filmov

tv

Bad Debt | Doubtful Debt | Ageing Analysis

Показать описание

For queries write us at

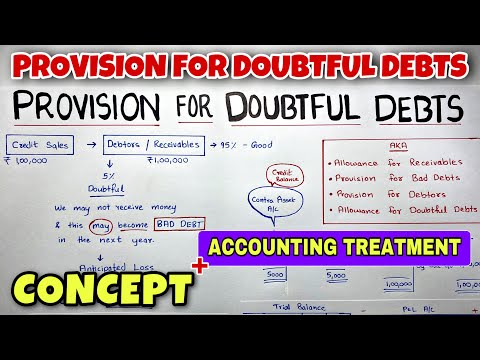

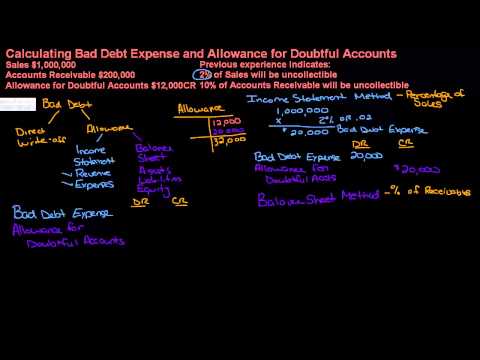

When the sale is made on credit, there’s a risk the Organization may not receive the cash that the customer owes it.

If significant doubt exist as to the recoverability of the amount then the organization will record it as a provision

Allowance for Bad Debt to

Provision for Bad Debt

If the customer dies, disputes the payment or goes bankrupt then the Organization will record bad debt as

Provision for Bad Debt to

Receivables

Conversely if the cash flow situation improves then the organization will reverse off the provision and record as

Provision for Bad Debt to

Allowance for Bad Debt

Organizations do ageing analysis of the overdue amounts to assess the likely hood of default to assess the provision required to be recorded.

#BadDebts #DoubtfulDebts #AgeingAnalysis

MRM is a Team Comprising of professionals experienced in Corporate and Project Finance, Transaction and Accounting Services, Taxation and Corporate Advisory Experience.

When the sale is made on credit, there’s a risk the Organization may not receive the cash that the customer owes it.

If significant doubt exist as to the recoverability of the amount then the organization will record it as a provision

Allowance for Bad Debt to

Provision for Bad Debt

If the customer dies, disputes the payment or goes bankrupt then the Organization will record bad debt as

Provision for Bad Debt to

Receivables

Conversely if the cash flow situation improves then the organization will reverse off the provision and record as

Provision for Bad Debt to

Allowance for Bad Debt

Organizations do ageing analysis of the overdue amounts to assess the likely hood of default to assess the provision required to be recorded.

#BadDebts #DoubtfulDebts #AgeingAnalysis

MRM is a Team Comprising of professionals experienced in Corporate and Project Finance, Transaction and Accounting Services, Taxation and Corporate Advisory Experience.

0:08:30

0:08:30

0:27:22

0:27:22

0:03:56

0:03:56

0:12:43

0:12:43

0:12:00

0:12:00

1:05:48

1:05:48

0:01:00

0:01:00

0:05:53

0:05:53

0:26:01

0:26:01

0:06:42

0:06:42

0:05:38

0:05:38

0:10:04

0:10:04

0:25:59

0:25:59

0:04:34

0:04:34

0:42:26

0:42:26

0:04:02

0:04:02

0:17:10

0:17:10

0:00:20

0:00:20

0:05:06

0:05:06

0:39:07

0:39:07

0:02:16

0:02:16

0:03:23

0:03:23

0:00:51

0:00:51

0:10:09

0:10:09