filmov

tv

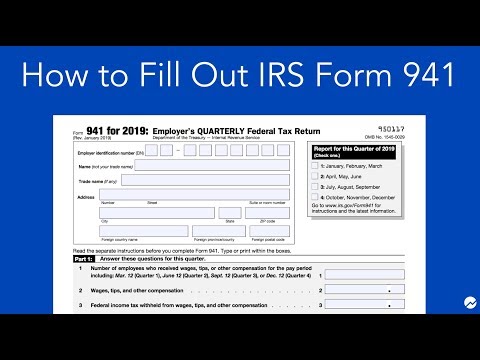

Form 941 and Form 1040-ES: Which Tax Forms Are Filed Quarterly?

Показать описание

Payroll + HR + Benefits in an all-in-one solution. Request a BerniePortal demo today!

We know tax forms can be confusing, and filing them 4 times a year can be somewhat stressful. That is why, in this episode, we break down which forms need to be filed every quarter and who needs to file them.

BerniePortal: The all-in-one HRIS that makes building a business & managing its people easy.

What is an HRIS?

BernieU: Your free one-stop-shop for compelling, convenient, and comprehensive HR training and courses that will keep you up-to-date on all things human resources. Approved for SHRM & HRCI recertification credit hours. Enroll today!

Join the HR Party of One Linkedin Group!

▬ Episode Resources & Links ▬▬▬▬▬▬▬▬▬▬

IRS "How and when to pay estimated taxes"

Guide to Paying Quarterly Taxes

IRS Instructions for Form 941

IRS Self Employed Individuals Tax Center

Turbotax What Is the IRS Form 941?

What Is IRS Form 1040-ES?

EFTPS Portal

Payroll by BerniePortal

▬ Contents of this video ▬▬▬▬▬▬▬▬▬▬

00:00 Weekdays with Bernie 2023

00:30 Intro

01:00 Which Tax Forms Must Be Submitted Quarterly?

01:46 What Is Estimated Tax?

02:30 Who Must File Quarterly?

03:17 When Are Quarterly Taxes Due for 2023?

04:08 How Are Quarterly Taxes Paid?

▬ Social Media ▬▬▬▬▬▬▬▬▬▬▬

▬ Podcast▬▬▬▬▬▬▬▬▬▬▬▬

#QuarterlyTaxes, #Form941, #Form1040ES, #HR, #HumanResources, #HRTips, #HumanResourcesTips, #SmallBusiness, #HRPartyOfOne,

We know tax forms can be confusing, and filing them 4 times a year can be somewhat stressful. That is why, in this episode, we break down which forms need to be filed every quarter and who needs to file them.

BerniePortal: The all-in-one HRIS that makes building a business & managing its people easy.

What is an HRIS?

BernieU: Your free one-stop-shop for compelling, convenient, and comprehensive HR training and courses that will keep you up-to-date on all things human resources. Approved for SHRM & HRCI recertification credit hours. Enroll today!

Join the HR Party of One Linkedin Group!

▬ Episode Resources & Links ▬▬▬▬▬▬▬▬▬▬

IRS "How and when to pay estimated taxes"

Guide to Paying Quarterly Taxes

IRS Instructions for Form 941

IRS Self Employed Individuals Tax Center

Turbotax What Is the IRS Form 941?

What Is IRS Form 1040-ES?

EFTPS Portal

Payroll by BerniePortal

▬ Contents of this video ▬▬▬▬▬▬▬▬▬▬

00:00 Weekdays with Bernie 2023

00:30 Intro

01:00 Which Tax Forms Must Be Submitted Quarterly?

01:46 What Is Estimated Tax?

02:30 Who Must File Quarterly?

03:17 When Are Quarterly Taxes Due for 2023?

04:08 How Are Quarterly Taxes Paid?

▬ Social Media ▬▬▬▬▬▬▬▬▬▬▬

▬ Podcast▬▬▬▬▬▬▬▬▬▬▬▬

#QuarterlyTaxes, #Form941, #Form1040ES, #HR, #HumanResources, #HRTips, #HumanResourcesTips, #SmallBusiness, #HRPartyOfOne,

0:04:37

0:04:37

0:15:15

0:15:15

0:03:51

0:03:51

0:03:43

0:03:43

0:00:53

0:00:53

0:04:11

0:04:11

0:02:31

0:02:31

0:18:10

0:18:10

0:07:52

0:07:52

0:33:46

0:33:46

0:14:52

0:14:52

0:33:45

0:33:45

0:03:58

0:03:58

0:57:33

0:57:33

0:09:49

0:09:49

0:02:42

0:02:42

0:07:54

0:07:54

0:01:33

0:01:33

0:05:33

0:05:33

0:03:05

0:03:05

0:40:44

0:40:44

0:11:35

0:11:35

0:04:55

0:04:55

0:05:36

0:05:36