filmov

tv

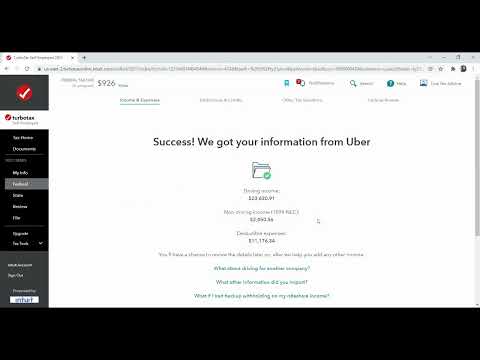

TurboTax Tutorial - Uber and Lyft Income

Показать описание

Step by step tutorial on how to go through TurboTax to report Uber and Lyft income and expenses

--------------------------

--------------------------

------------------------

///

Disclaimer: The information provided in this video is for informational purposes only and is not meant to take the place of professional legal, accounting, or financial advice. If you have any legal questions about this video or the subjects discussed, or any other legal matter, you should consult with an attorney or tax professional in your jurisdiction (i.e. where you live).

#turbotax #uber #lyft #tax

--------------------------

--------------------------

------------------------

///

Disclaimer: The information provided in this video is for informational purposes only and is not meant to take the place of professional legal, accounting, or financial advice. If you have any legal questions about this video or the subjects discussed, or any other legal matter, you should consult with an attorney or tax professional in your jurisdiction (i.e. where you live).

#turbotax #uber #lyft #tax

TurboTax Tutorial - Uber and Lyft Income

How to File Your Uber & Lyft Drivers Using TurboTax

How To File Your Uber & Lyft Driver Taxes Using TurboTax [2021]

How To File Uber Eats Taxes On Turbotax (2024)

How to import UberEats income and deduction in TurboTax to start filing your TAX

How To File Uber Eats Taxes On Turbotax (Tutorial)

TurboTax Canada Uber Partner Webinar for the 2017 Tax Year

How to File Your Taxes Online For Beginners (TurboTax Tutorial) 🧾

HOW TO FILE UBER EATS TAXES ON TURBOTAX 2024! (FULL GUIDE)

Uber Drivers: Common Expenses and Tax Deductions - TurboTax Tax Tip Video

TurboTax + Uber: Tax Write-Offs for Rideshare Drivers [Webinar]

Taxes for Ride-share Drivers - Uber and TurboTax Webinar

How do I clear and start over in TurboTax Online? - TurboTax Support Video

TurboTax + Uber: Tax Tips for Uber Drivers [Webinar]

HOW TO FILE UBER INCOME & EXPENSES WITH TURBOTAX

How To File Your Uber & Lyft Driver Taxes Using TurboTax [Jay Presents]

How To File Uber Eats Taxes On Turbotax 2024 (Step By Step Guide)

Uber Drivers: Tax Deductions for Mileage and Using a Rental Car - TurboTax Tax Tip Video

Uber Drivers: Gross Income vs Net Income - TurboTax Tax Tip Video

Uber Drivers: Yes, You're Self-Employed - TurboTax Tax Tip Video

HOW TO FILE UBER EATS TAXES ON TURBOTAX (Easy)

Quick Tips - TurboTax Workshop for Uber Partners

[Self-Employed TurboTax VIDEO #5] How To Write-Off a Vehicle? Actual Method vs. Standard Mileage

How do I enter my income & expenses from Uber 1099-NEC in TurboTax and deduction for Tax Return

Комментарии

0:26:00

0:26:00

0:12:17

0:12:17

0:13:43

0:13:43

0:02:40

0:02:40

0:13:36

0:13:36

0:02:33

0:02:33

0:39:30

0:39:30

0:04:43

0:04:43

0:01:16

0:01:16

0:00:57

0:00:57

0:17:31

0:17:31

0:38:27

0:38:27

0:00:37

0:00:37

0:16:14

0:16:14

0:11:20

0:11:20

0:15:12

0:15:12

0:00:39

0:00:39

0:01:28

0:01:28

0:00:53

0:00:53

0:01:20

0:01:20

0:00:45

0:00:45

0:52:33

0:52:33

0:15:30

0:15:30

0:25:28

0:25:28