filmov

tv

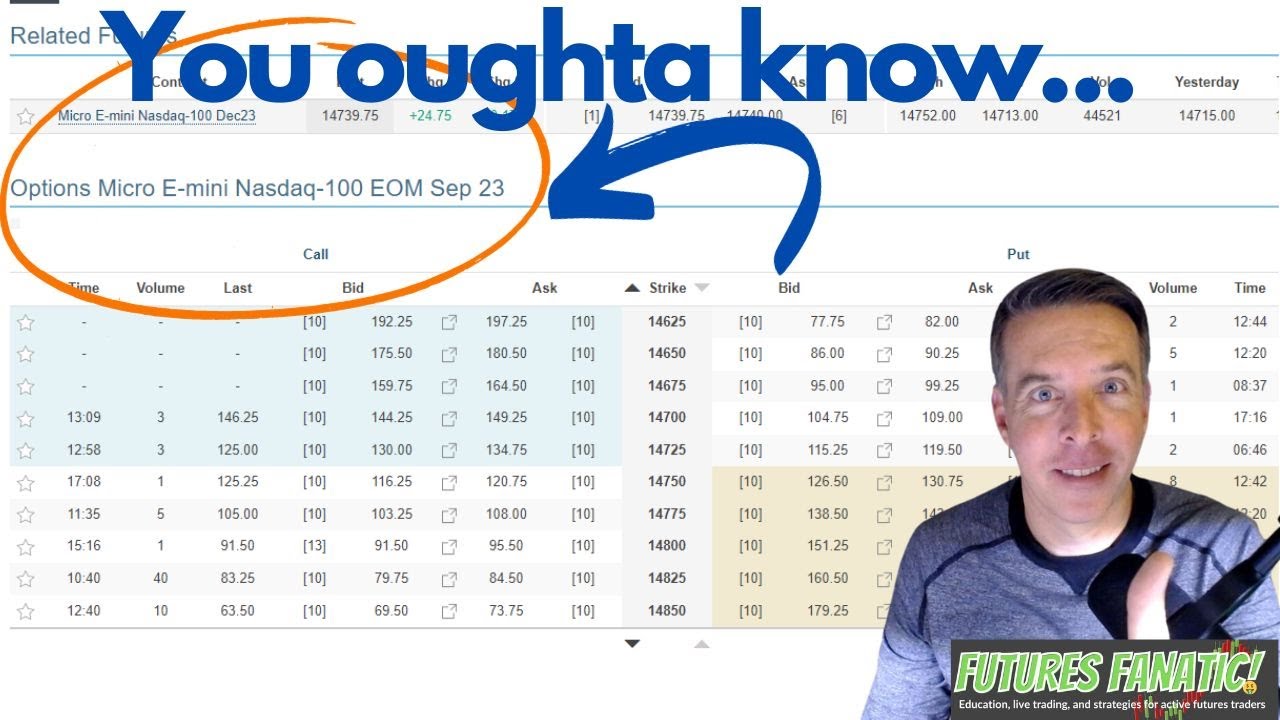

How & Why You Should Trade Micro E-mini Nasdaq Futures Options

Показать описание

#futuresoptions #futurestrading

This extended training explores the ins and outs of trading futures options on micro e-mini stock indices with a focus on the MNQ. Learn strategies, tips, and real-world examples that can help both beginners and experienced traders benefit from a very underappreciated financial instrument.

Micro E-mini Options Resources From CME

Get A FREE Futures Options Demo Account

❤️ If you find my content helpful, let's spend some more time together. Trade with me LIVE for 10-days for only $10! (2 full weeks)

FREE with coupon: SAVE10

✅ FOLLOW ME ON TRADINGVIEW for hundreds of free video lessons

💰Get Money To Trade

Earn a FUNDED futures trading account from Apex Trader Funding

Get 80% OFF EVERY MONTH of your subscription - offer ends 9/27/23

Use Code: TDG8080

……………………………………………………………………………………………………………………….

Commodity Futures Trading Commission. Futures and Options trading has large potential rewards, but also large potential risk. You must be aware of the risks and be willing to accept them in order to invest in the futures and options markets. Don’t trade with money you can’t afford to lose. This is neither a solicitation nor an offer to Buy/Sell futures or options. No representation is being made that any account will or is likely to achieve profits or losses similar to those discussed on this web site. The past performance of any trading system or methodology is not necessarily indicative of future results.

CFTC RULE 4.41 – HYPOTHETICAL OR SIMULATED PERFORMANCE RESULTS HAVE CERTAIN LIMITATIONS. UNLIKE AN ACTUAL PERFORMANCE RECORD, SIMULATED RESULTS DO NOT REPRESENT ACTUAL TRADING. ALSO, SINCE THE TRADES HAVE NOT BEEN EXECUTED, THE RESULTS MAY HAVE UNDER-OR-OVER COMPENSATED FOR THE IMPACT, IF ANY, OF CERTAIN MARKET FACTORS, SUCH AS LACK OF LIQUIDITY. SIMULATED TRADING PROGRAMS IN GENERAL ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFIT OF HINDSIGHT. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFIT OR LOSSES SIMILAR TO THOSE SHOWN.

This extended training explores the ins and outs of trading futures options on micro e-mini stock indices with a focus on the MNQ. Learn strategies, tips, and real-world examples that can help both beginners and experienced traders benefit from a very underappreciated financial instrument.

Micro E-mini Options Resources From CME

Get A FREE Futures Options Demo Account

❤️ If you find my content helpful, let's spend some more time together. Trade with me LIVE for 10-days for only $10! (2 full weeks)

FREE with coupon: SAVE10

✅ FOLLOW ME ON TRADINGVIEW for hundreds of free video lessons

💰Get Money To Trade

Earn a FUNDED futures trading account from Apex Trader Funding

Get 80% OFF EVERY MONTH of your subscription - offer ends 9/27/23

Use Code: TDG8080

……………………………………………………………………………………………………………………….

Commodity Futures Trading Commission. Futures and Options trading has large potential rewards, but also large potential risk. You must be aware of the risks and be willing to accept them in order to invest in the futures and options markets. Don’t trade with money you can’t afford to lose. This is neither a solicitation nor an offer to Buy/Sell futures or options. No representation is being made that any account will or is likely to achieve profits or losses similar to those discussed on this web site. The past performance of any trading system or methodology is not necessarily indicative of future results.

CFTC RULE 4.41 – HYPOTHETICAL OR SIMULATED PERFORMANCE RESULTS HAVE CERTAIN LIMITATIONS. UNLIKE AN ACTUAL PERFORMANCE RECORD, SIMULATED RESULTS DO NOT REPRESENT ACTUAL TRADING. ALSO, SINCE THE TRADES HAVE NOT BEEN EXECUTED, THE RESULTS MAY HAVE UNDER-OR-OVER COMPENSATED FOR THE IMPACT, IF ANY, OF CERTAIN MARKET FACTORS, SUCH AS LACK OF LIQUIDITY. SIMULATED TRADING PROGRAMS IN GENERAL ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFIT OF HINDSIGHT. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFIT OR LOSSES SIMILAR TO THOSE SHOWN.

Комментарии

0:12:42

0:12:42

0:04:22

0:04:22

0:03:18

0:03:18

0:04:58

0:04:58

0:11:53

0:11:53

0:05:17

0:05:17

0:11:58

0:11:58

0:08:35

0:08:35

0:01:56

0:01:56

0:05:12

0:05:12

0:19:15

0:19:15

0:04:40

0:04:40

0:05:26

0:05:26

0:08:11

0:08:11

0:05:10

0:05:10

0:03:04

0:03:04

0:04:52

0:04:52

0:24:23

0:24:23

0:06:07

0:06:07

0:12:41

0:12:41

0:09:36

0:09:36

0:02:46

0:02:46

0:06:35

0:06:35

0:02:56

0:02:56