filmov

tv

Stock Markets and Economic Data (Correlation)

Показать описание

Traders and investors should understand the relationship between the stock market and economic data.

Many are baffled when an economic report is produced showing poor performance, yet the market does the opposite. For the experienced this comes as no surprise because the stock market is very often a forecast of future economic data. The data itself is often lagging information.

Once you understand this you can better time your stock positions and be less surprised or even bemused by the stock market itself.

Links:-

StockTrading videos:-

Investing videos:-

As a long term investor/trader I have consumed hundreds of financial books and endured countless hours of self education. My hope is that this channel will reduce the learning curve duration of many aspiring investors by providing the key information in a concise and enjoyable manner.

Many are baffled when an economic report is produced showing poor performance, yet the market does the opposite. For the experienced this comes as no surprise because the stock market is very often a forecast of future economic data. The data itself is often lagging information.

Once you understand this you can better time your stock positions and be less surprised or even bemused by the stock market itself.

Links:-

StockTrading videos:-

Investing videos:-

As a long term investor/trader I have consumed hundreds of financial books and endured countless hours of self education. My hope is that this channel will reduce the learning curve duration of many aspiring investors by providing the key information in a concise and enjoyable manner.

Stock Markets and Economic Data (Correlation)

Economic data isn't bad but pricing is off, says Morgan Stanley's Chris Toomey

How does the stock market work? - Oliver Elfenbaum

(WARNING) Tomorrow's Report Could Shock the Stock Market...

The Stock Market vs. The Economy

Economic Indicators Investors Need to Know

How To Use The Economic Calendar

How Does the Stock Market Work? (Stocks, Exchanges, IPOs, and More)

The ADP employment change release #forex #marketdata #news #currencymarkets #financialmarketanalysis

Explained | The Stock Market | FULL EPISODE | Netflix

How To Trade Economic Data Like A Pro

Gary Shilling explains the only way to beat the market and win

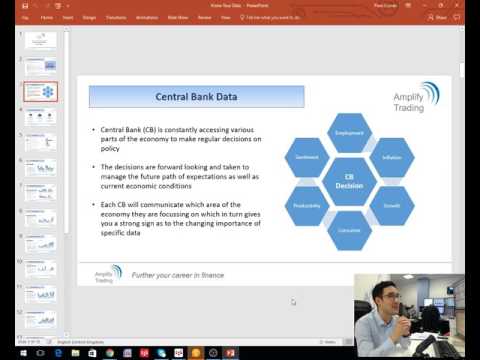

Understanding Important Economic Data

How do Interest Rates Impact the Stock Market?

Predict The Stock Market With Machine Learning And Python

Which Economic Data Releases Are Important for Day Trading?

4K 100% Royalty-Free Stock Footage | Economic Stock Financial Data Visuals | No Copyright Video

The Economy Is BOOMING | The TRUTH Behind the Latest Economic Data

Economic Data Analysis Project with Python Pandas - Data scraping, cleaning and exploration!

Key Market News: China’s Stock Boom & India’s Economic Data | Equentis- Research and Ranking

How The Economic Machine Works by Ray Dalio

Andrew Sheets: Which Economic Indicators are the Most Useful?

Multiple Indicators w/100% ACCURACY are Signaling a Market Crash!

Tom Lee's *NEW* Prediction for Stocks

Комментарии

0:06:53

0:06:53

0:05:37

0:05:37

0:04:30

0:04:30

0:04:00

0:04:00

0:12:17

0:12:17

0:08:24

0:08:24

0:17:35

0:17:35

0:08:49

0:08:49

0:00:56

0:00:56

0:17:34

0:17:34

0:08:49

0:08:49

0:03:06

0:03:06

0:35:25

0:35:25

0:03:16

0:03:16

0:35:55

0:35:55

0:09:46

0:09:46

0:00:29

0:00:29

0:15:09

0:15:09

0:44:55

0:44:55

0:04:46

0:04:46

0:31:00

0:31:00

0:03:15

0:03:15

0:15:31

0:15:31

0:24:17

0:24:17