filmov

tv

Everything You Need to Know About Savings

Показать описание

In the third episode of The College Student's Guide To Money, Chelsea walks you through everything you need to know about saving money. She'll cover the different types of savings accounts you need, where to store savings for different purposes, and much more.

The Financial Diet site:

The Financial Diet site:

This is EVERYTHING YOU NEED to Know About Cars

Claude Code: Everything You Need To Know

NEET 2025 Results Out | What’s Next? Everything You Need to Know | Chat with Sivan Sir | Ep. 148

Here is Everything We Don't Know (Extended)

becoming smart is easy, actually

Everything You Need to Know Before Watching Thunderbolts: The New Avengers- Marvel RECAP

William Ackman: Everything You Need to Know About Finance and Investing in Under an Hour | Big Think

Microeconomics- Everything You Need to Know

Grow a garden update! Everything you need to know! #growagarden #roblox

8 Important Things You Should Know About Yourself

Everything You Need to Know Before Modding Your Switch!

20 Things Most People Learn Too Late In Life

Top 100 Facts That Might Save Your Life One Day

Everything you need to know before training calisthenics (at home no weights)

Everything you need to know to read Homer's 'Odyssey' - Jill Dash

Everything We Don't Know

Everything You Need to Know About Seeing in the Spirit

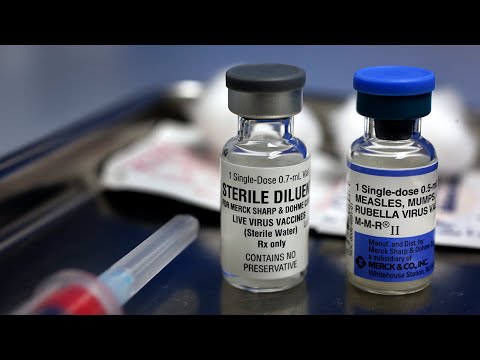

Everything You Need to Know (And Forget) About Vaccines

Macroeconomics- Everything You Need to Know

How is Money Created? – Everything You Need to Know

Mitski - Everything You Need To Know (Episode 42)

The SUGAR Expert: Everything You Need To Know About Glucose Spikes (& 5 HACKS TO PREVENT THEM)

Everything You Need to Know About Planet Earth

Everything You Need to Know Before Thunderbolts* #thunderbolts

Комментарии

0:11:57

0:11:57

2:31:21

2:31:21

0:39:21

0:39:21

3:01:58

3:01:58

0:07:33

0:07:33

0:26:58

0:26:58

0:43:57

0:43:57

0:28:55

0:28:55

0:00:34

0:00:34

0:06:27

0:06:27

0:05:34

0:05:34

0:07:38

0:07:38

0:26:07

0:26:07

0:11:04

0:11:04

0:04:57

0:04:57

0:14:05

0:14:05

1:06:30

1:06:30

0:33:24

0:33:24

0:29:58

0:29:58

0:29:56

0:29:56

0:04:00

0:04:00

1:11:11

1:11:11

0:07:22

0:07:22

0:00:48

0:00:48