filmov

tv

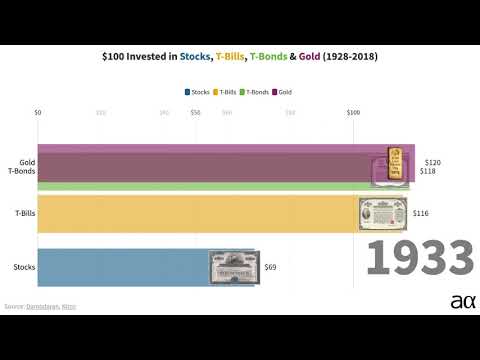

Returns Since 1928 for Stocks, Gold, Cash & Permanent Portfolio

Показать описание

Updated returns, stocks (16%) as well as gold (11%) did well this year, unlike last year where stocks did poorly (-18%) and gold just ok (0%). The surprise is again cash that is again returning 5% this year, which is zero after deducting 5% inflation. Last 10y, deducting also 5% for inflation, stocks still returned 7%, whereas gold only 1%.

The trend is still very clear if you look at the long term chart since 1928. A reversal in returns is unlikely given how short and weak this stock market cycle has been. Stocks can return a lot more and typically do if you look at previous cycles, and the inverse is true for gold. Gold held up well still but it can get a lot worse.

The trend is still very clear if you look at the long term chart since 1928. A reversal in returns is unlikely given how short and weak this stock market cycle has been. Stocks can return a lot more and typically do if you look at previous cycles, and the inverse is true for gold. Gold held up well still but it can get a lot worse.

Returns Since 1928 for Stocks, Gold, Cash & Permanent Portfolio

Historical Returns Since 1928 - Stocks, Gold, Inflation & Permanent Portfolio

Stocks v. Bonds: Which is actually riskier? [1928-2021]

The 1929 Stock Market Crash - Black Thursday - Extra History

Extremely Rare Long-Term Setups For Stocks 1928-2017

'How To Make Millions In A Market Crash' — Peter Lynch

President S&P 500 stock performance [1928-2022]

Mafia Cashed Check That Led To Stock Market Crash In 1928!!! #shorts

Stocks to trade tomorrow for Intraday | Prediction of Bank Nifty & Nifty for 10th January,2025

1928% Return Stocks#shorts #2021 #stock #trending #news #stock

US Stock Market Yearly Returns Est. 1928 #bearish #bearmarket #stockmarket #investing #foryou #spy

stock market crashes 2008 vs 1928 lessons for young investors#stockmarket #financialfreedom

Did Stock Brokers Jump off Buildings during the 1929 Stock Market Crash?

How to beat the S&P 500... by doing nothing [1935-2022]

It’s Happening Again…

A Serious Warning To All Investors

$100 Invested in Stocks, Bonds and Gold 1928-2018

How stocks have performed between Election Day and inauguration since 1928

Beyond the Magnificent Seven | Liz Ann Sonders on Markets, Cycles & Investing

What's a Good Return on Investment?

« This Time is Different »

Once I Learned THIS, Market Crashes Stopped Scaring Me

How Risky Is The Stock Market?

How to Evaluate Your Investment Decisions

Комментарии

0:09:24

0:09:24

0:44:29

0:44:29

0:09:31

0:09:31

0:09:15

0:09:15

0:17:34

0:17:34

0:10:09

0:10:09

0:02:13

0:02:13

0:00:29

0:00:29

0:09:56

0:09:56

0:00:20

0:00:20

0:00:29

0:00:29

0:01:42

0:01:42

0:03:47

0:03:47

0:17:26

0:17:26

0:09:08

0:09:08

0:09:44

0:09:44

0:01:02

0:01:02

0:02:48

0:02:48

1:02:11

1:02:11

0:06:25

0:06:25

0:08:12

0:08:12

0:11:28

0:11:28

0:06:38

0:06:38

0:12:05

0:12:05