing risk and exposure using options. I have been actively trading the stock market for over 25 years and have built most of my wealth by reinvesting my dividends and following my 14 Personal Rules of investing. I actively trade options on both the American and Canadian Stock exchanges using options strategies and buying and holding high yield dividend paying stocks.

I generate monthly income in two ways. Averaging more than an annual 7% return by collecting dividends on high yield dividend stocks that I hold. The second income stream comes from the selling of option premium and taking advantage of theta decay. I love trading strangles, Iron condors and diagonal spread for maximizing returns. Delta neutral strategies allows me to make money in both bull and bear markets and limits my risk. Both of these strategies are suitable for passive income and create a stable predictable safe passive monthly income.

Let’s Get Rich Together

Levi Woods

Disclaimer: I am not a financial planner and am not offering investment advice. This is an opinion channel only and should not be taken as any form of financial advice. I receive a small commission from the purchase of any item from using the links listed above. There are financial risks involved in taking on any monetary transaction that I discuss in my videos.

By subscribing to my investment newsletter and trade alerts service, you'll get access to expert market insights, up-to-date trade ideas, and strategies like covered calls, ensuring you stay ahead of the curve in today’s market. Don’t miss out—subscribe now for free updates!

Make sure to hit the like button, subscribe, and turn on notifications so you never miss out on new content designed to improve your investing skills.

This covered call strategy is perfect for tax-advantaged accounts like TFSA, RRSP, and ROTH IRA, making it ideal for long-term investors looking to generate monthly income while growing their portfolios. Whether you're using CIBC Investor's Edge or another platform, this simple, repeatable strategy helps maximize returns in registered accounts while minimizing risk. Perfect for both beginner and seasoned traders, it’s a great way to make your investments work harder for you every month.

▬ CONTENTS ▬▬▬▬▬▬▬▬▬▬

0:00 Intro to Covered Calls

0:35 Real annual returns in a TFSA

1:35 Stock Holdings Review and Sep Results

2:45 Step by Step Investor's Edge Rolling Calls

4:54 Confirm Order Before Submitting

6:06 How to adjust an open order

8:36 Get Trade Alerts

My primary investment strategy is long term high yield dividend investing, index funds and reducing risk and exposure using options. I have been actively trading the stock market for over 25 years and have built most of my wealth by reinvesting my dividends and following my 14 Personal Rules of investing. I actively trade options on both the American and Canadian Stock exchanges using options strategies and buying and holding high yield dividend paying stocks.

I generate monthly income in two ways. Averaging more than an annual 7% return by collecting dividends on high yield dividend stocks that I hold. The second income stream comes from the selling of option premium and taking advantage of theta decay. I love trading strangles, Iron condors and diagonal spread for maximizing returns. Delta neutral strategies allows me to make money in both bull and bear markets and limits my risk. Both of these strategies are suitable for passive income and create a stable predictable safe passive monthly income.

Let’s Get Rich Together

Levi Woods

Disclaimer: I am not a financial planner and am not offering investment advice. This is an opinion channel only and should not be taken as any form of financial advice. I receive a small commission from the purchase of any item from using the links listed above. There are financial risks involved in taking on any monetary transaction that I discuss in my videos.

Комментарии

0:09:10

0:09:10

0:02:51

0:02:51

0:01:19

0:01:19

0:10:43

0:10:43

0:07:49

0:07:49

0:08:53

0:08:53

0:11:06

0:11:06

0:07:12

0:07:12

0:10:59

0:10:59

0:12:31

0:12:31

0:05:08

0:05:08

0:06:47

0:06:47

0:10:04

0:10:04

0:05:51

0:05:51

0:07:27

0:07:27

0:08:36

0:08:36

0:17:34

0:17:34

0:02:50

0:02:50

0:40:27

0:40:27

0:00:23

0:00:23

0:10:42

0:10:42

0:44:51

0:44:51

0:03:38

0:03:38

0:00:51

0:00:51