filmov

tv

Bond Duration Explained Simply In 5 Minutes

Показать описание

Ryan O'Connell, CFA, FRM explains bond duration simply.

🎓 *Get 25% Off CFA Courses (Featuring My Videos!) — Use code RYAN25 here:*

Chapters:

0:00 - Bond Duration Definition

0:27 - Key Factors Affecting Bond Duration

2:01 - How to Calculate Macaulay Duration

*Disclosure: This is not financial advice and should not be taken as such. The information contained in this video is an opinion. Some of the information could be wrong. This channel is owned and operated by Portfolio Constructs LLC. Some of the links above are affiliate links, meaning, at no additional cost to you, I will earn a commission if you click through and make a purchase.

🎓 *Get 25% Off CFA Courses (Featuring My Videos!) — Use code RYAN25 here:*

Chapters:

0:00 - Bond Duration Definition

0:27 - Key Factors Affecting Bond Duration

2:01 - How to Calculate Macaulay Duration

*Disclosure: This is not financial advice and should not be taken as such. The information contained in this video is an opinion. Some of the information could be wrong. This channel is owned and operated by Portfolio Constructs LLC. Some of the links above are affiliate links, meaning, at no additional cost to you, I will earn a commission if you click through and make a purchase.

Bond Duration Explained Simply In 5 Minutes

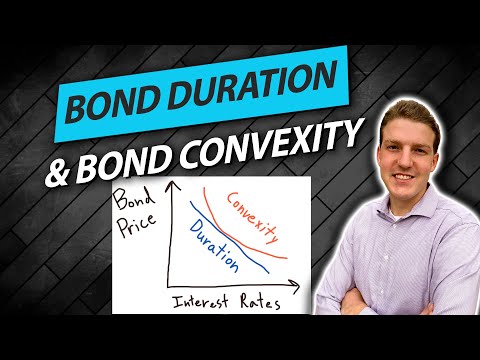

Bond Duration and Bond Convexity Explained

Investing Basics: Bonds

Bond Duration in Excel

Fixed Income: Simple bond illustrating all three durations (effective, mod, Mac) (FRM T4-36)

Macro Minute -- Bond Prices and Interest Rates

Bond Prices Vs Bond Yield | Inverse Relationship

The Basics of Bonds Explained in 5 Minutes

5 Simple Ways to Bond With Your Cat (That Most Owners Miss!)

Why Bond Yields Are a Key Economic Barometer | WSJ

Bond duration and convexity | Understand FINANCE in 2 minutes

How 'Convexity' Impacts Bond Yields

Treasury Bonds SIMPLY Explained

How to Calculate Spot Rates and Forward Rates in Bonds

Series 65 Exam and Series 66 Exam - Duration or Volatility of Bonds

Bond Investing 101--A Beginner's Guide to Bonds

Bonds (Corporate Bonds, Municipal Bonds, Government Bonds, etc.) Explained in One Minute

Calculating Macauley, Modified, and Effective Bond Durations in Excel

Calculate Bond Convexity and Duration in Excel | Interest Rate Risk

CFA level I - Relationship between Coupon Rate and Bond Duration

What are Bonds and How do they Work?

Bond Market Deleveraging: What's REALLY Happening

Dave Explains Why He Doesn't Recommend Bonds

Bonds Explained Simply | Presentation and Q&A with Michael Lebowitz

Комментарии

0:05:07

0:05:07

0:09:18

0:09:18

0:04:47

0:04:47

0:02:24

0:02:24

0:12:41

0:12:41

0:02:48

0:02:48

0:04:45

0:04:45

0:05:00

0:05:00

0:04:52

0:04:52

0:05:17

0:05:17

0:02:17

0:02:17

0:01:14

0:01:14

0:15:28

0:15:28

0:06:18

0:06:18

0:06:33

0:06:33

0:45:01

0:45:01

0:01:26

0:01:26

0:09:08

0:09:08

0:11:03

0:11:03

0:00:48

0:00:48

0:10:01

0:10:01

0:00:39

0:00:39

0:07:58

0:07:58

1:18:05

1:18:05