filmov

tv

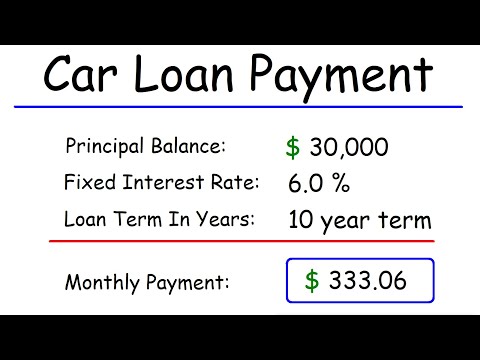

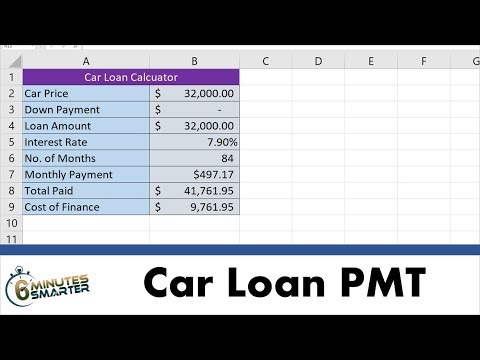

How to Calculate Car Payments

Показать описание

You've just seen the car of your dreams, but you're not sure if the price is right. In a few steps, you can calculate your potential car payments and decide if you'll be able to afford a new ride.

Step 1: Convert the interest rate percentage to a decimal

Convert your loan's interest rate to a decimal number by dropping the percent sign and dividing the number by 100.

Step 2: Divide decimal number by 12

Divide the interest rate on your car loan by 12. Write this number on a piece of paper.

Step 3: Multiply by your car loan principal

Multiply the number by the loan's principal amount -- the total amount of your car loan. Write this number down, as it will be used in your final calculation.

Tip

Remember to subtract any down payment you might make from the new car's purchase price when figuring out the principal amount.

Step 4: Add 1 plus the interest divided by 12

Recall the number you got from dividing the interest rate by 12 in step 2. Add 1 to this number.

Step 5: Multiply sum by itself, using number of payments as exponent

Take the sum from step 4 raised to the power of the number of months included in the term of your loan. For example, if you will make 36 monthly payments, multiply the sum from step 4 by itself 36 times.

Step 6: Calculate 1 divided by this sum

Calculate 1 divided by the result from step of your multiplication.

Tip

Round this number to the nearest hundredths place to make it easier to work with.

Step 7: Subtract sum from 1

Subtract this number from 1. Jot this number down for use in your final calculation.

Tip

Avoid the math by using car payment calculators found on many auto dealer and bank websites.

Step 8: Divide the first number by the second

Divide the number from step 3 by the number from step 7 for your final monthly car payment. Think about whether this will fit into your monthly budget. If so, you might want to ride off in that dream car.

Did You Know?

The Smithsonian Institute has been collecting cars since 1899, and has more than 60 cars in its collection, including a 1913 Model T Ford and a 1903 Cadillac.

Комментарии

0:10:44

0:10:44

0:01:59

0:01:59

0:08:35

0:08:35

0:05:42

0:05:42

0:00:55

0:00:55

0:04:00

0:04:00

0:12:39

0:12:39

0:00:21

0:00:21

0:13:45

0:13:45

0:04:31

0:04:31

0:02:11

0:02:11

0:05:58

0:05:58

0:06:15

0:06:15

0:17:36

0:17:36

0:05:27

0:05:27

0:07:03

0:07:03

0:01:00

0:01:00

0:11:06

0:11:06

0:06:09

0:06:09

0:00:25

0:00:25

0:06:04

0:06:04

0:08:52

0:08:52

0:02:23

0:02:23

0:01:00

0:01:00