filmov

tv

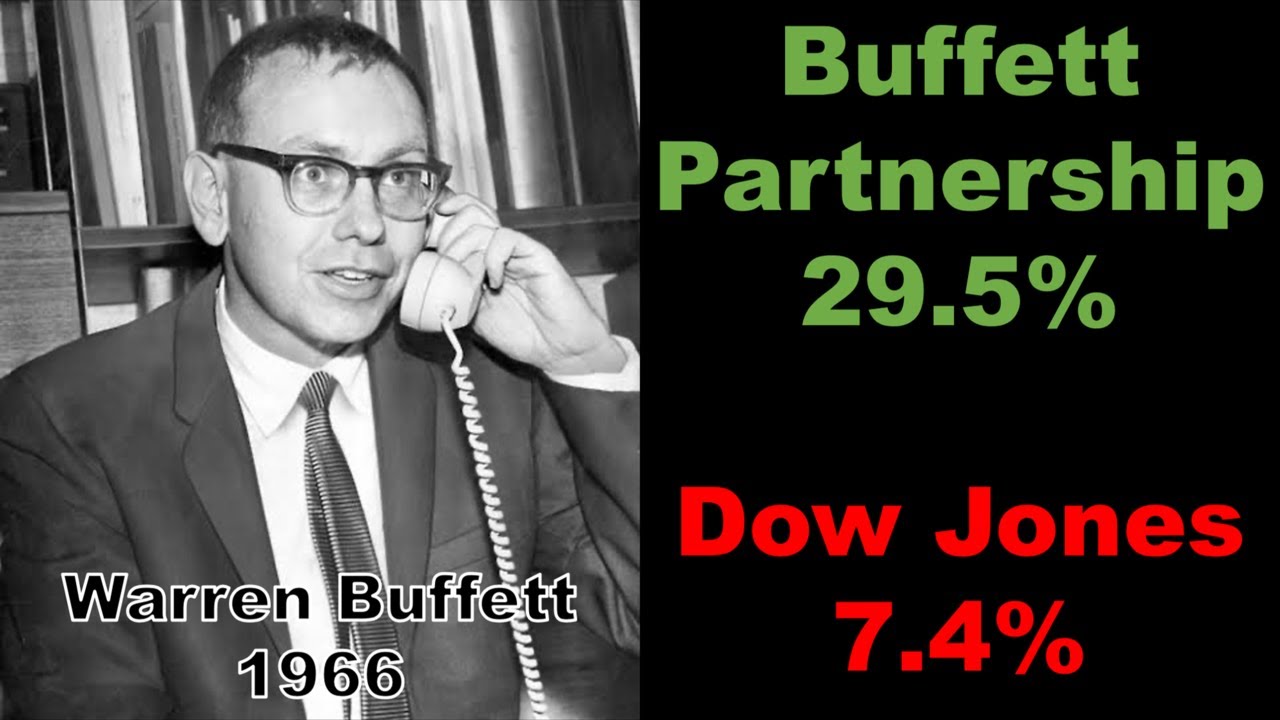

How the Buffett Partnership Crushed the Stock Market (1950's & 60's)

Показать описание

Buffett Partnership Letters:

Warren Buffett’s partnership of the 1950’s and 60’s crushed the stock market by a huge margin! Here are three reasons he was able to do so.

Enjoy the video 😉

Recommended Investing Books:

Rule One by Phil Town:

Payback Time by Phil Town:

The Intelligent Investor by Ben Graham:

The Education of a Value Investor by Guy Spier:

Recommended Personal Finance/Entrepreneurship Books:

Rich Dad, Poor Dad by Robert Kiyosaki:

Tools of Titans by Tim Ferriss:

Disclaimer:

I am not a financial adviser. This video is for education and entertainment purposes only. Seek professional help before making any investment decision

Warren Buffett’s partnership of the 1950’s and 60’s crushed the stock market by a huge margin! Here are three reasons he was able to do so.

Enjoy the video 😉

Recommended Investing Books:

Rule One by Phil Town:

Payback Time by Phil Town:

The Intelligent Investor by Ben Graham:

The Education of a Value Investor by Guy Spier:

Recommended Personal Finance/Entrepreneurship Books:

Rich Dad, Poor Dad by Robert Kiyosaki:

Tools of Titans by Tim Ferriss:

Disclaimer:

I am not a financial adviser. This video is for education and entertainment purposes only. Seek professional help before making any investment decision

How the Buffett Partnership Crushed the Stock Market (1950's & 60's)

Why Warren Buffett Closed the Buffett Partnerships and What If Berskhire Were a Limited Partnership

Why Did Warren Buffett Close His Original Partnership?

Warren Buffett on Why Buffett dissolved his partnership in 1969

Warren Buffett reflects on disbanding his partnership in 1969

Five Biggest Trades During the Partnership Years

1958 Buffett Partnership Letter - Analysis & Key Takeaways

THE BUFFETT PARTNERSHIP LETTERS (BY WARREN BUFFETT)

Warren Buffett’s Secret To Finding Good Business Partners

The Structure of Warren Buffett’s Early Partnerships #Shorts

1957 Buffett Partnership Letter - Analysis & Key Takeaways

An Early Buffett Partnership Investor Asks A Question On International Businesses (1996 Q21 pm)

How To Find A Good Business Partners Like Warren Buffett

The Warren Buffett Letters - To My Partners, 1961

1957 Partnership Letter - Warren Buffett

Charlie Munger’s Commentary on the 0/6/25 1960s Buffett Partnerships Fee Structure

How Warren Buffett Turned See's Candy Into a Billion Dollar Business

Warren Buffett's Original 7 Strategies for Success

How Women CRUSH Men at Investing

Why Warren Buffett Tried to Work for Free

Buffett & Munger - Warren Buffet's First 100k

EP6 Why Warren Buffett Closed Down His Successful Investment Partnership

Characteristics Of A Great Investor - Charlie munger

Warren Buffett - How to Turn 115$ Into 400,000$ By doing NOTHING But Waiting. #shorts #investing

Комментарии

0:13:00

0:13:00

0:03:41

0:03:41

0:01:00

0:01:00

0:04:49

0:04:49

0:04:20

0:04:20

0:18:22

0:18:22

0:03:54

0:03:54

0:19:17

0:19:17

0:00:37

0:00:37

0:00:57

0:00:57

0:04:30

0:04:30

0:03:35

0:03:35

0:00:27

0:00:27

0:08:17

0:08:17

0:08:04

0:08:04

0:06:41

0:06:41

0:00:27

0:00:27

0:08:33

0:08:33

0:08:03

0:08:03

0:00:47

0:00:47

0:04:02

0:04:02

0:21:40

0:21:40

0:00:39

0:00:39

0:00:16

0:00:16