filmov

tv

How to Calculate Your Accounts Receivable Turnover Ratio: Formula and Examples

Показать описание

Our video covers:

Accounts receivable turnover ratio formula (1:02)

The formula for accounts receivable turnover ratio is net credit sales divided by average accounts receivable. You can find these numbers on your business’s balance sheet.

Accounts receivable turnover ratio example (1:54)

What makes a good accounts receivable turnover ratio (3:41)

In general, a high accounts receivable turnover ratio is better than a low ratio. A low ratio can indicate that your credit collection policies aren’t strict enough. However, if your ratio is too high, you might be turning customers away with too-strict credit collection policies. It’s good to find a balance.

How to improve your accounts receivable turnover ratio (4:38)

The best way to improve your accounts receivable turnover ratio is to collect on invoices more quickly and efficiently. Some strategies to do this are sending out the invoice more quickly, offering early payment discounts, and enforcing late payment fees.

Learn How to Calculate Your Net Worth in One Minute

How Does Savings Account Interest Work?

How to Calculate Your Accounts Receivable Turnover Ratio: Formula and Examples

How To Calculate Lot Sizes Perfectly - Enter Forex Trades in 2 Seconds

How do you calculate your net profit margin?

How to Calculate Interest Rates (The Easy Way)

GCSE Maths - How to Calculate Simple Interest #95

How to Calculate the RIGHT Lot Size for Forex Trading 📈

Grade 10 Accounting Paper 1 Final Exam 2024 [Full version out of 150 Marks]

How to Calculate the Money Market Fund Interest Rate

Math in Daily Life : How to Calculate Interest on Savings

EASIEST Way to Calculate Lot Sizes / Pips in 3 Secs! (No BS Guide)

How To Calculate Your Mortgage Payment

How to Calculate Weighted Average Inventory - Fast!

HOW TO CALCULATE DIVIDENDS: 5 EASY STEPS

How to Calculate ROI (Return on Investment)

How to Calculate Net Profit

How to calculate PROFIT / OVERHEAD / LABOR COST the EASY way!

How To Calculate The Cash Conversion Cycle | And What It Means

How To Calculate Your Net Worth | NerdWallet

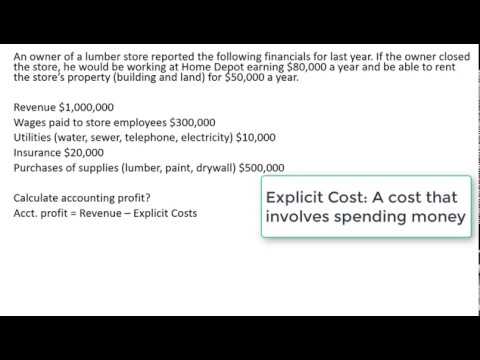

How to Calculate Accounting and Economic Profit

How to calculate money market fund interest

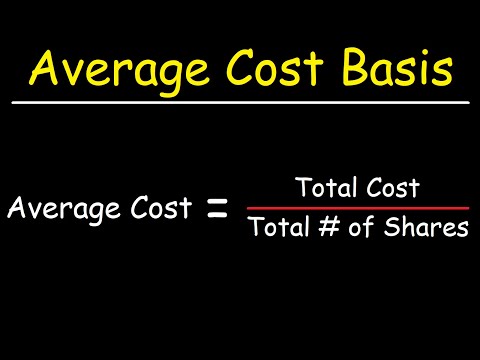

How To Calculate Your Average Cost Basis When Investing In Stocks

How to Calculate Accounts Receivable Turnover Ratio (Step by Step)

Комментарии

0:01:28

0:01:28

0:01:50

0:01:50

0:06:13

0:06:13

0:05:53

0:05:53

0:00:20

0:00:20

0:02:37

0:02:37

0:04:05

0:04:05

0:09:19

0:09:19

1:10:34

1:10:34

0:09:53

0:09:53

0:02:01

0:02:01

0:10:03

0:10:03

0:05:10

0:05:10

0:06:14

0:06:14

0:02:23

0:02:23

0:01:53

0:01:53

0:01:46

0:01:46

0:08:44

0:08:44

0:10:57

0:10:57

0:01:00

0:01:00

0:05:30

0:05:30

0:07:19

0:07:19

0:05:39

0:05:39

0:11:48

0:11:48