filmov

tv

How to enter Depreciation into QuickBooks

Показать описание

Did you just get your depreciation schedule from your tax professional?

Are you ready to learn how to enter depreciation into QuickBooks?

In this video, I will share what depreciation is, and how to enter it into QuickBooks both for Desktop and Online users. 😊

➡️ Depreciation

In accounting terms, depreciation is defined as the reduction of recorded cost of a fixed asset in a systematic manner until the value of the asset becomes zero or negligible.

➡️ Assets

An example of fixed assets are buildings, furniture, office equipment, machinery, vehicles, etc.

Land is the only exception which cannot be depreciated as the value of land appreciates with time.

➡️ Rules…

Depreciation allows a portion of the cost of a fixed asset to the revenue generated by the fixed asset.

This is mandatory under the matching principle as revenues are recorded with their associated expenses in the accounting period when the asset is in use.

This helps in getting a complete picture of the revenue generation transaction.

➡️ GAAP:

In the United States, accountants must adhere to Generally Accepted Accounting Principles (GAAP) in calculating and reporting depreciation on financial statements.

GAAP is a set of rules that includes the details, complexities, and legalities of business and corporate accounting.

GAAP guidelines highlight several separate allowable methods of depreciation that accounting professionals may use.

➡️ IRS

The IRS has information about the depreciation and lifespan of assets.

➡️ Three main inputs are required to calculate depreciations:

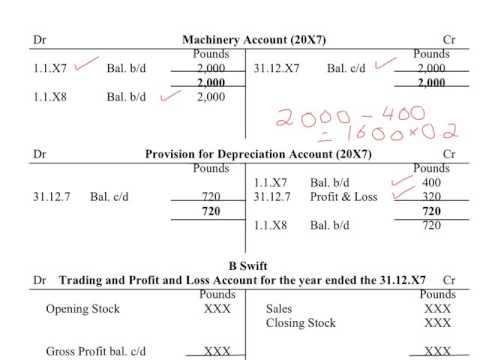

1. Useful life – this is the time period over which the organization considers the fixed asset to be productive. Beyond its useful life, the fixed asset is no longer cost effective to continue the operation of the asset.

2. Salvage value – Post the useful life of the fixed asset, the company may consider selling it at a reduced amount. This is known as the salvage value of the asset.

3. The cost of the asset – this includes taxes, shipping, and preparation/setup expenses.

➡️ How the Different Methods of Depreciation Work

➡️ There are three methods for depreciation:

Straight Line

Declining Balance

Sum-of-the-Years’ Digits

➡️ What vehicles qualify for the full section 179 deduction?

SUVs, trucks, vans, and other vehicles that don’t qualify as passenger vehicles aren’t subject to the IRS limits. You can take a full depreciation deduction each year. Using bonus depreciation and Section 179, you may be able to deduct all or most of the cost of such a vehicle in a single year.

If you'd like to receive our QB tips straight to your inbox each week visit:

Subscribe for more QuickBooks tips 👇

I’d love to hear if this inspired an “aha moment” and if you are ready to start entering in your depreciation.

Timestamps: (QuickBooks Tutorial)

0:00 - Intro

0:37 - Take notes

0:44 - What is Depreciation?

1:14 - Assets

1:48 - Rules (Depreciation)

2:14 - GAAP

2:26 - IRS Website

2:39 - Three main inputs are required to calculate depreciation

3:01 - Three methods for depreciation

3:15 - Straight line method

4:07 - What vehicles qualify for the full section 179 deduction?

4:21 - What is Accumulated Depreciation?

4:51 - Capitalized Asset/Depreciation/Accumulated Depreciation

5:13 - Start with adding your Assets

5:25 - Add Accounts to enter Depreciation in QuickBoooks

6:04 - Setup Depreciation Accounts (Desktop)

7:58 - Sample COA (Online)

11:32 - Journal Entry (Desktop)

12:47 - Checking Reports (Desktop)

14:39 - Setup Depreciation Accounts (Online)

17:24 - Journal Entry (Online)

19:07 - Checking Reports (Online)

21:10 - Final Thoughts

I’d love to connect with you 👇

#CandusKampfer

Are you ready to learn how to enter depreciation into QuickBooks?

In this video, I will share what depreciation is, and how to enter it into QuickBooks both for Desktop and Online users. 😊

➡️ Depreciation

In accounting terms, depreciation is defined as the reduction of recorded cost of a fixed asset in a systematic manner until the value of the asset becomes zero or negligible.

➡️ Assets

An example of fixed assets are buildings, furniture, office equipment, machinery, vehicles, etc.

Land is the only exception which cannot be depreciated as the value of land appreciates with time.

➡️ Rules…

Depreciation allows a portion of the cost of a fixed asset to the revenue generated by the fixed asset.

This is mandatory under the matching principle as revenues are recorded with their associated expenses in the accounting period when the asset is in use.

This helps in getting a complete picture of the revenue generation transaction.

➡️ GAAP:

In the United States, accountants must adhere to Generally Accepted Accounting Principles (GAAP) in calculating and reporting depreciation on financial statements.

GAAP is a set of rules that includes the details, complexities, and legalities of business and corporate accounting.

GAAP guidelines highlight several separate allowable methods of depreciation that accounting professionals may use.

➡️ IRS

The IRS has information about the depreciation and lifespan of assets.

➡️ Three main inputs are required to calculate depreciations:

1. Useful life – this is the time period over which the organization considers the fixed asset to be productive. Beyond its useful life, the fixed asset is no longer cost effective to continue the operation of the asset.

2. Salvage value – Post the useful life of the fixed asset, the company may consider selling it at a reduced amount. This is known as the salvage value of the asset.

3. The cost of the asset – this includes taxes, shipping, and preparation/setup expenses.

➡️ How the Different Methods of Depreciation Work

➡️ There are three methods for depreciation:

Straight Line

Declining Balance

Sum-of-the-Years’ Digits

➡️ What vehicles qualify for the full section 179 deduction?

SUVs, trucks, vans, and other vehicles that don’t qualify as passenger vehicles aren’t subject to the IRS limits. You can take a full depreciation deduction each year. Using bonus depreciation and Section 179, you may be able to deduct all or most of the cost of such a vehicle in a single year.

If you'd like to receive our QB tips straight to your inbox each week visit:

Subscribe for more QuickBooks tips 👇

I’d love to hear if this inspired an “aha moment” and if you are ready to start entering in your depreciation.

Timestamps: (QuickBooks Tutorial)

0:00 - Intro

0:37 - Take notes

0:44 - What is Depreciation?

1:14 - Assets

1:48 - Rules (Depreciation)

2:14 - GAAP

2:26 - IRS Website

2:39 - Three main inputs are required to calculate depreciation

3:01 - Three methods for depreciation

3:15 - Straight line method

4:07 - What vehicles qualify for the full section 179 deduction?

4:21 - What is Accumulated Depreciation?

4:51 - Capitalized Asset/Depreciation/Accumulated Depreciation

5:13 - Start with adding your Assets

5:25 - Add Accounts to enter Depreciation in QuickBoooks

6:04 - Setup Depreciation Accounts (Desktop)

7:58 - Sample COA (Online)

11:32 - Journal Entry (Desktop)

12:47 - Checking Reports (Desktop)

14:39 - Setup Depreciation Accounts (Online)

17:24 - Journal Entry (Online)

19:07 - Checking Reports (Online)

21:10 - Final Thoughts

I’d love to connect with you 👇

#CandusKampfer

Комментарии

0:21:58

0:21:58

0:11:24

0:11:24

0:04:47

0:04:47

0:00:57

0:00:57

0:03:45

0:03:45

0:03:20

0:03:20

0:03:25

0:03:25

0:10:54

0:10:54

2:58:38

2:58:38

0:04:06

0:04:06

0:02:47

0:02:47

0:04:17

0:04:17

0:01:49

0:01:49

0:07:18

0:07:18

0:03:00

0:03:00

0:08:45

0:08:45

0:06:52

0:06:52

0:07:39

0:07:39

0:07:17

0:07:17

0:02:23

0:02:23

0:10:33

0:10:33

0:08:09

0:08:09

0:05:52

0:05:52

0:06:43

0:06:43