filmov

tv

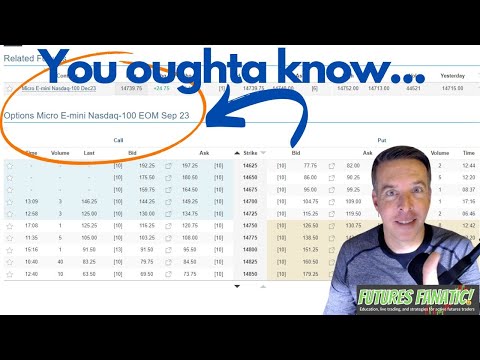

How Do Options On Micro E-mini Futures Work?

Показать описание

#optionsonfutures #CME #futurestrading

So the CME says 48K options contracts on Emini Micros have traded since the launch a few weeks ago. I must have missed all that volume and open interest but it was about time I placed a trade.

Learn more about Micro E-Mini futures options

👍 LIKE what we're doing? Hit the thumbs up!

🔔 SUBSCRIBE to know when we broadcast and post new videos

✅ CONNECT on IG, FB & Twitter @RoderickCasilli

🐦 TWEET @RoderickCasilli

………………………………………………………………………………………………………….

FOLLOW TDG ON TRADINGVIEW

………………………………………………………………………………………………………………….

WATCH US TRADE LIVE EVERYDAY

………………………………………………………………………………………………………………….

CHARTING PLATFORM SHOWN IN THIS VIDEO (Sometimes)

Join TradingView, the largest online trading community for FREE (and save $30 on any paid plan):

……………………………………………………………………………………………………………………

BROKERS WE USE

Tradovate - 14-Day FREE Trial

TastyWorks, home of the Small Exchange

Nadex Binary Options

Interactive Brokers (Best for Experienced Traders)

NinjaTrader & NinjaBroker

Get 14-days of FREE futures data

Download Voyager (Our New Favorite Crypto App) Get $25 of free Bitcoin

…………………………………………………………………………………………………………………….

FANTASTIC TOOLS, PROGRAMS, AND OTHER SOFTWARE WE USE EVERYDAY

Tradervue, the BEST online trade journal. Save $10 off your first month

Earn a FUNDED futures trading account at OneUP Trader

Bloodhound Signal Designer from Shark Indicators (For NinjaTrader)

Collective2, AutoTrading Signal Distribution (Copy Our Trades)

……………………………………………………………………………………………………………………….

Commodity Futures Trading Commission. Futures and Options trading has large potential rewards, but also large potential risk. You must be aware of the risks and be willing to accept them in order to invest in the futures and options markets. Don’t trade with money you can’t afford to lose. This is neither a solicitation nor an offer to Buy/Sell futures or options. No representation is being made that any account will or is likely to achieve profits or losses similar to those discussed on this web site. The past performance of any trading system or methodology is not necessarily indicative of future results.

CFTC RULE 4.41 – HYPOTHETICAL OR SIMULATED PERFORMANCE RESULTS HAVE CERTAIN LIMITATIONS. UNLIKE AN ACTUAL PERFORMANCE RECORD, SIMULATED RESULTS DO NOT REPRESENT ACTUAL TRADING. ALSO, SINCE THE TRADES HAVE NOT BEEN EXECUTED, THE RESULTS MAY HAVE UNDER-OR-OVER COMPENSATED FOR THE IMPACT, IF ANY, OF CERTAIN MARKET FACTORS, SUCH AS LACK OF LIQUIDITY. SIMULATED TRADING PROGRAMS IN GENERAL ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFIT OF HINDSIGHT. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFIT OR LOSSES SIMILAR TO THOSE SHOWN.

So the CME says 48K options contracts on Emini Micros have traded since the launch a few weeks ago. I must have missed all that volume and open interest but it was about time I placed a trade.

Learn more about Micro E-Mini futures options

👍 LIKE what we're doing? Hit the thumbs up!

🔔 SUBSCRIBE to know when we broadcast and post new videos

✅ CONNECT on IG, FB & Twitter @RoderickCasilli

🐦 TWEET @RoderickCasilli

………………………………………………………………………………………………………….

FOLLOW TDG ON TRADINGVIEW

………………………………………………………………………………………………………………….

WATCH US TRADE LIVE EVERYDAY

………………………………………………………………………………………………………………….

CHARTING PLATFORM SHOWN IN THIS VIDEO (Sometimes)

Join TradingView, the largest online trading community for FREE (and save $30 on any paid plan):

……………………………………………………………………………………………………………………

BROKERS WE USE

Tradovate - 14-Day FREE Trial

TastyWorks, home of the Small Exchange

Nadex Binary Options

Interactive Brokers (Best for Experienced Traders)

NinjaTrader & NinjaBroker

Get 14-days of FREE futures data

Download Voyager (Our New Favorite Crypto App) Get $25 of free Bitcoin

…………………………………………………………………………………………………………………….

FANTASTIC TOOLS, PROGRAMS, AND OTHER SOFTWARE WE USE EVERYDAY

Tradervue, the BEST online trade journal. Save $10 off your first month

Earn a FUNDED futures trading account at OneUP Trader

Bloodhound Signal Designer from Shark Indicators (For NinjaTrader)

Collective2, AutoTrading Signal Distribution (Copy Our Trades)

……………………………………………………………………………………………………………………….

Commodity Futures Trading Commission. Futures and Options trading has large potential rewards, but also large potential risk. You must be aware of the risks and be willing to accept them in order to invest in the futures and options markets. Don’t trade with money you can’t afford to lose. This is neither a solicitation nor an offer to Buy/Sell futures or options. No representation is being made that any account will or is likely to achieve profits or losses similar to those discussed on this web site. The past performance of any trading system or methodology is not necessarily indicative of future results.

CFTC RULE 4.41 – HYPOTHETICAL OR SIMULATED PERFORMANCE RESULTS HAVE CERTAIN LIMITATIONS. UNLIKE AN ACTUAL PERFORMANCE RECORD, SIMULATED RESULTS DO NOT REPRESENT ACTUAL TRADING. ALSO, SINCE THE TRADES HAVE NOT BEEN EXECUTED, THE RESULTS MAY HAVE UNDER-OR-OVER COMPENSATED FOR THE IMPACT, IF ANY, OF CERTAIN MARKET FACTORS, SUCH AS LACK OF LIQUIDITY. SIMULATED TRADING PROGRAMS IN GENERAL ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFIT OF HINDSIGHT. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFIT OR LOSSES SIMILAR TO THOSE SHOWN.

Комментарии

0:12:48

0:12:48

0:21:59

0:21:59

0:10:45

0:10:45

0:03:25

0:03:25

0:05:25

0:05:25

0:03:30

0:03:30

0:11:19

0:11:19

0:12:38

0:12:38

0:01:40

0:01:40

0:07:50

0:07:50

0:09:33

0:09:33

0:29:29

0:29:29

0:04:11

0:04:11

0:02:22

0:02:22

0:09:12

0:09:12

0:01:51

0:01:51

0:29:02

0:29:02

0:19:38

0:19:38

0:10:55

0:10:55

0:13:57

0:13:57

0:07:52

0:07:52

0:14:50

0:14:50

0:07:18

0:07:18

0:02:08

0:02:08