filmov

tv

Calculating Federal Income Taxes Using Excel | 2023 Tax Brackets

Показать описание

In this video, I use a simple Excel example to show how you can calculate federal income taxes depending on your taxable income and tax bracket. In the process you will also learn the difference between your average and marginal tax rate.

Reference: Qs 2-4, Corporate Finance 13e [Ross, Westerfield, Jaffe, Jordan]

Reference: Qs 2-4, Corporate Finance 13e [Ross, Westerfield, Jaffe, Jordan]

Calculating Federal Income Taxes Using Excel | 2023 Tax Brackets

How To Calculate Federal Income Taxes - Social Security & Medicare Included

How to estimate your personal income taxes

Calculating Federal Income Tax Withholding

Tax Brackets Explained For Beginners in The USA

MATH: Income Tax Brackets [PRACTICE IT]

Calculating Your US Federal Income Tax with Microsoft Excel Using Progressive Tax Brackets

How to Calculate Your Taxes Under the U.S. Tax System

Federal Income Tax FIT - Percent Method - How to calculate FIT using percent method

Federal Income Tax Calculation: LOOKUP Function Beats VLOOKUP & XLOOKUP! EMT 1828 Part 3

How To Calculate Federal Income Tax Withholding? - CountyOffice.org

Using Shaun's Federal Tax Calculator

What are Payroll Taxes? Introduction to Calculating Payroll Taxes with Hector Garcia in 2024

How to Calculate Your Federal Income Tax Liability | Personal Finance Series

The Basic US Federal Income Tax Formula 2014 - With Examples

8.2.2 Calculating Federal Income Tax

How do you calculate federal income tax withheld from paycheck?

How Do You Calculate How Much Federal Income Tax You Owe?

How Much Do I Owe in Taxes? Income Tax Calculation

Federal Income tax calculations. Math 10

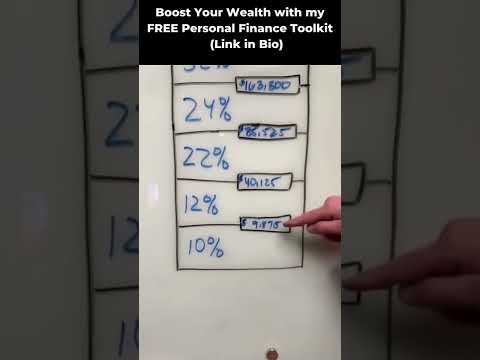

Using tax brackets to calculate tax

Estimate Your Federal Income Tax -- Tax Calculator - TurboTax Tax Tip Video

Calculating Federal Income Tax Withheld

Federal Income Tax - Percentage Method 25

Комментарии

0:12:29

0:12:29

0:25:05

0:25:05

0:04:49

0:04:49

0:11:52

0:11:52

0:04:29

0:04:29

0:02:35

0:02:35

0:11:56

0:11:56

0:00:59

0:00:59

0:08:06

0:08:06

0:03:05

0:03:05

0:02:04

0:02:04

0:01:52

0:01:52

0:11:06

0:11:06

0:08:23

0:08:23

0:28:35

0:28:35

0:22:35

0:22:35

0:01:20

0:01:20

0:00:40

0:00:40

0:03:03

0:03:03

0:13:37

0:13:37

0:02:08

0:02:08

0:01:55

0:01:55

0:06:33

0:06:33

0:07:42

0:07:42