filmov

tv

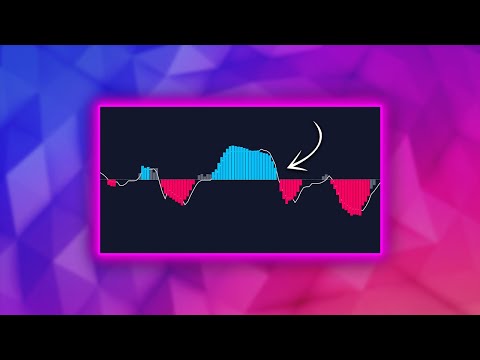

The SMARTEST Option Trading Strategy (No One Told You About)

Показать описание

In this video you are going to learn an option strategy that will consistently make you more money in your trading portfolio. There are

proven techniques that consistently produce profits. We are going to look at them so that you can have a bag of tools that you can use in your journey to grow your stock options trading account.

In this video I’m going to show you:

Option strategies that have been proven over time to increase profits and reduce risk

How To place an Option Trade to take advantage of the smartest strategy (Showing a real example on the option trading platform)

At the end we will provide you with a bonus simple formula for winning in the stock market using options

FREE Options Workshop:

FREE Options Strategy Trading Guide:

Coaching Program:

Automatic Options Income Trading Course:

Tastyworks - Option Trading Platform

Websites:

Twitter: @darren_steves

Disclaimer: I am NOT a financial advisor and nothing I say is meant to be a recommendation to buy or sell any financial instrument. Please do your own research and consult your Financial Planner before making financial decisions.

proven techniques that consistently produce profits. We are going to look at them so that you can have a bag of tools that you can use in your journey to grow your stock options trading account.

In this video I’m going to show you:

Option strategies that have been proven over time to increase profits and reduce risk

How To place an Option Trade to take advantage of the smartest strategy (Showing a real example on the option trading platform)

At the end we will provide you with a bonus simple formula for winning in the stock market using options

FREE Options Workshop:

FREE Options Strategy Trading Guide:

Coaching Program:

Automatic Options Income Trading Course:

Tastyworks - Option Trading Platform

Websites:

Twitter: @darren_steves

Disclaimer: I am NOT a financial advisor and nothing I say is meant to be a recommendation to buy or sell any financial instrument. Please do your own research and consult your Financial Planner before making financial decisions.

Комментарии

0:17:08

0:17:08

0:17:05

0:17:05

0:09:04

0:09:04

0:00:54

0:00:54

0:16:47

0:16:47

0:20:04

0:20:04

0:08:12

0:08:12

0:00:39

0:00:39

0:09:25

0:09:25

0:16:24

0:16:24

0:01:00

0:01:00

0:10:23

0:10:23

0:00:33

0:00:33

0:00:38

0:00:38

0:00:22

0:00:22

0:01:00

0:01:00

0:25:11

0:25:11

0:27:17

0:27:17

0:10:55

0:10:55

0:14:18

0:14:18

0:00:43

0:00:43

0:00:58

0:00:58

0:00:24

0:00:24

0:01:00

0:01:00