filmov

tv

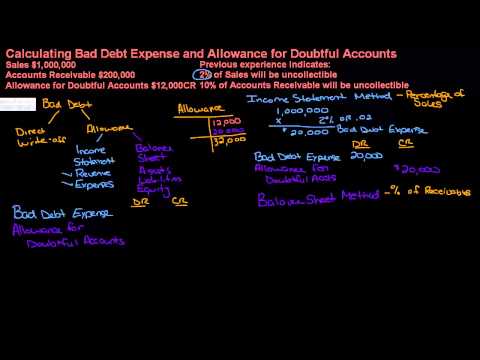

Calculating Bad Debt Expense and Allowance for Doubtful Accounts

Показать описание

This video highlights the calculations for Bad Debt Expense and Allowance for Doubtful Accounts using the Income Statement Method (Percentage of Sales) and a Balance Sheet Method (Percentage of Accounts Receivable. T-accounts are used to show the effect of each calculation on Allowance for Doubtful Accounts. Examples are given for both a debit and credit starting balance in Allowance for Doubtful Accounts.

Calculating Bad Debt Expense and Allowance for Doubtful Accounts

Bad debt accounting

Calculating Bad Debt Expense and Allowance For Doubtful Accounts

Allowance For Doubtful Accounts Explained with Examples

Calculate Bad Debt Expense - Percentage of Sales Method

What is bad debt | bad debt expense | Calculating bad debt expense | bad debt explained | Simplyinfo

Bad Debt Expense and Allowance for Bad Debts

Bad Debt Expense Calculation Methods ch9

DON'T BE IN DENIAL OF FRAUD

Calculate Bad Debt Expense - Percentage of Accounts Receivable Method

Bad Debt & Allowance for Bad Debts | Direct Write-Off, Balance Sheet & Income Statement Meth...

calculating bad debts video

Bad Debts & Allowance For Doubtful Accounts (Provision for bad debts) In Financial Statements

Financial Accounting - Lesson 8.7 - Allowance for Bad Debt Expense Example

How to account for Bad Debt Expense

Bad Debts and Recovery of Bad Debts - By Saheb Academy

Calculating Bad Debt Expense under the Allowance Method for both % of Sales and Receivables (MOM)

Bad debt expense - % of sales (Exercise 8-11)

Bad Debts (Allowance Method, Direct Write Off) [Full course FREE in description]

FA25 - How do you Write Off a Receivable?

Sales Method or Income Approach for Bad Debts Expense (Financial Accounting Tutorial #43)

Bad Debt Expense: Percent of Sales

FA23 - Accounts Receivable - Percentage of Sales Method Example

ACCOUNTING EQUATION 9 - BAD DEBTS

Комментарии

0:17:10

0:17:10

0:08:30

0:08:30

0:04:45

0:04:45

0:10:04

0:10:04

0:04:29

0:04:29

0:06:06

0:06:06

0:04:30

0:04:30

0:07:06

0:07:06

0:52:11

0:52:11

0:06:19

0:06:19

0:14:17

0:14:17

0:05:31

0:05:31

0:06:42

0:06:42

0:12:50

0:12:50

0:02:13

0:02:13

0:12:43

0:12:43

0:07:35

0:07:35

0:13:16

0:13:16

0:05:23

0:05:23

0:04:02

0:04:02

0:08:09

0:08:09

0:02:00

0:02:00

0:14:27

0:14:27

0:06:52

0:06:52