filmov

tv

Killik Explains: What is a stock market 'melt-up'?

Показать описание

The stock market’s recent bull run may be entering its most dangerous phase says Jeremy Grantham of GMO. This week I explain why.

Killik Explains: What is a 'stealth tax'?

Killik Explains: What is Wealth Management?

Killik Explains: What is a stock market 'melt-up'?

Killik Explains: A short guide to financial statements for equity investors

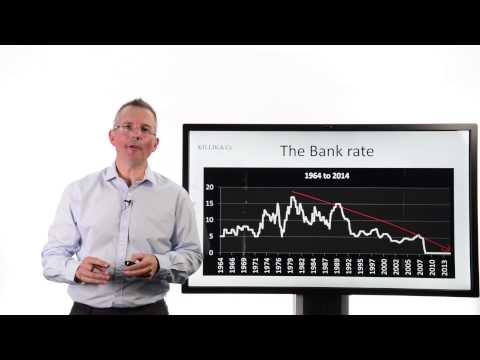

Killik Explains: Duration - The word every bond investor should understand

Killik Explains: The Difference between Financial Guidance and Advice

Killik Explains: Bond basics - a refresher

Killik Explains: How to invest money - five principles

Killik Explains: The best way to invest

Killik Explains: Fixed Income Basics - the yield curve

Killik Explains: How the new Lifetime ISA works

Killik Explains: Four reasons to become a saver

Killik Explains: An investor's quick guide to tax year 2019/20

Killik Explains: Three lessons for investors from The Fonz

Killik Explains: What MiFID II means for you

Killik Explains: What is offshore investing?

Killik Explains: How inheritance tax works

Killik Explains: Property Buying Basics - Part 1

Killik Explains: How to invest in equities the David Webb way

Killik Explains: How to buy shares - a snapshot

Killik Explains: What are repos and why do they matter?

Killik Explains: A short guide to crowdfunding

Killik Explains: How a cash flow model could change your life

Welcome to Killik Explains

Комментарии

0:09:19

0:09:19

0:04:42

0:04:42

0:11:11

0:11:11

0:08:26

0:08:26

0:10:17

0:10:17

0:06:29

0:06:29

0:07:37

0:07:37

0:05:26

0:05:26

0:06:13

0:06:13

0:10:48

0:10:48

0:09:14

0:09:14

0:08:38

0:08:38

0:06:56

0:06:56

0:09:35

0:09:35

0:06:43

0:06:43

0:07:37

0:07:37

0:05:57

0:05:57

0:09:06

0:09:06

0:06:09

0:06:09

0:06:03

0:06:03

0:07:41

0:07:41

0:08:20

0:08:20

0:10:12

0:10:12

0:01:19

0:01:19