filmov

tv

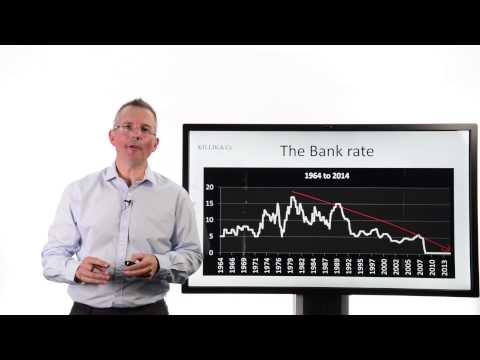

Killik Explains: Fixed Income Basics - the yield curve

Показать описание

Yield curves can reveal how bond investors see the future and help to guide borrowers on the direction of interest rates. Here I cover all the basics.

Killik Explains: Fixed Income Basics - the yield curve

Tim Bennett Explains: Fixed Income Basics - convertible bonds

Tim Bennett Explains: What are fixed income securities (bonds) - part 1

Killik Explains: Bond basics - a refresher

Tim Bennett Explains: Fixed Income Bond Market Red Flags - Yield spreads

Tim Bennett Explains: What are fixed income securities - part two, rewards and risks

Killik Explains: Duration - The word every bond investor should understand

Tim Bennett Explains: Bond fund or bond portfolio?

Killik Explains: The best way to invest

Killik Explains: How to invest money - five principles

How to approach bond investing

Introducing our Fixed Income Strategy

Killik Explains: Property Buying Basics - Part 1

Killik Explains: Five questions that every investor should ask

Tim Bennett: What are fixed income securities (Part 2)?

Killik Explains: 3 reasons for income investors to own shares

Killik Explains: How investors can spot dud income stocks

Killik Explains: Why Passive investing isn't perfect

How to generate income part 2 - using bonds

Killik Explains: 4 Bond Market Signals Investors Should Watch

Tim Bennett Explains: Why sky high bond prices have kept on rising

Equities vs fixed income

Killik Explains: How a cash flow model could change your life

Killik Explains: Why most investors should avoid 'alternative' investments

Комментарии

0:10:48

0:10:48

0:10:35

0:10:35

0:09:58

0:09:58

0:07:37

0:07:37

0:13:16

0:13:16

0:10:12

0:10:12

0:10:17

0:10:17

0:05:29

0:05:29

0:06:13

0:06:13

0:05:26

0:05:26

0:09:55

0:09:55

0:02:51

0:02:51

0:09:06

0:09:06

0:11:14

0:11:14

0:10:17

0:10:17

0:07:02

0:07:02

0:07:08

0:07:08

0:12:28

0:12:28

0:07:14

0:07:14

0:08:51

0:08:51

0:06:08

0:06:08

0:02:59

0:02:59

0:10:12

0:10:12

0:09:22

0:09:22