filmov

tv

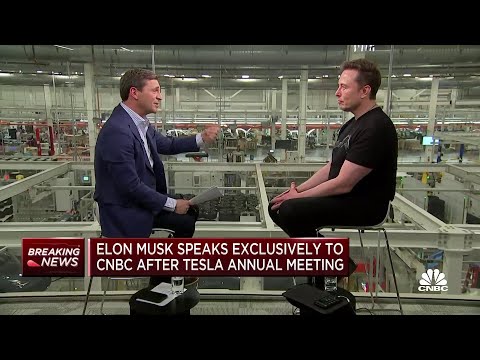

Why Tesla Shouldn't Do A Stock Buyback

Показать описание

Tesla is floating the idea of a $5-10B stock buyback. I wanted to give my thoughts. Although Tesla's $5.1B of operating cashflow is impressive, it's also good for Tesla to operate prudently with a cash cushion in case of a major global recession or some other unforeseen event. If it's true the only bottleneck is engineers not capital, then I may be able to be convinced in a small buyback. But part of me feels like Tesla is way to early in its maturity as a company, and progress towards achieving its mission to spend capital on a sharebuyback instead of something epic in the real world.

Let me know what you think in the comments!!

0:00 Buyback Idea

1:17 Earnings Quality/Cash Cushion

3:23 Elon Deploying Capital

4:20 Case FOR a buyback

6:48 Crazy ideas for Tesla’s Cash

As of 1/30/2022 I'm invested in: Tesla, SpaceX, Bitcoin, Ethereum, Unisocks, VeeFriends, JOYToys, Coinbase, Arcimoto, Dogecoin, Snap, Rainbow Wallet, Atoms, Carta, Pipe, Alloy Automation, Genies, DMN8, Haus, Community, Dadi, Pigeon Loans & others.

Let me know what you think in the comments!!

0:00 Buyback Idea

1:17 Earnings Quality/Cash Cushion

3:23 Elon Deploying Capital

4:20 Case FOR a buyback

6:48 Crazy ideas for Tesla’s Cash

As of 1/30/2022 I'm invested in: Tesla, SpaceX, Bitcoin, Ethereum, Unisocks, VeeFriends, JOYToys, Coinbase, Arcimoto, Dogecoin, Snap, Rainbow Wallet, Atoms, Carta, Pipe, Alloy Automation, Genies, DMN8, Haus, Community, Dadi, Pigeon Loans & others.

Комментарии

0:15:38

0:15:38

0:17:54

0:17:54

0:00:51

0:00:51

0:05:11

0:05:11

0:10:38

0:10:38

0:09:44

0:09:44

0:13:13

0:13:13

0:18:09

0:18:09

0:12:01

0:12:01

0:00:21

0:00:21

0:16:49

0:16:49

0:06:30

0:06:30

0:09:59

0:09:59

0:27:56

0:27:56

0:27:23

0:27:23

0:10:34

0:10:34

0:09:40

0:09:40

0:10:31

0:10:31

0:16:21

0:16:21

0:22:31

0:22:31

0:15:26

0:15:26

0:10:15

0:10:15

0:01:00

0:01:00

0:10:22

0:10:22