filmov

tv

S Corp Tax Compliance: A Step-by-Step Tax Extension Filing Guide

Показать описание

Are you an S Corp owner dreading the tax filing season? Fear not! "S Corp Tax Compliance: A Step-by-Step Tax Extension Filing Guide" is here to rescue you from the clutches of tax anxiety. In this must-watch video, Jamie Trull, finance expert and CPA, demystifies the tax extension filing process for S Corps with precision and ease where you will learn to navigate the IRS Form 2553 and understand critical deadlines to keep your business on track. .

Highlights of this video include:

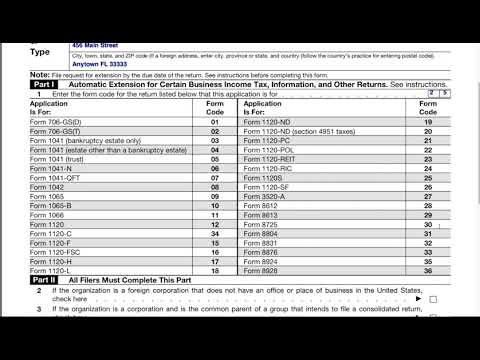

- A thorough breakdown of the 1120S form and its requirements

- Pro tips to avoid late filing penalties and stay compliant

- A walkthrough of the TaxAct platform for hassle-free e-filing

- Strategies for leveraging S Corp status for optimal tax benefits

Don't let tax season become a source of stress. With Jamie's expert guidance, you'll gain the confidence to handle your S Corp taxes like a seasoned professional. Plus, you'll find out how to avoid common pitfalls and ensure your business remains in good standing with the IRS.

Take Action Now:

▶️ File your FREE S Corp extension

▶️ Form mentioned: IRS Form 7004

Other Videos where I talk about S Corps

Blogs where I talk about S Corps

// SHOP MY STUFF //

//FINANCIAL TOOLS & SYSTEMS I LOVE //

// CHOOSE YOUR ADVENTURE //

Oh! And follow me

**DISCLAIMER: This video is meant for educational purposes only. This is not to be relied on or considered a substitute for advice on your specific situation from your tax advisor.

Note: There may be affiliate links in this description or video. We do not actively monitor comments on these threads.

Highlights of this video include:

- A thorough breakdown of the 1120S form and its requirements

- Pro tips to avoid late filing penalties and stay compliant

- A walkthrough of the TaxAct platform for hassle-free e-filing

- Strategies for leveraging S Corp status for optimal tax benefits

Don't let tax season become a source of stress. With Jamie's expert guidance, you'll gain the confidence to handle your S Corp taxes like a seasoned professional. Plus, you'll find out how to avoid common pitfalls and ensure your business remains in good standing with the IRS.

Take Action Now:

▶️ File your FREE S Corp extension

▶️ Form mentioned: IRS Form 7004

Other Videos where I talk about S Corps

Blogs where I talk about S Corps

// SHOP MY STUFF //

//FINANCIAL TOOLS & SYSTEMS I LOVE //

// CHOOSE YOUR ADVENTURE //

Oh! And follow me

**DISCLAIMER: This video is meant for educational purposes only. This is not to be relied on or considered a substitute for advice on your specific situation from your tax advisor.

Note: There may be affiliate links in this description or video. We do not actively monitor comments on these threads.

Комментарии

0:12:03

0:12:03

0:14:19

0:14:19

0:17:59

0:17:59

0:14:57

0:14:57

0:04:34

0:04:34

0:09:39

0:09:39

0:08:28

0:08:28

0:36:15

0:36:15

0:28:27

0:28:27

0:00:57

0:00:57

0:06:19

0:06:19

0:00:53

0:00:53

0:00:40

0:00:40

0:00:42

0:00:42

0:12:21

0:12:21

0:00:25

0:00:25

0:12:13

0:12:13

0:03:08

0:03:08

0:37:24

0:37:24

0:05:54

0:05:54

0:44:42

0:44:42

0:03:25

0:03:25

0:01:50

0:01:50

0:00:17

0:00:17