filmov

tv

Net Present Value (NPV) | HP 10bII+ Financial Calculator | Constant (Even) Cash Flows

Показать описание

In this lesson, we go through an example of how to calculate the Net Present Value (NPV) when you have Constant (Even) Cash Flows using the Financial Calculator HP 10bII+. Check it out

Check out other straight-forward examples on our channel.

We also offer one-on-one tutorials at reasonable rates.

Connect with us:

Check out other straight-forward examples on our channel.

We also offer one-on-one tutorials at reasonable rates.

Connect with us:

Net Present Value (NPV) explained

How to calculate the Net Present value (NPV)

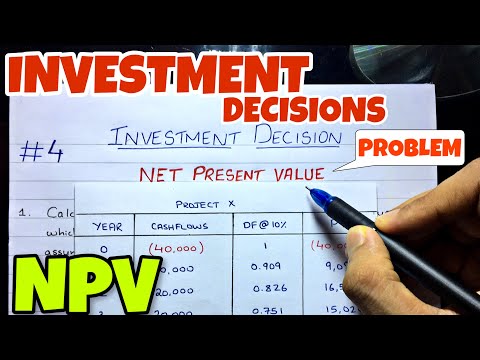

#4 Net Present Value (NPV) - Investment Decision - Financial Management ~ B.COM / BBA / CMA

How to Calculate a Project's NPV?

Net Present Value (NPV): How to Do NPV Analysis

Net Present Value - NPV, Profitability Index - PI, & Internal Rate of Return - IRR Using Excel

🔴 3 Minutes! NPV and Net Present Value Explained with NPV Example (Quickest Overview)

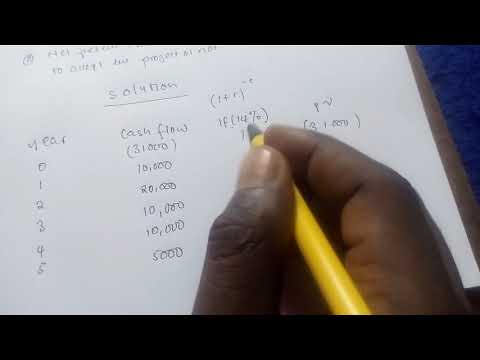

Net present value (NPV) example problem

Net Present Value (NPV) Calculation Example Using Table | Non-constant (uneven) cash flows

Investment Appraisal Net Present Value (NPV) | A-Level & IB Business

How to Calculate NPV (Net Present Value) in Excel

NPV and IRR explained

Introduction to Net Present Value (NPV)

Net Present Value (NPV) in Excel Explained | Should You Accept the Project?

Net Present Value (NPV) - Basics, Formula, Calculations in Excel (Step by Step)

Net Present Value (NPV)

The Concept of Net Present Value (NPV) Explained

Net Present Value (NPV) with Excel

Investment Appraisal: Net Present Value (NPV)

BA II Plus | Cash Flows 1: Net Present Value (NPV) and IRR Calculations - DCF

Net Present Value Explained in Five Minutes

A level Business Revision - Net Present Value Method of Investment Appraisal

Net Present Value NPV using Table | Constant Cashflows

What is Discounted Cash Flow (DCF)?

Комментарии

0:05:26

0:05:26

0:07:27

0:07:27

0:18:50

0:18:50

0:05:13

0:05:13

0:03:12

0:03:12

0:18:22

0:18:22

0:03:05

0:03:05

0:02:43

0:02:43

0:09:01

0:09:01

0:06:18

0:06:18

0:02:56

0:02:56

0:06:48

0:06:48

0:03:45

0:03:45

0:03:56

0:03:56

0:25:14

0:25:14

0:07:28

0:07:28

0:06:35

0:06:35

0:05:31

0:05:31

0:15:39

0:15:39

0:02:53

0:02:53

0:04:34

0:04:34

0:10:58

0:10:58

0:06:46

0:06:46

0:05:02

0:05:02