filmov

tv

11 September 2021 | Daily Current Affairs MCQs by Aman Sir

Показать описание

Daily Current Affairs 2021 | Current Affairs by Aman Sir | Current Affairs Today | World Affairs Current Affairs MCQs | World Affairs

🚀 Follow Aman Sir on Unacademy:

#CurrentAffairs2021 #CurrentAffairsToday #AmanSirGK #CurrentAffairs #SSCCurrentAffairs

In this video lecture, Aman Sir brings you "11 September 2021 - Daily Current Affairs MCQs".

Aman Sir and more top educators are teaching live on Unacademy.

Use Special Code “LIVEAMAN” to get 10% discount on your Unacademy Subscription.

Download the Unacademy Learning App here:

Unacademy Subscription Benefits:

1. Learn from your favourite teacher

2. Dedicated DOUBT sessions

3. One Subscription, Unlimited Access

4. Real-time interaction with Teachers

5. You can ask doubts in the live class

6. Limited students

7. Download the videos & watch offline

4. Real-time interaction with Teachers

5. You can ask doubts in the live class

6. Limited students

7. Download the videos & watch offline

🚀 Follow Aman Sir on Unacademy:

#CurrentAffairs2021 #CurrentAffairsToday #AmanSirGK #CurrentAffairs #SSCCurrentAffairs

In this video lecture, Aman Sir brings you "11 September 2021 - Daily Current Affairs MCQs".

Aman Sir and more top educators are teaching live on Unacademy.

Use Special Code “LIVEAMAN” to get 10% discount on your Unacademy Subscription.

Download the Unacademy Learning App here:

Unacademy Subscription Benefits:

1. Learn from your favourite teacher

2. Dedicated DOUBT sessions

3. One Subscription, Unlimited Access

4. Real-time interaction with Teachers

5. You can ask doubts in the live class

6. Limited students

7. Download the videos & watch offline

4. Real-time interaction with Teachers

5. You can ask doubts in the live class

6. Limited students

7. Download the videos & watch offline

The South Tower (Full Episode) | 9/11 One Day in America

September 11, 2001: Former President George W. Bush addresses the nation | ABC News

September 11, 2021

Catholic Mass Today | Daily TV Mass, Saturday September 11 2021

Trump and Harris shake hands during 9/11 memorial service

DAILY BLESSING 2024 SEPT - 11/FR.MATHEW VAYALAMANNIL CST

September 11, 2021

Pinoy Big Brother Gen 11: FYANG'S MESSAGE TO JAS AND JM | September 15, 2024 Latest Episode

Official 9/11 Memorial Museum Tribute In Time-Lapse 2004-2014

Daily Reading for Saturday, September 11th, 2021 HD

11 September 2021 | Daily Current Affairs MCQs by Aman Sir

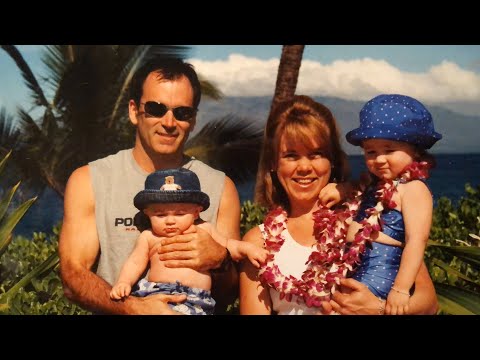

'I didn't realize he was saying goodbye': Wife of 9/11 victim recalls their last conv...

Top Morning news headlines of the day | 11 September, 2021

Daily News Analysis | 11-September-2021 | Crack UPSC CSE 2021 | Rahul Bhardwaj

Morodok Techo National Stadium One Day Before Grand Opening On 11 September 2021

Daily Reading for Wednesday, September 11th, 2024 HD

Video Power Day am 11. September 2021

Daily KHL Update - September 11th, 2021 (English)

Top Political news headlines of the day | 11 September 2021

Historical Day for Afghanistan! | Headlines | 08:00 AM | 11 September 2021 | 92NewsHD

Daily Raasi Palaalu | Anugraham | 11 September 2021 | Gemini TV

Daily prophetic Word - 11th of September 2021

11 September Current Affairs MCQ 2021- 11 September Daily Current Affairs

11 Oct | Happy Marriage Anniversary status 2021 | Happy Wedding Anniversary status 2021

Комментарии

0:44:25

0:44:25

0:03:39

0:03:39

0:03:35

0:03:35

0:29:06

0:29:06

0:00:19

0:00:19

0:10:54

0:10:54

0:00:10

0:00:10

0:00:08

0:00:08

0:02:40

0:02:40

0:03:26

0:03:26

0:15:11

0:15:11

0:09:20

0:09:20

0:10:16

0:10:16

0:39:30

0:39:30

0:36:29

0:36:29

0:04:14

0:04:14

0:06:45

0:06:45

0:05:10

0:05:10

0:03:52

0:03:52

0:09:16

0:09:16

0:19:14

0:19:14

0:02:28

0:02:28

0:21:01

0:21:01

0:00:28

0:00:28