filmov

tv

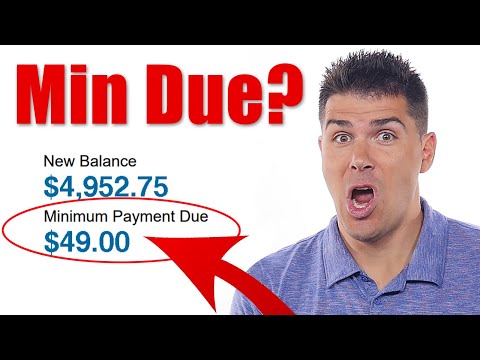

pay your credit card the right way to avoid turning a $50 purchase into $150 of debt

Показать описание

BEST Day to Pay your Credit Card Bill (Increase Credit Score)

pay your credit card the right way to avoid turning a $50 purchase into $150 of debt

Credit Card Payments Explained (Beginners Guide)

How To Pay Off Your Credit Card Correctly

When To Pay Your Credit Card Bill (Everything You NEED To Know)

Paying A Credit Card Bill (I Wish I Knew THIS)

How To Pay Off A Credit Card with -0- Cash Flow! I am not a Mathematician, but the concept is REAL

Credit Card Minimum Payments Explained

DON'T impact your personal credit! #businesscredit #creditscore #personal credit

Who actually pays for your credit card rewards?

Should You Pay Your Credit Card With Auto pay?

I Found The Best Day To Pay Your Credit Card (INCREASE CREDIT SCORE!)

How to pay your credit card bill to increase your credit score

How To Pay Your Mortgage or Rent With A Credit Card

Should You Pay Your Credit Card in FULL?

What Happens If You Never Pay Your Credit Card? (Explained)

How to Pay Off Credit Card Debt Fast: Top 5 Solutions

What is APR on a Credit Card? | Discover | Card Smarts

How to calculate credit card interest

How To Pay Your Chase Credit Card (Correctly)

Who Actually Pays For Credit Card Rewards?

When To Pay Credit Card Bill (INCREASE CREDIT SCORE!)

The Best Time to Pay Your Credit Card Bill (And Increase Your Credit Score)

Scotia ATM | How to make credit card payment

Комментарии

0:08:04

0:08:04

0:00:59

0:00:59

0:05:28

0:05:28

0:00:44

0:00:44

0:15:28

0:15:28

0:14:44

0:14:44

0:12:18

0:12:18

0:05:49

0:05:49

0:00:31

0:00:31

0:05:28

0:05:28

0:04:02

0:04:02

0:08:45

0:08:45

0:14:48

0:14:48

0:05:37

0:05:37

0:10:13

0:10:13

0:04:41

0:04:41

0:15:10

0:15:10

0:01:04

0:01:04

0:01:34

0:01:34

0:04:39

0:04:39

0:17:50

0:17:50

0:09:40

0:09:40

0:03:59

0:03:59

0:00:52

0:00:52