filmov

tv

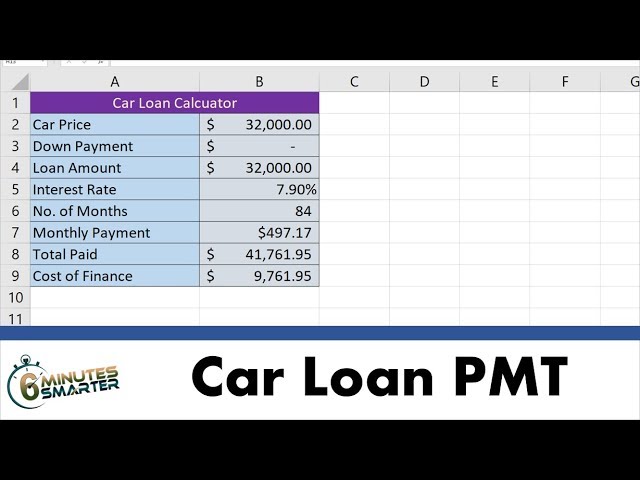

Use the PMT Function to Calculate Car Loan Payments and Cost of Financing

Показать описание

The PMT function in Excel can be be used to determine the monthly payment for any fixed-rate loan. By providing information like car loan amount, interest rate, and months, we can calculate the exact monthly payment and then determine the total cost paid for a car.

Calculate Loan Payments with Excel PMT Function

How To Calculate Loan Payments Using The PMT Function In Excel

Excel PMT Function #shorts #excel #spreadsheet #exceltips

How to Use Excel PMT Function to Calculate Loan Payments

Excel PMT() Function Basics

How to Use Excel PMT Function | Calculate Monthly Loan Payment Amount

How to Calculate Monthly Payments in Excel with PMT Function

How to Use the PMT Function to Calculate Repayments in Excel

PMT Function in Excel.

Use the PMT Function

1-Minute Tech - PMT Function in Excel Explained | Excel Tips | Intellipaat

How to Use the PMT Function in Google Sheets

How To Use The PMT Function In Excel

How To Calculate Loan Payments & Savings Goals In Excel | PMT() Function

O365 Excel - How to use the Payment (PMT) Function

How to Calculate Loan EMI and Loan interest by using PMT Function in Excel

00178 - How To Use The PMT Function To Determine The Payment of A Loan Amount Using Microsoft Excel

Microsoft Excel Tutorial - How to Use PMT Function

Microsoft Excel Tutorial - Using Excel’s ‘Payment’ function (=PMT)

Excel EMI Calculator 🤩 Use PMT Function of Excel #shorts

Use the PMT Function to Calculate Car Loan Payments and Cost of Financing

Excel PMT Function - house or car loan payment | Excel One Minute Quick Reference

How to calculate EMI in Excel? || PMT | PPMT | IPMT function in Excel #shorts #msexcel

PMT Function in Excel

Комментарии

0:03:10

0:03:10

0:10:47

0:10:47

0:00:25

0:00:25

0:06:01

0:06:01

0:08:06

0:08:06

0:03:08

0:03:08

0:04:16

0:04:16

0:10:22

0:10:22

0:00:42

0:00:42

0:05:04

0:05:04

0:00:58

0:00:58

0:05:53

0:05:53

0:00:21

0:00:21

0:08:40

0:08:40

0:06:20

0:06:20

0:04:14

0:04:14

0:02:59

0:02:59

0:02:08

0:02:08

0:04:30

0:04:30

0:01:00

0:01:00

0:07:03

0:07:03

0:02:42

0:02:42

0:00:58

0:00:58

0:00:57

0:00:57