filmov

tv

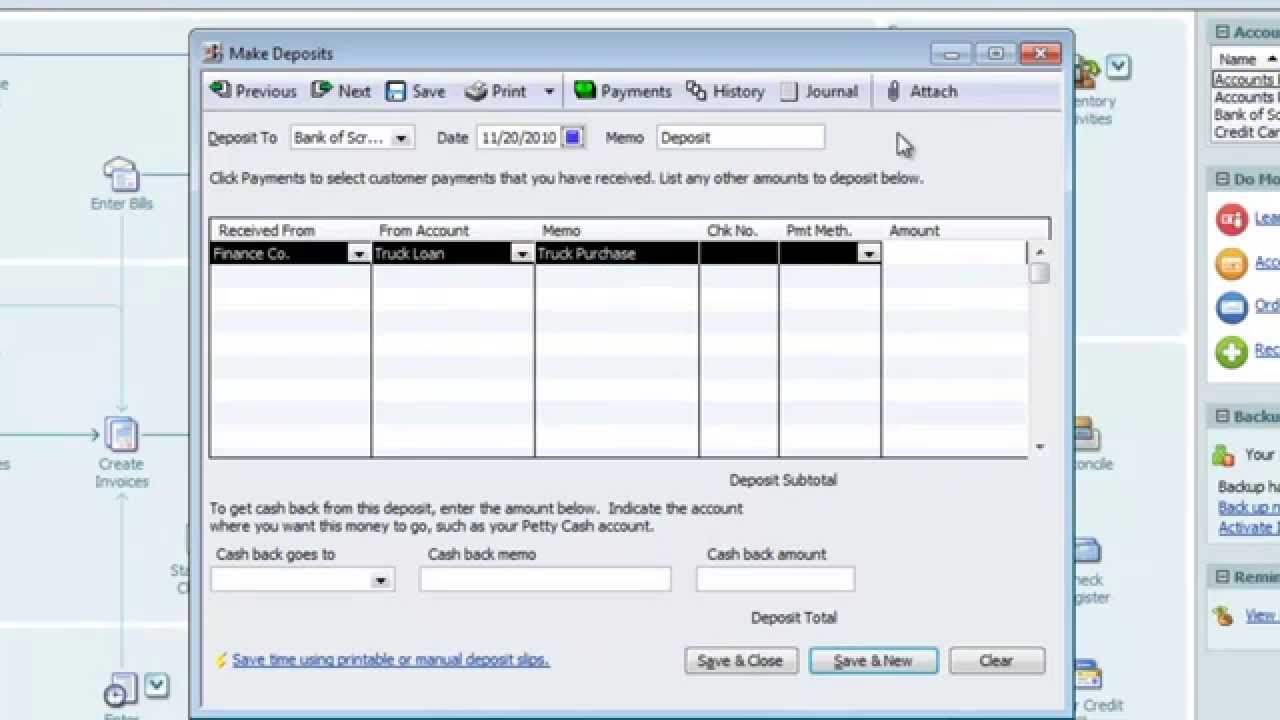

Quickbooks: Recording a New Fixed Asset

Показать описание

This screencast illustrates the ways you can record the acquisition of a new fixed asset in Quickbooks, and demonstrates how to properly record payments on the financing.

Quickbooks: Recording a New Fixed Asset

How to Record New Fixed Asset in QuickBooks Online (Step-by-Step)

How to manage fixed assets in QuickBooks Online Advanced

Which Form to Use to Record the Purchase of Fixed Assets - QuickBooks Online 2023

How to Record Fixed Assets in QuickBooks Online

How to Record the Sale of an Asset in Quickbooks

How To Record The Sale Of A Fixed Asset In QuickBooks Online | QBO Tutorial | Home Bookkeeper

How to Record Fixed Assets and Loans to QuickBooks Online | Ask a CPA!

QuickBooks Online Tutorial: Entering Depreciation Expenses Easily! | QuickBooks I Intuit

How to Record a Fixed Asset Purchase in QuickBooks Online

C063 ||QuickBooks|| Recording a New Fixed Assets & Deprecation in Urdu-Hindi

How To Add A Fixed Asset In QuickBooks Online | QBO Tutorial | Bookkeeper View

Fix Duplicate Income & Clean-up A/R in QuickBooks Online

QuickBooks Online Fixed Assets: Record Fixed Assets, Depreciation, Purchase of Fixed Assets on Loan

QuickBooks Desktop | Purchase and Record Fixed Assets

How to record Depreciation and Accumulated Depreciation in QuickBooks Accounting Software.

How to Record a Vehicle Purchase in QuickBooks Online

QuickBooks Online: troubleshooting duplicate transfers or credit card payments when reconciling

How To Enter Fixed Assets in QuickBooks Online

QuickBooks Online Exciting New Feature!

How to Record Fixed Assets Using Journal Entries in QuickBooks Desktop

How to record the sale of an asset in QuickBooks Online

Track your fixed assets easily in Quickbooks Online (QBO)

QuickBooks Desktop | Selling a Fixed Asset and Record Gain or Loss

Комментарии

0:05:37

0:05:37

0:05:24

0:05:24

0:04:59

0:04:59

0:01:15

0:01:15

0:02:57

0:02:57

0:08:36

0:08:36

0:04:45

0:04:45

0:09:02

0:09:02

0:03:45

0:03:45

0:02:58

0:02:58

0:15:41

0:15:41

0:04:26

0:04:26

0:11:02

0:11:02

0:42:59

0:42:59

0:06:03

0:06:03

0:10:54

0:10:54

0:13:13

0:13:13

0:09:22

0:09:22

0:08:45

0:08:45

0:00:16

0:00:16

0:01:53

0:01:53

0:04:25

0:04:25

0:17:13

0:17:13

0:07:04

0:07:04