filmov

tv

GST Rule 42 - ITC Reversal In Malayalam

Показать описание

A channel to provide help in GST and Tally Topics

#GSTRule42 #ITCReversalRule42 #GST RUle42 Explained in Malayalam

#GSTRule42 #ITCReversalRule42 #GST RUle42 Explained in Malayalam

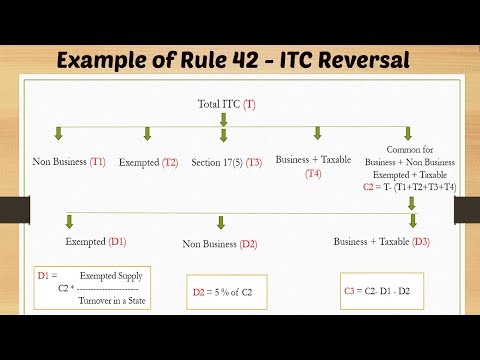

Examples of Rule 42- ITC Reversal

Very Famous Bottle Waala Experiment | Best way to understand Rule 42 of GST| Nikunj Goenka

GST Section 17 Rule 42 and Rule 43 Notice | GST updates | CA Kapil Jain

Apportionment of Input Tax Credit in GST , Rule 42 explained with example

How to calculate ITC Reversal under Rule 42 & 43?

IDT Revision CA/CMA Final May 24 & Nov 24 | Input Tax Credit (ITC) | CA Surender Mittal AIR 5

Rule 42 Apportionment of Credit ITCon Input and Input Services With Examples - Input Tax Credit

Duty Credit Scrips Amendment under GST - Reversal of ITC under Rule 42 (Explained) - Exempt Turnover

How to Handle Reversal of ITC under Rule 42 and 43 of GST with regards to Input & Capital Goods

Real Estate Sector: Reversal of Input Tax Credit under Rule 42 | ITC Reversal under GST | CGST Rules

Input Tax Credit (ITC) | Mega Revision in 2.5 hrs | CA Final IDT Nov'24/May'25 | CA Akshan...

Rule 42 | Rule 43 | CGST Rules | ITC reversals | gst credit | input tax credit | Excel tool

Revisionary lecture GST For May 2020 ITC Part II Section 17 DG SIR

ITC Rule 42 IP/IPS | CA Sanjay Mundhra | SJC Institute

GST Rule 42 - ITC Reversal In Malayalam

COMMON ITC REVERSAL NOTICE REPLY | ITC REVERSAL EXEMPT SALE ME KAB HOGA

GST : ITC Rule 42 : Input Tax Credit

CA FINAL NOV24 Input Tax Credit(ITC) Rule42/rule 43 Input Service Distributor(ISD) Question revision

ITC Reversal Rules 42 and 43 #gstbilling #invoiceprocessing

RULE 42 & 43 OF INPUT TAX CREDIT RULES

Rule 42 of CGST Rules - Ineligible Inputs & Input Services Credit - Use in Taxable & Exempte...

Common Credit Ka Reversal Kaise Karen | Rule 42 of CGST | Input Tax Credit | ITC Reversal | GST ITC

8 Situation for ITC ( Input Tax Credit ) Reversal in GST | ITC Reversal in GST

ITC Reversal As Per Rule 43 | Rule 43 of CGST Rules | Common ITC of Capital Goods Under GST Rule 43

Комментарии

0:12:31

0:12:31

0:18:47

0:18:47

0:08:40

0:08:40

0:17:46

0:17:46

0:12:59

0:12:59

2:22:11

2:22:11

0:37:09

0:37:09

0:29:32

0:29:32

0:18:02

0:18:02

0:38:06

0:38:06

2:42:43

2:42:43

0:12:27

0:12:27

2:10:18

2:10:18

1:04:49

1:04:49

0:13:03

0:13:03

0:10:30

0:10:30

0:16:49

0:16:49

5:46:42

5:46:42

0:01:39

0:01:39

0:38:22

0:38:22

0:13:39

0:13:39

0:11:41

0:11:41

0:07:46

0:07:46

0:08:49

0:08:49