filmov

tv

How to enter Depreciation in Xero

Показать описание

From my BEST-SELLING online course LEARN XERO IN A DAY.

In this video I show you step-by-step how to enter the Depreciation of your Fixed Assets in Xero.

Want to learn more?

You can have lifetime access to the online course LEARN XERO IN A DAY using the link below.

Check out the full course details here:

UPDATE FOR 2019

The Xero menus have been updated since this video was recorded.

From the Dashboard you now choose:

Accounting

Advanced

Fixed Assets

I hope you still enjoy the video!

Until next time, happy xero-ing :-)

In this video I show you step-by-step how to enter the Depreciation of your Fixed Assets in Xero.

Want to learn more?

You can have lifetime access to the online course LEARN XERO IN A DAY using the link below.

Check out the full course details here:

UPDATE FOR 2019

The Xero menus have been updated since this video was recorded.

From the Dashboard you now choose:

Accounting

Advanced

Fixed Assets

I hope you still enjoy the video!

Until next time, happy xero-ing :-)

DEPRECIATION BASICS! With Journal Entries

How to enter Depreciation into QuickBooks

How to Record Depreciation in QuickBooks Online | South Africa

How to Enter Depreciation Entry In TallyPrime

How to enter Depreciation in Xero

QuickBooks Online Tutorial: Entering Depreciation Expenses Easily! | QuickBooks I Intuit

How to add Depreciation in QuickBooks

How to record Depreciation and Accumulated Depreciation in QuickBooks Accounting Software.

Day 2 - CI & ANNUITY | Live Revision CA Foundation | Quantitative Aptitude | Mathematics of Fina...

Depreciation & Accumulated Depreciation Journal Entry and Balance Sheet Recording

STRAIGHT LINE Method of Depreciation in 3 Steps!

Journal Entry for Depreciation

How to record Depreciation in T accounts?

Accumulated depreciation

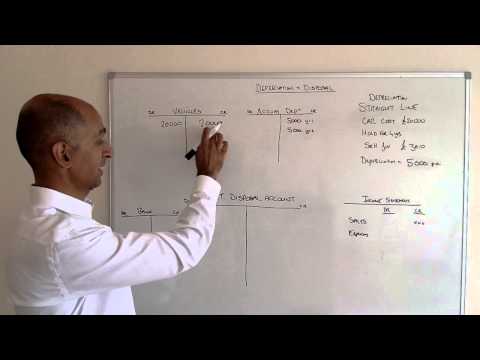

Depreciation and Disposal of Fixed Assets

How to Claim Tax Depreciation in MyGov: A Quick Guide in 3 Minutes

Learn How to Track Depreciation in QuickBooks Online: A Training Tutorial

How to do Depreciation Entry in Tally Prime | Techjockey | Watch video till the end for a surprise

Peachtree Tutorial : How to Record Depreciation Expense entry |Depreciation |depreciation accounting

Accumulated Depreciation in QuickBooks Desktop

Depreciation Expense in QuickBooks

How to enter Vehicle Depreciation in a return

Accumulated Depreciation in QuickBooks Online

Depreciation Methods: Straight Line, Double Declining & Units of Production

Комментарии

0:11:24

0:11:24

0:21:58

0:21:58

0:00:57

0:00:57

0:04:47

0:04:47

0:03:20

0:03:20

0:03:45

0:03:45

0:04:06

0:04:06

0:10:54

0:10:54

0:52:36

0:52:36

0:03:25

0:03:25

0:06:52

0:06:52

0:04:17

0:04:17

0:02:47

0:02:47

0:02:23

0:02:23

0:07:18

0:07:18

0:03:39

0:03:39

0:01:49

0:01:49

0:03:00

0:03:00

0:08:02

0:08:02

0:03:41

0:03:41

0:07:17

0:07:17

0:02:40

0:02:40

0:04:36

0:04:36

0:02:54

0:02:54