filmov

tv

IRS Form 1040-ES Line-by-Line Instructions 2024: Self-Employment Tax Worksheet Rules 🔶 TAXES S2•E101

Показать описание

👇👇UNLOCK YOUR BUSINESS POTENTIAL TODAY! START MAKING MILLIONS *NOW* !👇👇

▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬

▶️AWESOME VIDEOS ON THIS CHANNEL👇

▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬

COPYRIGHT-FREE MATERIAL😉😉😉

STOCK IMAGES: DREAMSTIME, iSTOCK and GETTY IMAGES

🎵 VIDEO MUSIC FROM YOUTUBE AUDIO LIBRARY🎵

▶️ INTRO: "AVERAGE"BY PATRICK PATRIKIOS

▶️ BACKGROUND: "TIMPANI BEAT" BY NANA KWABENA

#SwittyKiwiTaxMasterClass#HowToFileTaxes#IRSForm1040ES

▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬

▶️AWESOME VIDEOS ON THIS CHANNEL👇

▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬

COPYRIGHT-FREE MATERIAL😉😉😉

STOCK IMAGES: DREAMSTIME, iSTOCK and GETTY IMAGES

🎵 VIDEO MUSIC FROM YOUTUBE AUDIO LIBRARY🎵

▶️ INTRO: "AVERAGE"BY PATRICK PATRIKIOS

▶️ BACKGROUND: "TIMPANI BEAT" BY NANA KWABENA

#SwittyKiwiTaxMasterClass#HowToFileTaxes#IRSForm1040ES

IRS Form 1040-ES walkthrough (Estimated Tax Voucher)

IRS Form 1040-ES Line-by-Line Instructions 2024: Form 1040-ES Example Fully Filled Out 🔶TAXES S3•E6...

IRS Form 1040-ES Line-by-Line Instructions 2024: Self-Employment Tax Worksheet Rules 🔶 TAXES S2•E101...

How to calculate estimated taxes - 1040-ES Explained! {Calculator Available}

how to pay quarterly taxes “ONLINE” (much easier once you know how): IRS estimated taxes direct pay...

How to Fill Out Form 1040 for 2023 | Taxes 2024 | Money Instructor

How to Fill Out Form 1040 | Preparing your Taxes | Money Instructor

IRS Form 1040 Line-by-Line Instructions 2024: How to Prepare Your 1040 in 2024 👀📘🤔 🔶 TAXES S2•E52...

Making Estimated Payments (or not!)

Form 1040-ES Example Return (2024) | IRS Form 1040-ES: What It Is, How to Fill It Out💰TAXES S5•E192...

Learn How to Fill the Form 1040-ES Estimated Tax for Individuals

Form 941 and Form 1040-ES: Which Tax Forms Are Filed Quarterly?

Form 1040-ES - Estimated Tax Payments

IRS Form 1040 Walkthrough Step By Step | Single No Dependents | 2024 Form 1040 Explained

How to Fill Out Form 1040 for 2022 | Taxes 2023 | Money Instructor

2021 IRS Form 1040 Walkthrough | Single No Dependents

Form 1040 Schedule SE 2024 Line-by-Line Instructions: Schedule SE Filled Out Example 🔶TAXES S3•E4...

IRS Form 1040 Schedule SE Walkthrough

2022 IRS Form 1040 Walkthrough | Married Filing Jointly

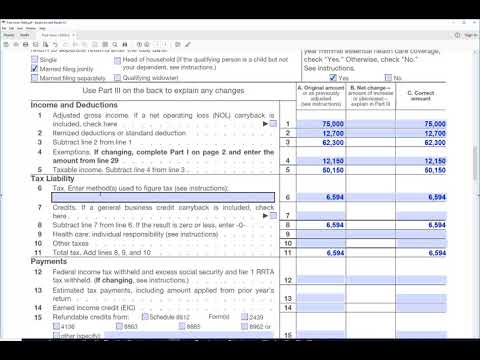

IRS Form 1040-X Line-by-Line Instructions 2024: Form 1040-X Example Fully Filled Out 🔶TAXES S3•E5...

The IRS is now paying more attention to THIS tax form (1040-ES)

How to Figure Estimated Quarterly Taxes (2023)

Schedule SE walkthrough (Self-Employment Tax)

How to fill out Form 1040X, Amended Tax Return

Комментарии

0:25:54

0:25:54

0:21:18

0:21:18

0:18:25

0:18:25

0:22:53

0:22:53

0:03:43

0:03:43

0:12:47

0:12:47

0:06:26

0:06:26

0:28:40

0:28:40

0:07:03

0:07:03

0:20:17

0:20:17

0:02:00

0:02:00

0:04:37

0:04:37

0:01:16

0:01:16

0:18:04

0:18:04

0:11:48

0:11:48

0:12:51

0:12:51

0:23:05

0:23:05

0:04:15

0:04:15

0:17:59

0:17:59

0:23:18

0:23:18

0:00:24

0:00:24

0:19:41

0:19:41

0:20:52

0:20:52

0:05:41

0:05:41