filmov

tv

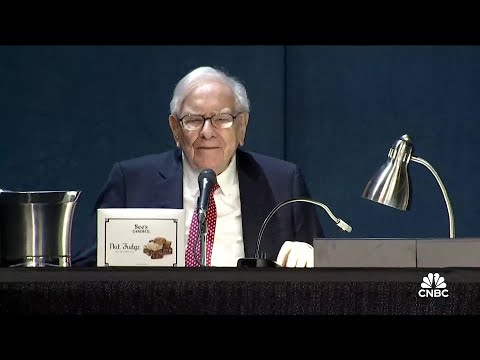

Berkshire's 2023 annual shareholder meeting: Watch the full morning session with Warren Buffett

Показать описание

Turn to CNBC TV for the latest stock market news and analysis. From market futures to live price updates CNBC is the leader in business news worldwide.

Connect with CNBC News Online

#CNBC

#CNBCTV

Berkshire's 2023 annual shareholder meeting: Watch the full morning session with Warren Buffett

Berkshire Hathaway’s 2023 Annual Shareholders Meeting: What to expect

Watch Warren Buffett and Charlie Munger preside over full 2023 Berkshire Hathaway annual meeting

Warren Buffett and Charlie Munger join the 2023 Berkshire Hathaway annual meeting — 5/6/23

Berkshire's 2024 annual shareholder meeting: Watch the full morning session

Berkshire's 2024 annual shareholder meeting: Watch the full afternoon session

Watch Warren Buffett preside over the full 2024 Berkshire Hathaway annual shareholders meeting

Warren Buffett presides over the 2024 Berkshire Hathaway annual shareholders meeting — 5/4/24

Buffett kicks off 2024 Berkshire Hathaway annual meeting after emotional tribute to Charlie Munger

Warren Buffett explains why Berkshire reduced its big Apple stake

Watch the 2024 Berkshire Hathaway annual shareholders meeting on Saturday, May 4

Buffett on Berkshire's $188 billion cash pile: 'We only swing at pitches we like'

Tech investor Ann Winblad discusses A.I. advances, Apple and more from 2023 Berkshire meeting

Warren Buffett breaks down Berkshire's most recent quarter during annual meeting

Warren Buffett breaks down how he would invest if he had to start again with $1 million

Warren Buffett on his friendship with Charlie Munger: We never had any doubts about the other person

Apple stake and potential Canada investment dominate headlines from Berkshire's annual meeting

Warren Buffett on Apple stake: Apple is a better business than any other we own

If you offered me all the bitcoin in the world for $25, I wouldn’t take it, says Warren Buffett

Jim Cramer: Warren Buffett's sale of airline stocks concerns me near term

Warren Buffett: AI is profound, and that's what makes it a genie

Berkshire shareholder Bill Murray responds to allegations of inappropriate behavior on movie set

Berkshire Hathaway's Sue Decker on the absence of Charlie Munger: His impact will go on forever

'The Woodstock of capitalism': Berkshire Hathaway shareholder meeting returns to Omaha

Комментарии

2:44:45

2:44:45

0:02:28

0:02:28

5:16:37

5:16:37

7:44:01

7:44:01

2:55:07

2:55:07

1:56:54

1:56:54

4:52:00

4:52:00

7:16:10

7:16:10

0:04:28

0:04:28

0:09:36

0:09:36

0:00:31

0:00:31

0:02:32

0:02:32

0:05:45

0:05:45

0:05:50

0:05:50

0:05:20

0:05:20

0:07:28

0:07:28

0:05:14

0:05:14

0:05:22

0:05:22

0:06:47

0:06:47

0:03:55

0:03:55

0:03:27

0:03:27

0:05:04

0:05:04

0:06:57

0:06:57

0:02:28

0:02:28