filmov

tv

VAT Calculations - AAT Level 2 - Introduction to Bookkeeping (ITBK) - Q2022

Показать описание

In this video we will cover a basic understanding of how VAT is applied to the sale of goods.

We will see that some traders must register for VAT when their sales reach a certain threshold.

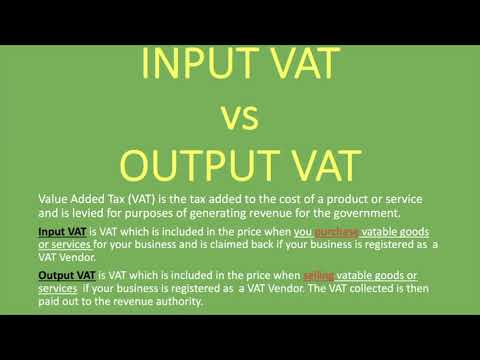

We will see how VAT registered businesses can claim back the VAT they are charged.

You will learn the importance of checking and authorising documents.

This video is suitable for distance learning students, self-studiers or those attending college studying the AAT Q2022 Level 2 Certificate in Accounting or AAT Q2022 Level 2 Certificate in Bookkeeping.

We will see that some traders must register for VAT when their sales reach a certain threshold.

We will see how VAT registered businesses can claim back the VAT they are charged.

You will learn the importance of checking and authorising documents.

This video is suitable for distance learning students, self-studiers or those attending college studying the AAT Q2022 Level 2 Certificate in Accounting or AAT Q2022 Level 2 Certificate in Bookkeeping.

0:05:54

0:05:54

0:05:07

0:05:07

0:07:41

0:07:41

0:07:46

0:07:46

0:00:29

0:00:29

0:06:40

0:06:40

0:06:08

0:06:08

0:06:56

0:06:56

0:05:07

0:05:07

0:38:03

0:38:03

0:05:30

0:05:30

0:05:56

0:05:56

0:05:34

0:05:34

0:04:09

0:04:09

0:11:40

0:11:40

0:31:06

0:31:06

0:05:28

0:05:28

0:05:31

0:05:31

0:39:21

0:39:21

0:06:21

0:06:21

0:42:37

0:42:37

0:06:08

0:06:08

0:04:39

0:04:39

1:04:57

1:04:57