filmov

tv

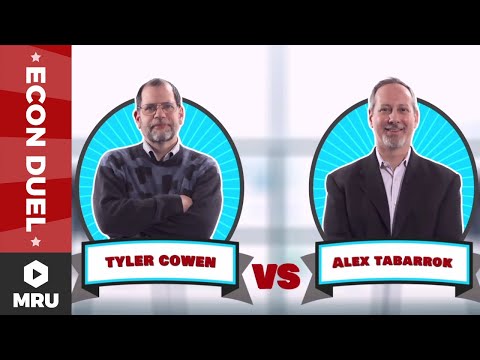

Econ Duel: Rent or Buy?

Показать описание

Owning a home is a huge part of the American Dream. But is the dream of homeownership really all it’s cracked up to be?

In this new Econ Duel from Marginal Revolution University, Professors Tyler Cowen and Alex Tabarrok weigh in on the issue. Each representing a side of the home ownership debate, the two professors ask what’s smarter—to rent, or to buy?

On the “buy” side, Tyler Cowen shares the tax advantages of buying a home as well as the effect homeownership has on one’s stability and savings regimen. Does buying a home force us into better savings habits?

Against those arguments, we have Alex Tabarrok, coming down on the “rent” side of the equation.

Among other points, he talks about the real beneficiary of tax breaks (hint: It may not be you!). Along with that, Alex tackles the trials and tribulations of home-buying, in places like San Francisco, New York, or Boston, where a combination of scarce building permits and increased demand drive up home prices. Plus, doesn’t owning a home -- and committing a 20% down payment -- break the diversification rule of good investing?

All that said, though, here’s the real question that matters—which side are YOU on? Watch and let us know in the comments!

In this new Econ Duel from Marginal Revolution University, Professors Tyler Cowen and Alex Tabarrok weigh in on the issue. Each representing a side of the home ownership debate, the two professors ask what’s smarter—to rent, or to buy?

On the “buy” side, Tyler Cowen shares the tax advantages of buying a home as well as the effect homeownership has on one’s stability and savings regimen. Does buying a home force us into better savings habits?

Against those arguments, we have Alex Tabarrok, coming down on the “rent” side of the equation.

Among other points, he talks about the real beneficiary of tax breaks (hint: It may not be you!). Along with that, Alex tackles the trials and tribulations of home-buying, in places like San Francisco, New York, or Boston, where a combination of scarce building permits and increased demand drive up home prices. Plus, doesn’t owning a home -- and committing a 20% down payment -- break the diversification rule of good investing?

All that said, though, here’s the real question that matters—which side are YOU on? Watch and let us know in the comments!

Комментарии

0:06:17

0:06:17

0:09:54

0:09:54

0:09:32

0:09:32

0:09:59

0:09:59

0:08:00

0:08:00

0:09:56

0:09:56

0:02:31

0:02:31

0:02:19

0:02:19

0:04:49

0:04:49

0:07:31

0:07:31

0:01:18

0:01:18

0:04:06

0:04:06

0:06:08

0:06:08

0:08:20

0:08:20

0:04:44

0:04:44

0:04:47

0:04:47

0:12:24

0:12:24

0:11:48

0:11:48

0:04:40

0:04:40

0:02:56

0:02:56

0:01:54

0:01:54

0:09:51

0:09:51

0:03:06

0:03:06

0:01:19

0:01:19