filmov

tv

How to file an s-corporation extension Form 7004

Показать описание

This video shows you how to file an extension for an S-Corporation return. So the deadline to file is March 15 and if you need a little extra time, this will give you until September. I walk you through line by line, how to fill out the form 7004 application for automatic extension of time to file. So we're going to start with our name, something really goofy. This is just an example, and you're going to fill out all your basic identifying information. So identifying number is your EIN. Should have that and your address, And you can get this as a PDF fill in from the IRS website. In this example, I chose Florida because that's where I am.

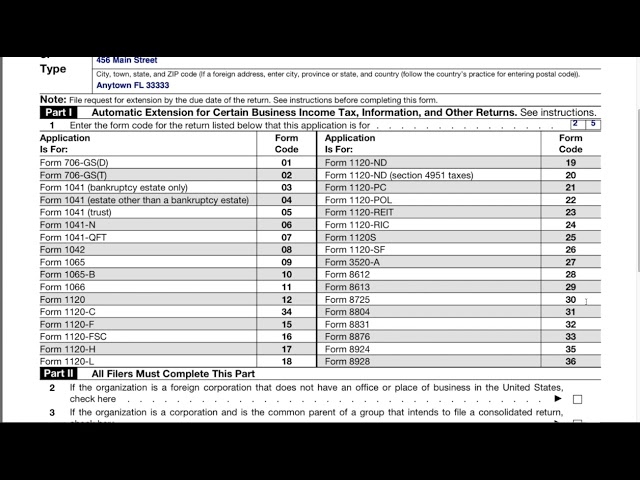

So now when you move into part one, you'll see here, enter form code for the return listed below that this application is for. So this is for an S-Corporation and what an S-Corporation files is the 1120S form for S-Corporation. So if you come here, you'll see it says form 1120S and the code is 25. So you're going to go back up to this box over here and type in a two and a five and that's how the IRS knows that you are intending to file at a later date, the S-Corporation return.

Now, if you continue down, there's some other things, most of these will not apply to an S-Corporation. Okay? So you can kind of ignore this stuff. Go down to number five. Application is for the year. Right now, I'm in 2017, but you can put this in for whatever year you're needing to file for. If you started your business part way through the year, say you didn't go into business until June of '17, you would file the dates. We call this a short year because it's part of the year, it's short. If this was your first year, you would want to also go ahead and check that box.

Now, an S-Corporation does not pay taxes, so you're not going to have any tax due. You can put these as zero or you can just leave it blank. The IRS knows the S-Corporation is not paying income tax. So that's not an issue. Then you're going to go ahead and print this and stick it in the mail. I highly recommend mailing out certified return receipt with those green cards. The reason is if the IRS comes back and says, "Oh, you didn't send this in in time," you have proof of when you mailed it and it needs to be postmarked by March 15th. Depending on the year, it might move a day or two, but that's it. That gets you your extension until September and I hope you found this video helpful. If you did, please like it or leave me a comment and please subscribe, check out my other videos.

If you have any questions, you can put them in the comments on Youtube or reach out to me directly.

So now when you move into part one, you'll see here, enter form code for the return listed below that this application is for. So this is for an S-Corporation and what an S-Corporation files is the 1120S form for S-Corporation. So if you come here, you'll see it says form 1120S and the code is 25. So you're going to go back up to this box over here and type in a two and a five and that's how the IRS knows that you are intending to file at a later date, the S-Corporation return.

Now, if you continue down, there's some other things, most of these will not apply to an S-Corporation. Okay? So you can kind of ignore this stuff. Go down to number five. Application is for the year. Right now, I'm in 2017, but you can put this in for whatever year you're needing to file for. If you started your business part way through the year, say you didn't go into business until June of '17, you would file the dates. We call this a short year because it's part of the year, it's short. If this was your first year, you would want to also go ahead and check that box.

Now, an S-Corporation does not pay taxes, so you're not going to have any tax due. You can put these as zero or you can just leave it blank. The IRS knows the S-Corporation is not paying income tax. So that's not an issue. Then you're going to go ahead and print this and stick it in the mail. I highly recommend mailing out certified return receipt with those green cards. The reason is if the IRS comes back and says, "Oh, you didn't send this in in time," you have proof of when you mailed it and it needs to be postmarked by March 15th. Depending on the year, it might move a day or two, but that's it. That gets you your extension until September and I hope you found this video helpful. If you did, please like it or leave me a comment and please subscribe, check out my other videos.

If you have any questions, you can put them in the comments on Youtube or reach out to me directly.

Комментарии

0:15:36

0:15:36

0:14:19

0:14:19

0:03:58

0:03:58

0:26:42

0:26:42

0:14:18

0:14:18

0:19:43

0:19:43

0:15:50

0:15:50

0:13:59

0:13:59

0:15:40

0:15:40

0:09:05

0:09:05

0:03:39

0:03:39

0:12:32

0:12:32

0:09:39

0:09:39

0:17:59

0:17:59

0:08:04

0:08:04

0:15:27

0:15:27

0:22:17

0:22:17

0:10:36

0:10:36

0:09:48

0:09:48

0:16:35

0:16:35

0:17:11

0:17:11

0:12:40

0:12:40

0:15:42

0:15:42

0:28:25

0:28:25