filmov

tv

How to Calculate Your Taxes Under the U.S. Tax System

Показать описание

#shorts

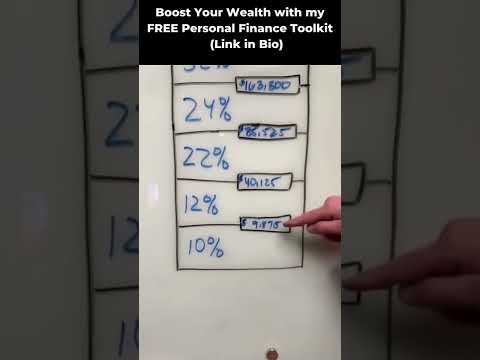

It might sound obvious for someone who already knows the progressive US tax system. However, still many don't know the right way to calculate their taxes. This short clip could answer your question on how taxation works.

It might sound obvious for someone who already knows the progressive US tax system. However, still many don't know the right way to calculate their taxes. This short clip could answer your question on how taxation works.

How to estimate your personal income taxes

Financial Education: How To Calculate Your Taxes in 2021?

How to Calculate your Income Tax? Step-by-Step Guide for Income Tax Calculation

How To Calculate Federal Income Taxes - Social Security & Medicare Included

Tax Basics For Beginners (Taxes 101)

How to calculate tax

Tax Brackets Explained For Beginners in The USA

How to Calculate Your Taxes Under the U.S. Tax System

Understanding Townwide Revaluation || What does it mean for your taxes?

UK Income Tax Explained (UK Tax Bands & Calculating Tax)

HOW TO CALCULATE INCOME TAX(Example 1)

Calculating Federal Income Taxes Using Excel | 2023 Tax Brackets

How to calculate your taxes (self-employed)

Income Tax Calculation 2024-25 | How To Calculate Income Tax FY 2024-25 | New Income Tax Slab Rates

How To Calculate Sales Tax On Calculator Easy Way

How to Calculate Your Federal Income Tax Liability | Personal Finance Series

Income Tax Calculation on Salary Payslip | How to Calculate Income Tax [Calculator]

How to Calculate Sales Tax | Math with Mr. J

Budget 2024 | Income Tax Calculation | How To Calculate Income Tax | New Income Tax Slab Rates

HOW TO CALCULATE INCOME TAX 🤔

Understanding Canadian Tax Brackets and Taxes in Canada (2023 Guide)

How To Calculate Tax On 1099-MISC Income?

How tax brackets actually work

How to File Your Taxes as a LLC Owner in 2024 [Step-by-Step]

Комментарии

0:04:49

0:04:49

0:03:14

0:03:14

0:07:37

0:07:37

0:25:05

0:25:05

0:18:05

0:18:05

0:13:07

0:13:07

0:04:29

0:04:29

0:00:59

0:00:59

0:05:19

0:05:19

0:09:54

0:09:54

0:10:20

0:10:20

0:12:29

0:12:29

0:04:13

0:04:13

0:11:36

0:11:36

0:03:15

0:03:15

0:08:23

0:08:23

0:21:33

0:21:33

0:07:21

0:07:21

0:05:58

0:05:58

0:00:58

0:00:58

0:13:41

0:13:41

0:03:06

0:03:06

0:02:48

0:02:48

0:09:49

0:09:49