filmov

tv

How Should You Factor In a Pension Into Your Net Worth Statement?

Показать описание

How Should You Factor In a Pension Into Your Net Worth Statement?

Let’s make sure you’re on the path to financial success - then help you stay there!

The Money Guy Show takes the edge off of personal finance. We’re financial advisors that believe anyone can be wealthy! First, LEARN smart financial principles. Next, APPLY those principles! Then watch your finances GROW!

We can’t wait to see you accomplish your goals and reach financial freedom! New shows every week on YouTube and your favorite podcast app. Thanks for coming along on the journey with us.

Let’s make sure you’re on the path to financial success - then help you stay there!

The Money Guy Show takes the edge off of personal finance. We’re financial advisors that believe anyone can be wealthy! First, LEARN smart financial principles. Next, APPLY those principles! Then watch your finances GROW!

We can’t wait to see you accomplish your goals and reach financial freedom! New shows every week on YouTube and your favorite podcast app. Thanks for coming along on the journey with us.

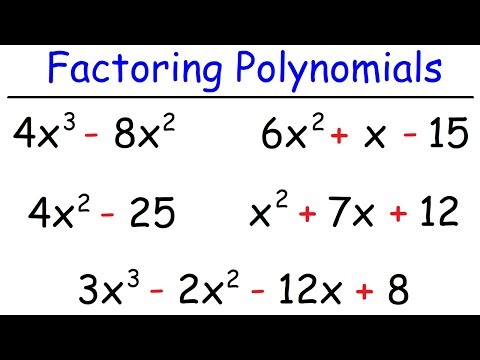

How To Factor Polynomials The Easy Way!

Factoring practice - Learn how to factor - Step by step math instruction

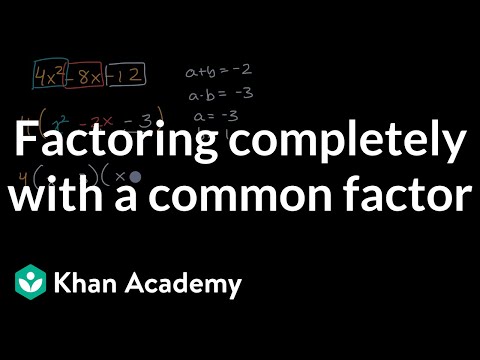

Factoring completely with a common factor | Algebra 1 | Khan Academy

Factoring - How to Factor Different Types

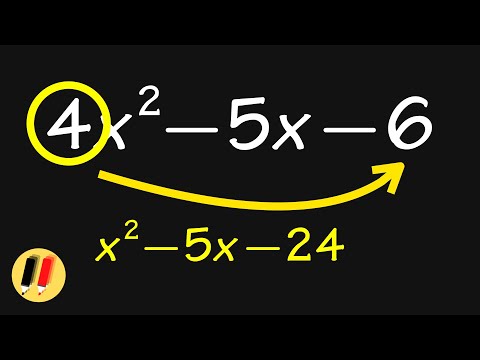

FASTEST way to factor a trinomial! #shorts

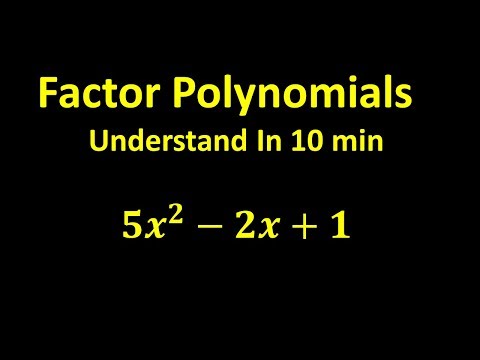

Factor Polynomials - Understand In 10 min

How to Factor and Solve Quadratics - Sneaky Trick - No Fuss Factoring

How to factor a perfect square trinomial and why is it important

Can you factor a complex trinomial with TWO variables? #shorts

Factors | Common Factors | Greatest Common Factor (GCF) | Math with Mr. J

How do you factor a polynomial

How to Factor and Solve Quadratic Trinomials - No Fuss Factoring - Quick Math Trick

Why You Should Turn On Two Factor Authentication

How To Factor The Greatest Common Factor In a Polynomial | Algebra

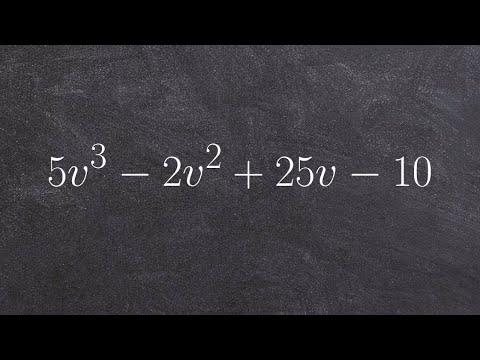

How to Factor by grouping - Factor by grouping - Factoring a polynomial

One Factor vs. Two Factor ANOVA [One Way vs Two Way]

Learn how to factor an expression with the GCF

Learn how to factor a trinomial factoring practice

Greatest Common Factor | How to Find the Greatest Common Factor (GCF)

STOP using this Two-Factor Authentication (2FA) method!

How to Factor a Perfect Square Trinomial? Factoring Polynomials - Grade 8 Math

How to Factor Completely

Should You Be Factor Investing?

05 - Factoring the GCF (Greatest Common Factor) from a Polynomial in Algebra, Part 1

Комментарии

0:11:54

0:11:54

0:06:55

0:06:55

0:04:00

0:04:00

0:21:52

0:21:52

0:00:55

0:00:55

0:14:06

0:14:06

0:05:42

0:05:42

0:03:39

0:03:39

0:00:38

0:00:38

0:05:10

0:05:10

0:04:26

0:04:26

0:03:54

0:03:54

0:08:12

0:08:12

0:10:42

0:10:42

0:03:25

0:03:25

0:03:48

0:03:48

0:02:37

0:02:37

0:07:03

0:07:03

0:07:39

0:07:39

0:05:05

0:05:05

0:06:50

0:06:50

0:08:33

0:08:33

0:08:17

0:08:17

0:28:46

0:28:46