filmov

tv

Dividend Discount Model with Gordon Growth as Terminal Value

Показать описание

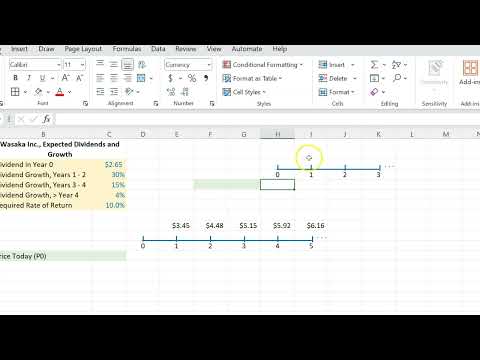

In this example, I combine the Dividend Discount Model with the Gordon Growth Model to estimate the value of a stock.

Example: Bluewater Cruisers International just paid a dividend of $2 per share. The dividends are expected to grow at a rate of 10 percent for the next 3 years and then level off to a growth rate of 4 percent indefinitely. If the required return is 12 percent, what is the value of the stock today?

Example: Bluewater Cruisers International just paid a dividend of $2 per share. The dividends are expected to grow at a rate of 10 percent for the next 3 years and then level off to a growth rate of 4 percent indefinitely. If the required return is 12 percent, what is the value of the stock today?

0:05:09

0:05:09

0:09:43

0:09:43

0:04:45

0:04:45

0:04:34

0:04:34

0:06:51

0:06:51

0:05:28

0:05:28

0:12:16

0:12:16

0:00:56

0:00:56

1:02:28

1:02:28

0:03:31

0:03:31

0:05:07

0:05:07

0:20:52

0:20:52

0:06:19

0:06:19

0:05:38

0:05:38

0:11:06

0:11:06

0:05:57

0:05:57

0:01:50

0:01:50

0:07:13

0:07:13

0:19:53

0:19:53

0:37:48

0:37:48

0:18:31

0:18:31

0:08:06

0:08:06

0:05:30

0:05:30

0:03:33

0:03:33