filmov

tv

Property Tax Exemptions | Cobb County Georgia | Real Estate Taxes

Показать описание

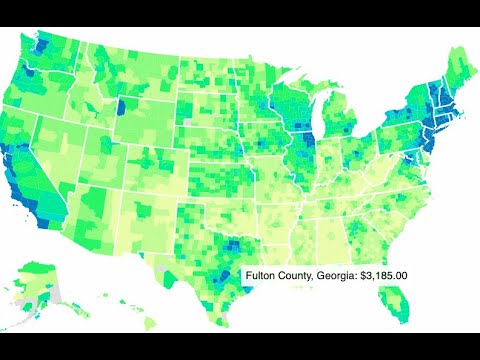

In this video I talk about saving money on property taxes by living in Cobb County instead of Fulton County. Enjoy working & playing in Fulton while saving money by living in Cobb County.

I'm Sonya Peterson and I am a Realtor in the Atlanta Metro area. My family and I have lived in Marietta for over 20 years.

My videos will give insight on what's available outside of the city of Atlanta, specifically highlighting Cobb, Douglas & Paulding County.

Sonya Peterson, Associate Broker

Realty One Group Edge

I'm Sonya Peterson and I am a Realtor in the Atlanta Metro area. My family and I have lived in Marietta for over 20 years.

My videos will give insight on what's available outside of the city of Atlanta, specifically highlighting Cobb, Douglas & Paulding County.

Sonya Peterson, Associate Broker

Realty One Group Edge

DID YOU KNOW - Your Cobb Co Property Tax Bill

Property Tax Exemptions | Cobb County Georgia | Real Estate Taxes

Cobb's Tax Assessor Explains (the confusing) Homestead Exemption!

Cobb County tax assessments increase for most homeowners

How to appeal a property tax assessment notice | FOX 5 News

Real Estate & Tax Exemptions benefits in Fulton and Cobb counties 🏡. PART 1 subscribe for PART...

Is it worth it to appeal your property tax assessment in Cobb County, Ga? Lowered assessment $10k!

Georgia Homestead Exemption Explained 2023 | Is it worth filing for?

Property Tax Exemption Georgia

Home Assessments UPDATE from the Tax Assessor's Office - May 24, 2022

Cobb's Staffing Crisis and Budget Challenges Explained - June 8, 2022

Cobb's FY25 Budget Presentation - Work Session

Property Tax Appeal Process Cobb County, Georgia (Annual Notice of Assessment)

Appeal your property tax assessment, Cobb County, Ga

Property Tax Appeal. Cobb County, Ga. John Grimes

Cobb Tax Assessors Roll Out New Online Appeal System

Cobb's Tax Assessor reveals new website with new features - June 6, 2019

Cobb County and Metro Atlanta Real Estate Agent: Homestead Exemption

States With NO Property Tax For Retirees

Housing surge could drive up property taxes in Cobb County

Tax Assessor's 2021 Tax Digest Estimate - March 31, 2021

How To Find Comparables [Comps] To Appeal Property Taxes

How to win property assessment appeal

Your 2014 Cobb County Tax Bill

Комментарии

0:03:19

0:03:19

0:07:19

0:07:19

0:05:44

0:05:44

0:02:17

0:02:17

0:02:20

0:02:20

0:01:01

0:01:01

0:00:33

0:00:33

0:07:27

0:07:27

0:04:35

0:04:35

0:12:55

0:12:55

0:03:47

0:03:47

0:40:00

0:40:00

0:26:36

0:26:36

0:03:22

0:03:22

0:00:19

0:00:19

0:03:00

0:03:00

0:01:41

0:01:41

0:02:45

0:02:45

0:11:39

0:11:39

0:02:14

0:02:14

0:05:39

0:05:39

0:06:58

0:06:58

0:03:03

0:03:03

0:02:34

0:02:34