filmov

tv

Multiple Indicators w/100% ACCURACY are Signaling a Market Crash!

Показать описание

There are multiple economic indicators and models that are predicting a recession and stock market crash either in 2024 or 2025!

Chapters

0:00 Intro

1:00 Yield Curve Inversion

5:30 Sahm Rule

8:10 Michez Rule

9:05 The FED & My Thoughts

14:30 Conclusion

Thanks for watching and please subscribe!!! :)

***Please be advised that I am not giving any financial or investing advice. I am not telling anyone how to spend or invest their money. Take all of my videos as my own opinion, as entertainment, and at your own risk.***

Multiple Indicators w/100% ACCURACY are Signaling a Market Crash!

This Tradingview indicator wins 99% trades!

FOUND the BEST INDICATOR ON TRADINGVIEW with 100%....

The Magic Multi Type RSI TradingView Indicator: 100% WIN Buy/Sell Signals

The Only TradingView INDICATOR You EVER Need [Secret Strategy]🔥

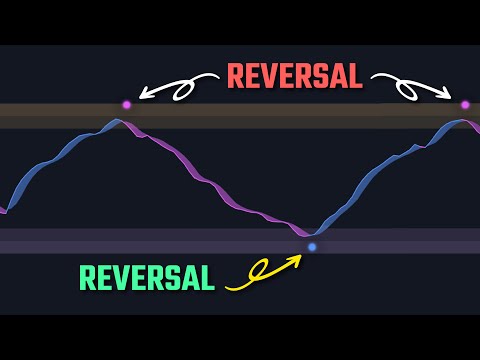

This tradingview Indicator predicts 100% accurate reversals

This Tradingview Indicator GIVE 100% ACCURATE REVERSAL Signals If......

The Most Accurate Buy Sell Signal Indicator in TradingView - 100% Profitable Scalping Strategy

100% Accurate Reversals Using this Secret Tradingview Indicator

40 INDICATORS IN ONE! Most Professional BUY SELL Indicator on TradingView

FULL POWER Indicator on TradingView Gives Perfect Signals

700% Profit In ONE Trade Using A Secret Indicator 🤯 #shorts

This TradingView Indicator Finds Reversals | V4 Divergence Trading Strategy

THE BEST SCALPING INDICATOR ON TRADINGVIEW | STRATEGY | SCALPING | 1MINUTE | #forex

This Buy Sell Tradingview Scalping Indicator Makes $100 Every....

100% Accurate Reversals Using this Secret Tradingview Indicator

This indicator will help you predict market moves in Tradingview #shorts #forex #forextrading

10 HIGHLY Profitable TradingView Indicators For Perfect Trading

NEW TradingView Indicator Draws 100% Accurate Trendlines

NEW Trend Indicator on TradingView with PERFECT Signals [NO ONE KNOWS YET🤫]

100% Accurate Reversals Using The Enhanced WaveTrend Indicator

STOP Using the Heiken Ashi! This Indicator will DOUBLE your profits

STOP Using The MACD! Try THIS Indicator Instead

🤯CRAZY Accurate Supply Demand Indicator

Комментарии

0:15:31

0:15:31

0:04:40

0:04:40

0:04:14

0:04:14

0:08:41

0:08:41

0:04:16

0:04:16

0:07:45

0:07:45

0:03:47

0:03:47

0:07:35

0:07:35

0:05:48

0:05:48

0:08:02

0:08:02

0:09:25

0:09:25

0:00:22

0:00:22

0:07:07

0:07:07

0:00:17

0:00:17

0:04:39

0:04:39

0:03:40

0:03:40

0:00:25

0:00:25

0:15:25

0:15:25

0:08:01

0:08:01

0:04:04

0:04:04

0:10:05

0:10:05

0:11:14

0:11:14

0:11:21

0:11:21

0:00:51

0:00:51