filmov

tv

How to Make Rentals Cash Flow With 8% Mortgages

Показать описание

⭐ Join Rental Property Mastery, my coaching & learning community:

🎙️ Episode 316 - Buying a rental with a conventional 8% mortgage is a recipe for negative cashflow. Instead, I'll teach you 4 powerful strategies to make deals work in today's high-interest market.

📄 Show Notes:

🎬 Topics Covered:

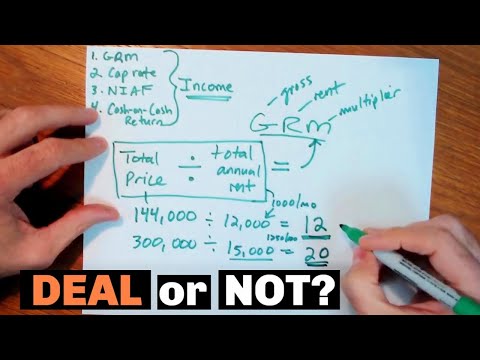

0:00 - 8% Interest + High Home Prices = Disaster

0:51 - The Huge Difference Between 4% & 8%

4:33 - Why Buy Low and Sell High

5:37 - How to Pay ALL Cash

8:20 - Private Lenders Love This

11:39 - Finding Sellers to Become the Bank

15:07 - Taking Over Low-Interest Mortgages "Subject-to"

19:20 - Final Thoughts

--------------------------

⚒️ Get my FREE Real Estate Investor Toolkit:

🖥️ My Real Estate Courses:

[FREE COURSE] Find Your Focus in Real Estate for Beginners:

30 Days to a Better Rental Investor:

Creative Financing for Real Estate Investors:

📘 (My Book) The Small & Mighty Real Estate Investor:

📙 (My Book) Retire Early with Real Estate:

💰 DealMachine - Software to help you buy more real estate deals:

✅ Subscribe for more videos about real estate investing:

👋 Connect with me:

🎙️ Episode 316 - Buying a rental with a conventional 8% mortgage is a recipe for negative cashflow. Instead, I'll teach you 4 powerful strategies to make deals work in today's high-interest market.

📄 Show Notes:

🎬 Topics Covered:

0:00 - 8% Interest + High Home Prices = Disaster

0:51 - The Huge Difference Between 4% & 8%

4:33 - Why Buy Low and Sell High

5:37 - How to Pay ALL Cash

8:20 - Private Lenders Love This

11:39 - Finding Sellers to Become the Bank

15:07 - Taking Over Low-Interest Mortgages "Subject-to"

19:20 - Final Thoughts

--------------------------

⚒️ Get my FREE Real Estate Investor Toolkit:

🖥️ My Real Estate Courses:

[FREE COURSE] Find Your Focus in Real Estate for Beginners:

30 Days to a Better Rental Investor:

Creative Financing for Real Estate Investors:

📘 (My Book) The Small & Mighty Real Estate Investor:

📙 (My Book) Retire Early with Real Estate:

💰 DealMachine - Software to help you buy more real estate deals:

✅ Subscribe for more videos about real estate investing:

👋 Connect with me:

Комментарии

0:21:24

0:21:24

1:03:19

1:03:19

0:10:05

0:10:05

0:13:44

0:13:44

0:35:11

0:35:11

0:43:58

0:43:58

0:09:24

0:09:24

0:07:12

0:07:12

0:14:16

0:14:16

0:09:57

0:09:57

0:19:39

0:19:39

0:09:35

0:09:35

0:12:25

0:12:25

0:11:31

0:11:31

0:17:18

0:17:18

0:27:15

0:27:15

0:15:44

0:15:44

0:32:13

0:32:13

0:04:41

0:04:41

0:03:46

0:03:46

0:00:53

0:00:53

0:38:25

0:38:25

0:16:46

0:16:46

0:14:38

0:14:38