filmov

tv

Tax Credit Mismatch Rectification | Tax Credit Mismatch | How to Rectify Tax Credit Mismatch in ITR

Показать описание

Tax Credit Mismatch Rectification | Tax Credit Mismatch | How to Rectify Tax Credit Mismatch in ITR

tax credit mismatch rectification

tax credit mismatch

how to rectify tax credit mismatch in itr

tax credit mismatch 26as

tax credit mismatch correction

tax credit mismatch for tds claim amount

what is tax credit mismatch

income tax credit mismatch

how to correct tax credit mismatch

itr tax credit mismatch

how to solve tax credit mismatch

----------------------------------------------------------------------------------------------------------------------------------------

tax credit mismatch rectification

tax credit mismatch

how to rectify tax credit mismatch in itr

tax credit mismatch 26as

tax credit mismatch correction

tax credit mismatch for tds claim amount

what is tax credit mismatch

income tax credit mismatch

how to correct tax credit mismatch

itr tax credit mismatch

how to solve tax credit mismatch

----------------------------------------------------------------------------------------------------------------------------------------

TDS Mismatch Rectification | Tax Credit Mismatch for TDS Claim Amount | Tax Credit Mismatch

Tax Credit Mismatch Rectification | Tax Credit Mismatch | How to Rectify Tax Credit Mismatch in ITR

How to file Rectification Request for Tax credit mismatch correction?

Tax Credit Mismatch Rectification | TDS Mismatch Correction Online | How to rectify Tax Credit |

How to file Rectification Request for Income Tax credit mismatch correction | Rectification online |

Tax Credit Mismatch | Rectification u/s 154 | Tax Credit Mismatch in 26AS | TDS Mismatch

Resolve tax credit mismatch

Income Tax New Feature! Tax Credit Mismatch! Avoid Income Tax Notice! CA Hemant Aggarwal! Must Watch

Check TDS Credit Mismatch if excess or short TDS claim in ITR ( Income Tax Return )

How to file Rectification Request for Tax credit mismatch correction ITR RECTIFICATION PROCESS

Faulty ITR Processing Intimation AY 2024-25 I Income Tax Demand I TDS credit Mismatch

How to file rectification request for tax credit mismatch?

Rectification in Income Tax Return | ITR Rectification Process | Rectification Request Income Tax

When to choose Tax credit mismatch option while filing rectification request in Income tax portal?

Rectification in Income Tax Return | ITR Rectification Data Correction | Rectification 143(1) or 154

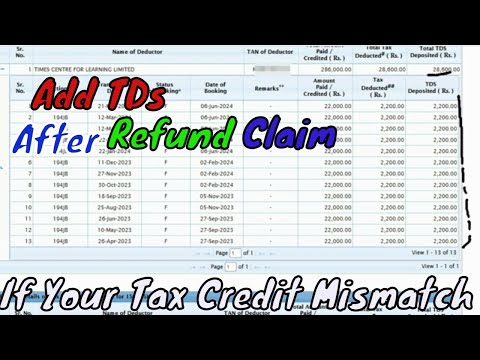

Add Tds After Refund Claim, verify your tax paid details....if your tax credit mismatch

How to file Rectification Request for Reprocessing the Return?

How to file Rectification return U/s 143(1) demand notice in Tamil #tamil #demand

How to file rectification request under section 154 ft @skillvivekawasthi

ITR Rectification Process 2024 | Rectification in Income Tax Return | How to request Rectification

Demand notice received from Income Tax Department on TDS Mismatch. How to Reply on demand notice

Notice Under Section 154 For TDS Credit Mis-Match. Rectify Income Tax Return

Form 26AS Mismatch? How to resolve mismatch in Form 26AS (Request for Resolution)

Income Tax Me Tax Credit Mismatch jaror check kare....

Комментарии

0:05:03

0:05:03

0:05:11

0:05:11

0:05:16

0:05:16

0:09:27

0:09:27

0:06:23

0:06:23

0:12:02

0:12:02

0:01:38

0:01:38

0:01:15

0:01:15

0:03:27

0:03:27

0:05:31

0:05:31

0:04:01

0:04:01

0:01:27

0:01:27

0:09:01

0:09:01

0:02:34

0:02:34

0:09:25

0:09:25

0:04:27

0:04:27

0:03:32

0:03:32

0:07:28

0:07:28

0:35:11

0:35:11

0:12:18

0:12:18

0:07:28

0:07:28

0:07:47

0:07:47

0:02:40

0:02:40

0:04:24

0:04:24