filmov

tv

Cost of Capital Complete Chapter | CA Inter Financial Management Chapter 4 | CA Inter FM Chapter 4

Показать описание

Cost of Capital Complete Chapter | CA Inter Financial Management Chapter 4 | As Per ICAI New Scheme

In This Video We Will Discuss the Cost of Capital all Concepts, Problems and Examples for CA Inter and CA Inter FM Chapter – 4 All Concepts and Problems With Solution has been Discussed by Chandan Poddar Sir For CA Intermediate Grooming Education.

⚫ 𝐂𝐀 𝐈𝐧𝐭𝐞𝐫 𝐅𝐌 𝐈𝐧𝐝𝐢𝐯𝐢𝐝𝐮𝐚𝐥 𝐂𝐨𝐮𝐫𝐬𝐞

⚫ 𝐂𝐀 𝐈𝐧𝐭𝐞𝐫 𝟑.𝟎 𝐁𝐨𝐭𝐡 𝐆𝐫𝐨𝐮𝐩

⚫ 𝐂𝐀 𝐈𝐧𝐭𝐞𝐫 𝟑.𝟎: 𝐆𝐫𝐨𝐮𝐩 𝟏

⚫ 𝐂𝐀 𝐈𝐧𝐭𝐞𝐫 𝟑.𝟎: 𝐆𝐫𝐨𝐮𝐩 𝟐

⚫ 𝐂𝐀 𝐈𝐧𝐭𝐞𝐫 𝐈𝐧𝐝𝐢𝐯𝐢𝐝𝐮𝐚𝐥 𝐂𝐨𝐮𝐫𝐬𝐞𝐬

⚫ 𝐂𝐀 𝐈𝐧𝐭𝐞𝐫 𝐒𝐮𝐠𝐠𝐞𝐬𝐭𝐞𝐝 𝐀𝐧𝐬𝐰𝐞𝐫𝐬

⚫ 𝐃𝐨𝐰𝐧𝐥𝐨𝐚𝐝 𝐨𝐮𝐫 𝐄𝐬𝐜𝐡𝐨𝐥𝐚𝐫𝐬 𝐀𝐈 𝐀𝐩𝐩

Watch Next:-

⚫ Ratio Analysis:-

⚫ Capital Budgeting Chapter in Single Video:-

Topics Covered:-

Introduction

Concept of tax benefit

Cost of irredeemable debentures

Cost of redeemable debentures

Cost of debt using present value method YTM

Amortisation of bond

Cost of convertible debentures

Cost of preference share capital

Cost of equity dividend price approach

Cost of equity earning price approach

Cost of equity CAPM approach

Cost of equity realized yield approach

Cost of retained earnings

Weighted avg cost of capital

Practice question on WACC

Practice question on WACC and MCC

Practice question of WACC

Cost of capital is the required return necessary to make a capital budgeting project, such as building a new factory, worthwhile. When analysts and investors discuss the cost of capital, they typically mean the weighted average of a firm's cost of debt and cost of equity blended together.

The cost of the capital metric is used by companies internally to judge whether a capital project is worth the expenditure of resources, and by investors who use it to determine whether an investment is worth the risk compared to the return. The cost of capital depends on the mode of financing used. It refers to the cost of equity if the business is financed solely through equity,

Many companies use a combination of debt and equity to finance their businesses and, for such companies, the overall cost of capital is derived from the weighted average cost of all capital sources, widely known as the WACC

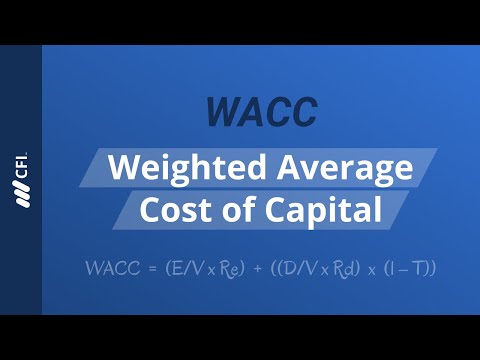

Weighted Average Cost of Capital (WACC)

A firm's cost of capital is typically calculated using the weighted average cost of capital formula that considers the cost of both debt and equity capital. Each category of the firm's capital is weighted proportionately to arrive at a blended rate, and the formula considers every type of debt and equity on the company's balance sheet, including common and preferred stock, bonds, and other forms of debt.

The Cost of Capital and Tax Considerations

One element to consider in deciding to finance capital projects via equity or debt is the possibility of any tax savings from taking on debt since the interest expense can lower a firm's taxable income, and thus, its income tax liability.

The Difference Between Cost of Capital and the Discount Rate

The cost of capital and discount rate are somewhat similar and are often used interchangeably. Cost of capital is often calculated by a company's finance department and used by management to set a discount rate (or hurdle rate) that must be beaten to justify an investment.

To know about the courses and books that best suits your requirement call at our helpline number: 𝟖𝟖𝟖 𝟖𝟖𝟖 𝟎𝟒𝟎𝟐

#CAInter #FM #Cost_Of_Capital #CAIntermediate #ChandanPoddar #ICAI #Chapter4

In This Video We Will Discuss the Cost of Capital all Concepts, Problems and Examples for CA Inter and CA Inter FM Chapter – 4 All Concepts and Problems With Solution has been Discussed by Chandan Poddar Sir For CA Intermediate Grooming Education.

⚫ 𝐂𝐀 𝐈𝐧𝐭𝐞𝐫 𝐅𝐌 𝐈𝐧𝐝𝐢𝐯𝐢𝐝𝐮𝐚𝐥 𝐂𝐨𝐮𝐫𝐬𝐞

⚫ 𝐂𝐀 𝐈𝐧𝐭𝐞𝐫 𝟑.𝟎 𝐁𝐨𝐭𝐡 𝐆𝐫𝐨𝐮𝐩

⚫ 𝐂𝐀 𝐈𝐧𝐭𝐞𝐫 𝟑.𝟎: 𝐆𝐫𝐨𝐮𝐩 𝟏

⚫ 𝐂𝐀 𝐈𝐧𝐭𝐞𝐫 𝟑.𝟎: 𝐆𝐫𝐨𝐮𝐩 𝟐

⚫ 𝐂𝐀 𝐈𝐧𝐭𝐞𝐫 𝐈𝐧𝐝𝐢𝐯𝐢𝐝𝐮𝐚𝐥 𝐂𝐨𝐮𝐫𝐬𝐞𝐬

⚫ 𝐂𝐀 𝐈𝐧𝐭𝐞𝐫 𝐒𝐮𝐠𝐠𝐞𝐬𝐭𝐞𝐝 𝐀𝐧𝐬𝐰𝐞𝐫𝐬

⚫ 𝐃𝐨𝐰𝐧𝐥𝐨𝐚𝐝 𝐨𝐮𝐫 𝐄𝐬𝐜𝐡𝐨𝐥𝐚𝐫𝐬 𝐀𝐈 𝐀𝐩𝐩

Watch Next:-

⚫ Ratio Analysis:-

⚫ Capital Budgeting Chapter in Single Video:-

Topics Covered:-

Introduction

Concept of tax benefit

Cost of irredeemable debentures

Cost of redeemable debentures

Cost of debt using present value method YTM

Amortisation of bond

Cost of convertible debentures

Cost of preference share capital

Cost of equity dividend price approach

Cost of equity earning price approach

Cost of equity CAPM approach

Cost of equity realized yield approach

Cost of retained earnings

Weighted avg cost of capital

Practice question on WACC

Practice question on WACC and MCC

Practice question of WACC

Cost of capital is the required return necessary to make a capital budgeting project, such as building a new factory, worthwhile. When analysts and investors discuss the cost of capital, they typically mean the weighted average of a firm's cost of debt and cost of equity blended together.

The cost of the capital metric is used by companies internally to judge whether a capital project is worth the expenditure of resources, and by investors who use it to determine whether an investment is worth the risk compared to the return. The cost of capital depends on the mode of financing used. It refers to the cost of equity if the business is financed solely through equity,

Many companies use a combination of debt and equity to finance their businesses and, for such companies, the overall cost of capital is derived from the weighted average cost of all capital sources, widely known as the WACC

Weighted Average Cost of Capital (WACC)

A firm's cost of capital is typically calculated using the weighted average cost of capital formula that considers the cost of both debt and equity capital. Each category of the firm's capital is weighted proportionately to arrive at a blended rate, and the formula considers every type of debt and equity on the company's balance sheet, including common and preferred stock, bonds, and other forms of debt.

The Cost of Capital and Tax Considerations

One element to consider in deciding to finance capital projects via equity or debt is the possibility of any tax savings from taking on debt since the interest expense can lower a firm's taxable income, and thus, its income tax liability.

The Difference Between Cost of Capital and the Discount Rate

The cost of capital and discount rate are somewhat similar and are often used interchangeably. Cost of capital is often calculated by a company's finance department and used by management to set a discount rate (or hurdle rate) that must be beaten to justify an investment.

To know about the courses and books that best suits your requirement call at our helpline number: 𝟖𝟖𝟖 𝟖𝟖𝟖 𝟎𝟒𝟎𝟐

#CAInter #FM #Cost_Of_Capital #CAIntermediate #ChandanPoddar #ICAI #Chapter4

Комментарии

2:57:49

2:57:49

0:35:22

0:35:22

0:41:55

0:41:55

0:20:33

0:20:33

0:23:43

0:23:43

0:02:16

0:02:16

0:13:16

0:13:16

0:38:20

0:38:20

2:30:20

2:30:20

1:24:34

1:24:34

0:36:29

0:36:29

0:18:47

0:18:47

0:31:13

0:31:13

0:17:21

0:17:21

0:29:17

0:29:17

0:06:28

0:06:28

0:40:18

0:40:18

0:31:59

0:31:59

0:27:01

0:27:01

0:18:31

0:18:31

2:23:07

2:23:07

0:03:39

0:03:39

2:20:01

2:20:01

0:10:02

0:10:02