filmov

tv

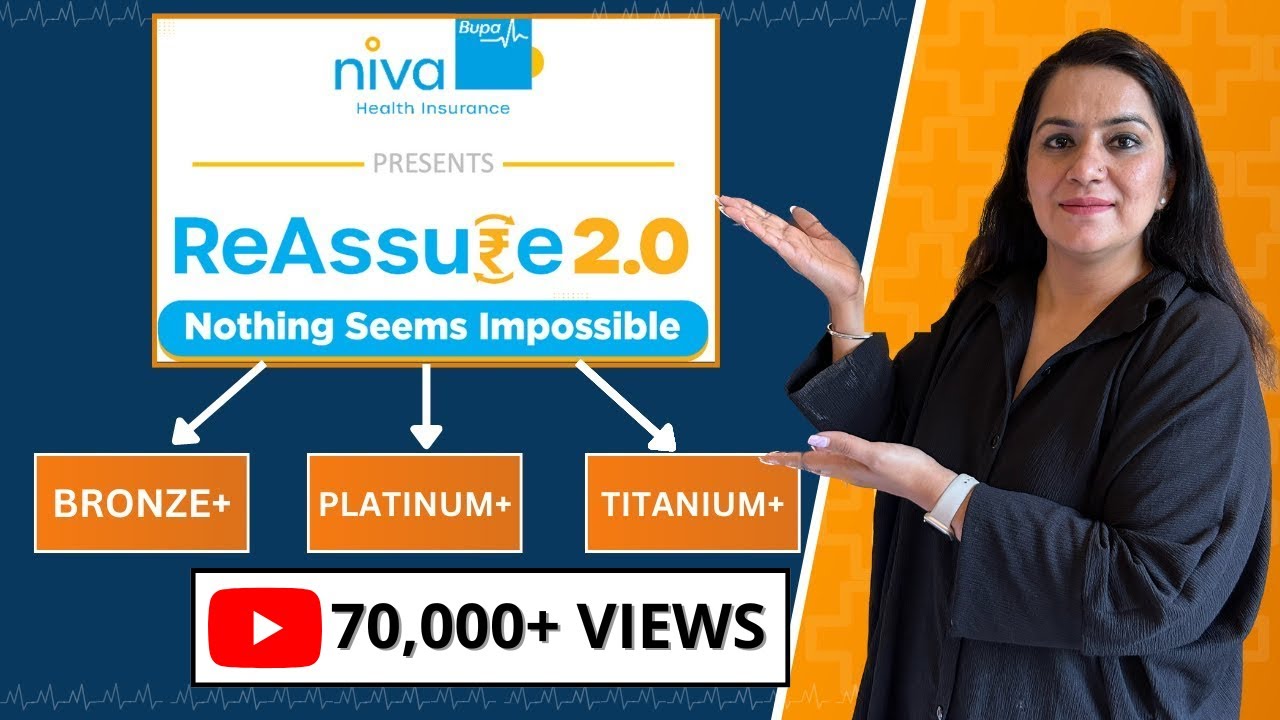

Niva Bupa ReAssure 2.0 VARIANTS | Bronze+ , Platinum+ & Titanium+ EXPLAINED | Gurleen Kaur Tikku

Показать описание

Niva Bupa ReAssure 2.0 is a latest health insurance plan that offers comprehensive coverage with several unique benefits, such as ReAssure Forever, Lock the Clock, Booster+, Safeguard+, etc

Niva Bupa ReAssure 2.0 has 3 Variants : Bronze+ , Platinum+ & Titanium+

In this video, we have explained the difference between all the variants available in Niva Bupa ReAssure 2.0

WATCH THE VIDEO FOR MORE DETAILS :)

--------------------------------------------------------------------------------------------

✅ TIME STAMPS :-

0:00 Introduction of Niva Bupa Reassure 2.0

1:24 Booster+ Benefit in Niva Bupa ReAssure 2.0

1:48 Booster + in different variants

2:10 Lock the Clock of Niva Bupa ReAssure 2.0

3:13 Lock the Clock not available in Bronze+

3:55 Example of Niva Bupa ReAssure 2.0

6:41 Premium of Niva Bupa ReAssure 2.0

6:57 Conclusion

--------------------------------------------------------------------------------------------

For any queries:

📞 Call : 9650706699

--------------------------------------------------------------------------------------------

You can also reach out to us on our Social Media:

Do SUBSCRIBE to our channel for more such informative videos:

--------------------------------------------------------------------------------------------

niva bupa reassure 2.0 , niva bupa health insurance , reassure 2.0 bronze+ , reassure 2.0 platinum+ , reassure 2.0 titanium+ , niva bupa reassure 2.0 hindi , niva bupa latest health insurance , niva bupa health insurance review , niva bupa reassure 2.0 hindi , niva bupa reassure 2.0 premiums , health insurance india , best health insurance , family health insurance , booster+ benefit in reassure 2.0 , insurance agent , financial advisor , health insurance review , gurleen kaur tikku , hareepatti

#nivabupa #nivabupareassure #gurleenkaurtikku

-------------------------------------------------------------------------------------------

Disclaimer : Information presented in this video is for educational purpose only. It may not necessarily be taken as financial, legal or any other type of advice. It is not as per individual needs, objectives or financial situation of any particular person.The video is based on 17 years of experience of Financial industry.

It is based on researches from various books, internet etc and may include opinions of one or more persons who may or may not be the part of Hareepatti.

Gurleen Kaur Tikku or any other team member of Hareepatti will not hold be held responsible as this is not to be considered as personal finance advise.The video does not mean to hurt anyone’s sentiments or spread rumours of any sorts.Viewers should do their own due diligence before taking any action based on the video.

Viewers discretion is advised.

Niva Bupa ReAssure 2.0 has 3 Variants : Bronze+ , Platinum+ & Titanium+

In this video, we have explained the difference between all the variants available in Niva Bupa ReAssure 2.0

WATCH THE VIDEO FOR MORE DETAILS :)

--------------------------------------------------------------------------------------------

✅ TIME STAMPS :-

0:00 Introduction of Niva Bupa Reassure 2.0

1:24 Booster+ Benefit in Niva Bupa ReAssure 2.0

1:48 Booster + in different variants

2:10 Lock the Clock of Niva Bupa ReAssure 2.0

3:13 Lock the Clock not available in Bronze+

3:55 Example of Niva Bupa ReAssure 2.0

6:41 Premium of Niva Bupa ReAssure 2.0

6:57 Conclusion

--------------------------------------------------------------------------------------------

For any queries:

📞 Call : 9650706699

--------------------------------------------------------------------------------------------

You can also reach out to us on our Social Media:

Do SUBSCRIBE to our channel for more such informative videos:

--------------------------------------------------------------------------------------------

niva bupa reassure 2.0 , niva bupa health insurance , reassure 2.0 bronze+ , reassure 2.0 platinum+ , reassure 2.0 titanium+ , niva bupa reassure 2.0 hindi , niva bupa latest health insurance , niva bupa health insurance review , niva bupa reassure 2.0 hindi , niva bupa reassure 2.0 premiums , health insurance india , best health insurance , family health insurance , booster+ benefit in reassure 2.0 , insurance agent , financial advisor , health insurance review , gurleen kaur tikku , hareepatti

#nivabupa #nivabupareassure #gurleenkaurtikku

-------------------------------------------------------------------------------------------

Disclaimer : Information presented in this video is for educational purpose only. It may not necessarily be taken as financial, legal or any other type of advice. It is not as per individual needs, objectives or financial situation of any particular person.The video is based on 17 years of experience of Financial industry.

It is based on researches from various books, internet etc and may include opinions of one or more persons who may or may not be the part of Hareepatti.

Gurleen Kaur Tikku or any other team member of Hareepatti will not hold be held responsible as this is not to be considered as personal finance advise.The video does not mean to hurt anyone’s sentiments or spread rumours of any sorts.Viewers should do their own due diligence before taking any action based on the video.

Viewers discretion is advised.

Комментарии

0:11:40

0:11:40

0:07:16

0:07:16

0:00:39

0:00:39

0:12:13

0:12:13

0:21:38

0:21:38

0:12:57

0:12:57

0:13:55

0:13:55

0:11:30

0:11:30

0:11:05

0:11:05

0:11:32

0:11:32

0:14:00

0:14:00

0:16:17

0:16:17

0:00:56

0:00:56

0:12:42

0:12:42

0:11:59

0:11:59

0:15:05

0:15:05

0:09:20

0:09:20

0:05:37

0:05:37

0:01:22

0:01:22

0:18:43

0:18:43

0:14:29

0:14:29

0:09:49

0:09:49

0:09:39

0:09:39

0:01:22

0:01:22